Ethereum’s breakout odds – Here’s what traders can look out for!

10/31/2024 17:00

Ethereum (ETH), at the time of writing, seemed to show some positive momentum in the market, backed by strong bid volumes and signs of...

- Combined books for ETH showed an overall positive trend in price action

- Whale activity on Ethereum network has grown lately too

Ethereum (ETH), at the time of writing, seemed to show some positive momentum in the market, backed by strong bid volumes and signs of growing buying interest.

In fact, recent data revealed combined bid volumes of $27.173 million and ask volumes of $60.615 million, indicating an upward trend in demand.

With ETH’s price at $2,683 at press time, consistent buying pressure in the coming sessions could push it towards a higher resistance level. Any major sell-off might lead ETH closer to its support at around $2,300.

ETH price action and prediction

ETH’s price hasn’t shown significant strength in recent months, but it appeared close to a breakthrough.

ETH sat close to a critical resistance level near $2,800, which, if breached, could signal a parabolic move towards the $4,000-mark.

This market foundation, coupled with a slow but steady price uptick, suggested that ETH could be primed for an upward move soon.

However, ETH’s market remains unpredictable. In fact, some analysts are speculating that a pullback could occur before a more sustained rally.

Price predictions remain cautious though, as Ethereum could dip to retest the $2500 area, forming a stronger foundation for a subsequent rally.

For investors employing a dollar-cost averaging (DCA) strategy, these price levels might offer favorable entry points for long-term positions.

Whale activity and crypto breadth

In addition to the market sentiment, Ethereum’s whale activity recently spiked, marking a six-week high as ETH dipped to $2,380.

Historically, whale activity of this scale often means accumulation by major investors. This pattern could encourage a price recovery if whales continue to accumulate ETH in anticipation of further gains.

However, any price impact from whale activity would depend on whether Ethereum sustains this buying interest over the longer term.

A successful break would likely ignite broader interest across the crypto market, potentially boosting altcoin prices as well.

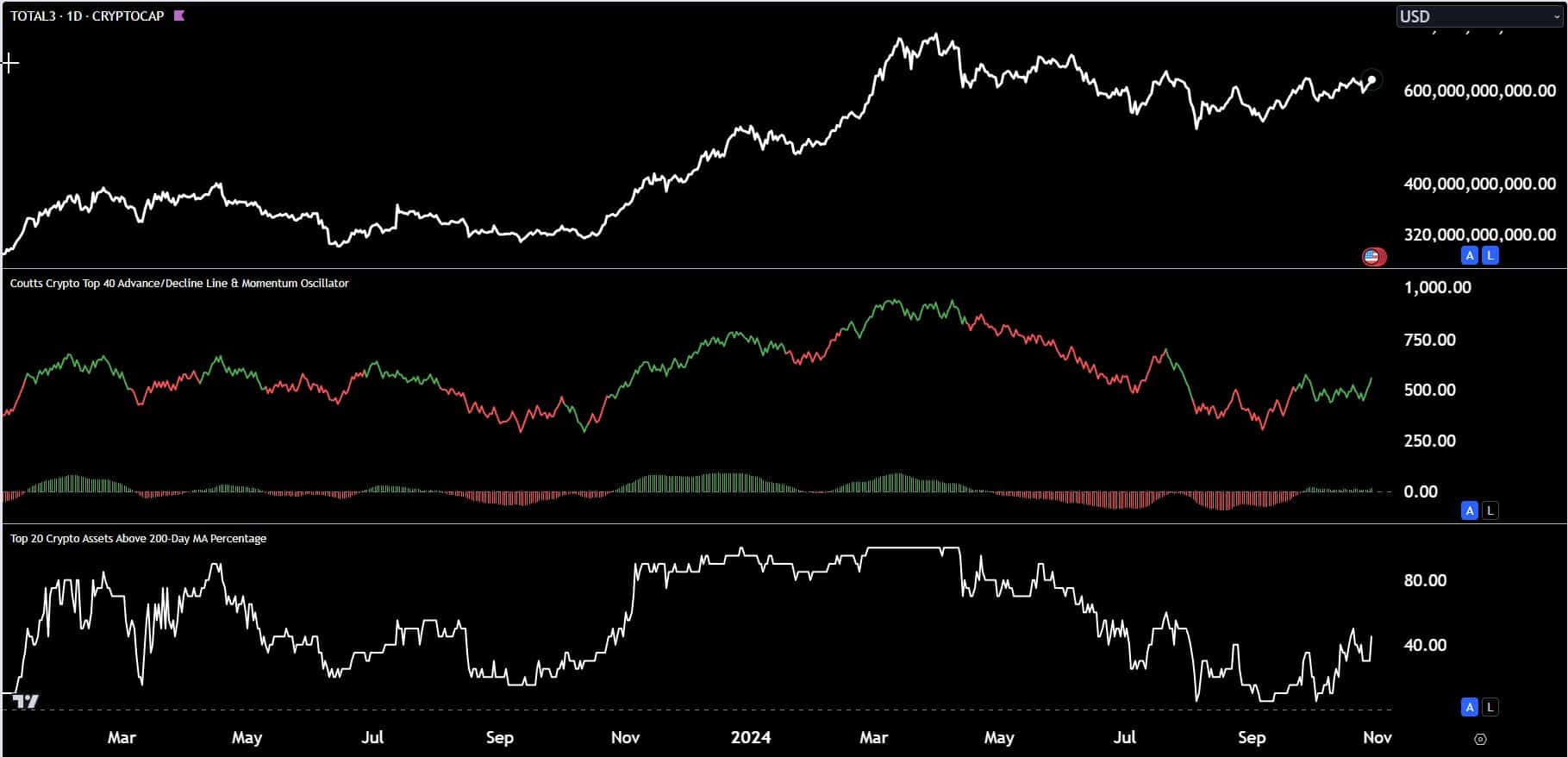

The rising technical breadth measures confirmed the bottom in the crypto market in early September for the top 200 assets. The custom advance or decline line and other crypto breadth measures increased while the prices oscillated over the past 2 months.

Analysts watching ETH’s price action expect it to perform well, compared to Bitcoin (BTC), which has outperformed ETH in recent weeks.

ETH’s potential breakout might narrow the performance gap between the two leading cryptocurrencies. However, market participants should keep an eye on support and resistance levels, as the market’s next moves will depend on whether Ethereum sustains its current buying pressure or not.