Maker crypto surges 26%: Is this the beginning of a sustained recovery?

11/01/2024 01:00

Assessing MKR potential especially after its latest recovery attempt. MakerDAO Fee and revenue growth as a yardstick for assessing utility.

- MKR shows signs of hope after demonstrating a demand surge from the depths of its October lows.

- MakerDAO fees and revenue ranking confirms healthy activity but also demonstrates depth of competition.

Its been a rough month and year for Maker [MKR] holders and perhaps a good one for MKR short sellers. Its price has been heavily focused on a downward trajectory with weak attempts at recovery up until this week.

While most major coins have maintained some gains in 2024, MKR crashed below its November and December 2023 support levels. A sign that investors had lost confidence in Maker DAO’s native token. However, it managed to achieve some recovery in the last 7 days.

MKR bottomed out at $1.006 on 25th October but has since then bounced back strong, achieving a 26% upside to its $1.27 price level. However, this recovery was modest considering the token’s massive pullback since April, which is equivalent to a 68% discount.

Some may see the huge discount as an opportunity to for more gains ahead especially now that MKR is finally finding favor with the bulls. The token was in the green for the last 6 consecutive days, indicating strong demand with minimal sell pressure.

The latest weekly performance was reminiscent of MKR’s bullish relief in July. The token rallied by over 50% back then and this time it is attempting a recovery from a lower price level which means the potential gains might be higher. However, a major recovery requires robust demand which has been lacking for months.

MakerDAO joins list of top 10 dapps by weekly fees

Speaking of demand, MakerDAO was recently ranked 10th in the list of top dapps by weekly revenue and fees. It generated roughly $5.67 million in weekly fees which indicated decent level of utility, thus painting a rough picture of the level of demand for the platform.

✨ TOP DAPPS BY WEEKLY FEES GENERATED VS REVENUE GAINED@Tether_to $93.6M@circle $28.9M@jito_sol $28.7M@RaydiumProtocol $22.3M@LidoFinance $15.2M@Uniswap $9.76M@pancakeswap $8.92M@pumpdotfun $6.94M@Aave $6.70M@MakerDAO $5.67M$USDT $JTO $RAY $LDO $UNI $CAKE $AAVE $MKR pic.twitter.com/24gcbvRdyx

— Chain Broker 🇺🇦 (@chain_broker) October 30, 2024

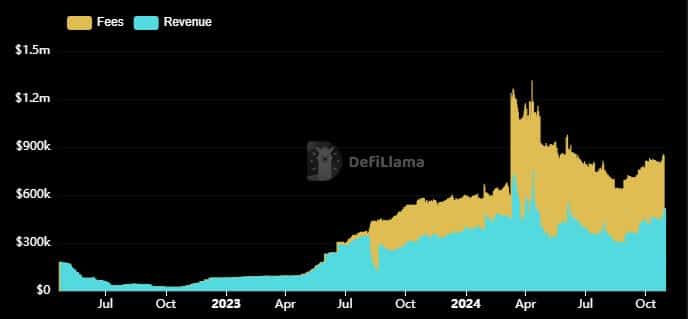

A closer look at MakerDAO revenue and fees in the last 12 months revealed some interesting findings. The network generated $31,680 in fees and the same figure for revenues on 31 October 2023. Fees on 30 October 2024 amounted to $847,750 while revenues came in at $517,600, confirming healthy year over year growth.

Source: DeFiLlama

The higher fees and revenue figures confirm that the DeFi platform is still able to capture growth from the resurging demand. Nevertheless, the competition has been intensifying, and this was evident by some of the higher ranking newer Dapps on the list.

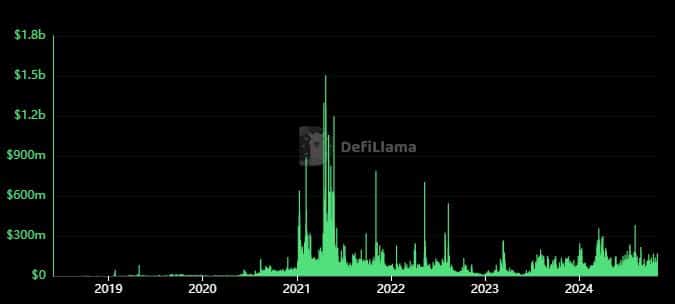

On-chain data also revealed that MKR volumes were significantly lower compared to 2021, especially in the few months near the market peak.

Source: DeFiLlama

Read Maker’s [MKR] Price Prediction 2024–2025

The above observation may be a reflection of the current state of the market. Altcoins have relatively underperformed despite Bitcoin’s latest momentum. These outcomes likely undermined potential demand for MKR.

A surge in demand for altcoins especially in the DeFi ecosystem may trigger more demand for MKR. However, we will have to wait and see if that will happen.