$600 Million Bitcoin Transfer Stuns Major US Exchange Coinbase

11/01/2024 18:54

WisdomTree allegedly transfers $600 million in Bitcoin (BTC) to major US exchange Coinbase and sparks suspicions

WisdomTree allegedly transfers $600 million in Bitcoin (BTC) to major US exchange Coinbase and sparks suspicions

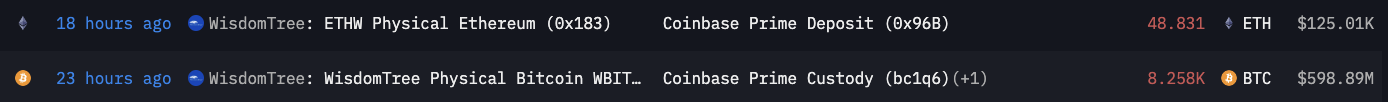

In the past 20 hours, WisdomTree, a major ETF issuer in the U.S., executed a large transaction, transferring 8,258 Bitcoin (BTC), valued at approximately $600 million, and 48.83 Ethereum (ETH), valued at nearly $125,000, to the Coinbase exchange.

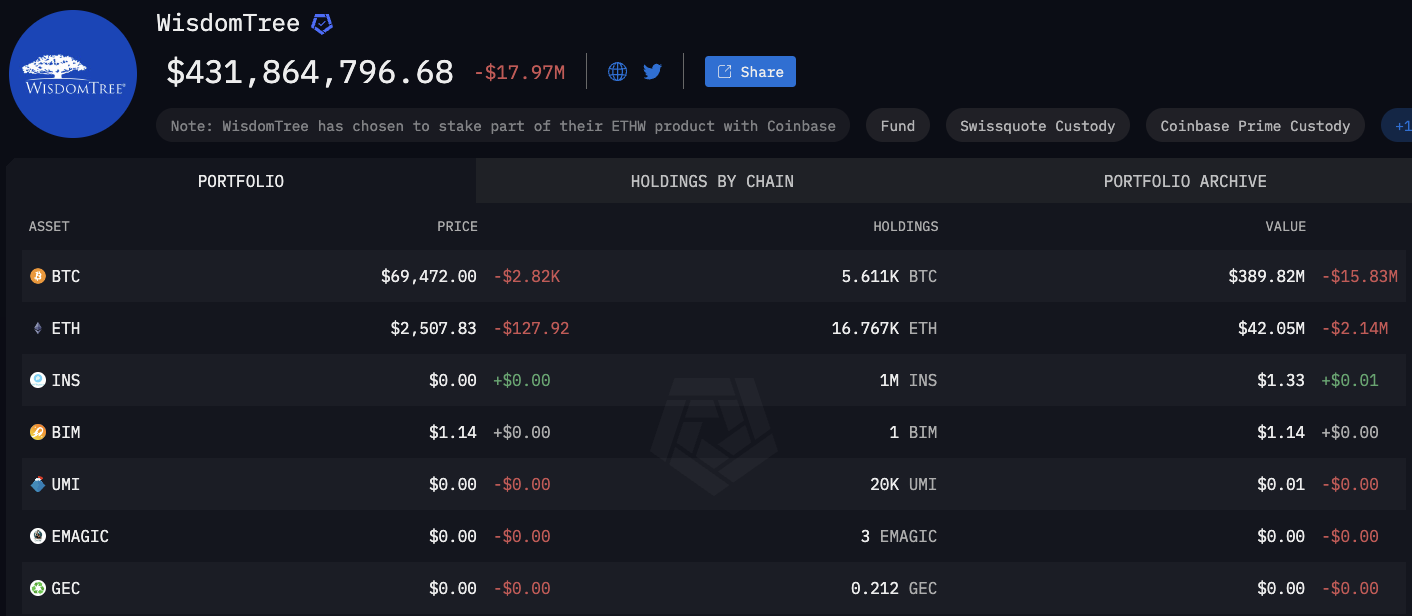

As of January 2024, New York-based WisdomTree manages approximately $99.5 billion in assets globally, with investments spanning multiple asset classes and countries. Its holdings include allocations to Bitcoin, Ethereum and select altcoins through cryptocurrency-backed funds.

After this recent transaction, WisdomTree still holds 5,611 BTC, valued at approximately $388 million, and 16,767 ETH, valued at approximately $41.9 million. However, these transfers have raised questions about possible adjustments to the firm's cryptocurrency strategies.

WisdomTree's recent decisions on the cryptocurrency market add to this narrative, as the firm withdrew its application for a spot Ethereum ETF, citing no specific reasons. This withdrawal has led to suggestions that WisdomTree sees limited demand for this product.

For example, WisdomTree's existing Bitcoin ETF remains active with a valuation of $217 million but is one of the smaller Bitcoin ETFs among U.S. issuers.

It looks like WisdomTree may be taking a more cautious approach to cryptocurrency-oriented investments, given the timing of the move to Coinbase and recent ETF changes. Some believe that this big shift in BTC could mean that the firm is looking to reduce its direct cryptocurrency holdings to bring them in line with cumulative ETF net flows.

About the author

Gamza Khanzadaev

Financial analyst, trader and crypto enthusiast.

Gamza graduated with a degree in finance and credit with a specialization in securities and financial derivatives. He then also completed a master's program in banking and asset management.

He wants to have a hand in covering economic and fintech topics, as well as educate more people about cryptocurrencies and blockchain.

Advertisement

TopCryptoNewsinYourMailbox

TopCryptoNewsinYourMailbox