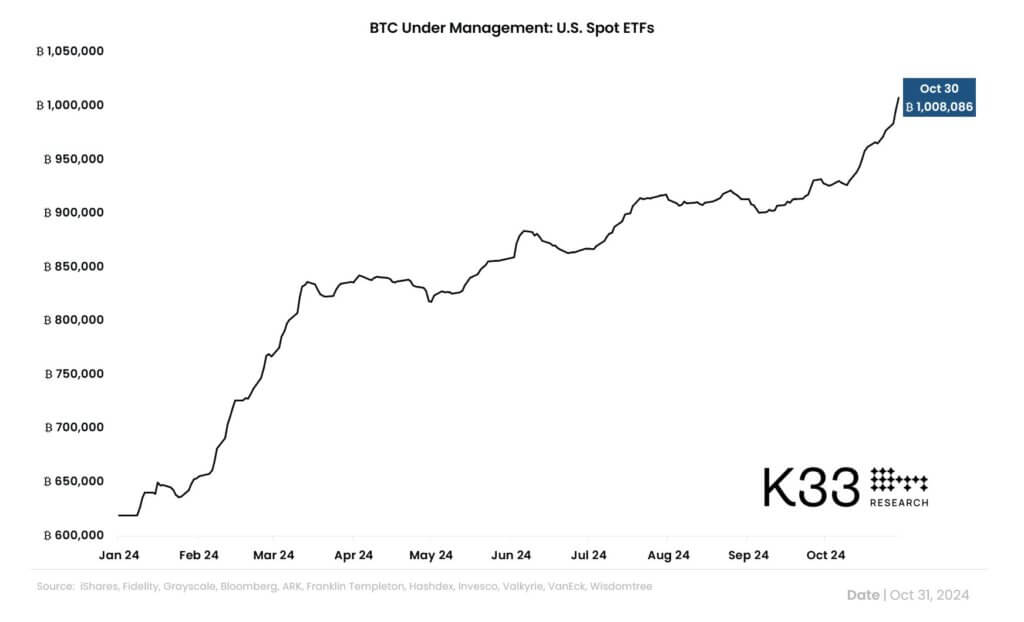

According to K33 Research, the combined on-chain assets under management (AUM) of all spot Bitcoin ETFs have surpassed 1 million Bitcoin. This milestone indicates growing investor confidence in the digital asset.

CryptoSlate has corroborated the data through Coinglass and CryptoQuant data, which indicate that the AUM stood at 995,000 BTC before yesterday’s massive inflow of over 10,000 BTC. However, numbers across different data providers are surprisingly inconsistent, potentially due to the omission by some of Grayscale’s mini-BTC fund.

To push the funds over the landmark, spot Bitcoin ETFs recorded total inflows of $893.3 million on Oct. 30, with the iShares Bitcoin Trust (IBIT) leading at $872 million. Other ETFs like Invesco’s BTCO and Valkyrie’s BRRR contributed $7.2 million and $6.1 million, respectively, while Bitwise’s BITB saw an outflow of $23.9 million, according to Farside Investors.

These inflows followed Bitcoin’s price reaching $73,500 on Oct. 29, just shy of its all-time high of $73,700.

The substantial inflows into IBIT suggest that traditional investment vehicles are becoming a preferred method for many US investors to gain exposure to Bitcoin.