How massive USDT mints on Tron, Ethereum impacts market dynamics

11/03/2024 17:00

USDT minting have pushed Tether’s circulating supply to new highs, with a fresh $1B on TRON bringing the supply from $48.8B to nearly $62.8B.

- $1 billion USDT mints on TRON and Ethereum are fueling liquidity and aligning with bullish sentiment across the market.

- Onchain data shows strong optimism, with 11.83% of holders profiting, reinforcing Tether’s role as a liquidity anchor.

The recent surge in Tether [USDT] minting has pushed Tether’s circulating supply to new highs, with a fresh $1 billion mint on TRON bringing the stablecoin’s supply from $48.8 billion to nearly $62.8 billion.

This ongoing trend across TRON and Ethereum reflects a growing demand for liquidity in the market. However, these issuances directly impact market dynamics, influencing trading sentiment, liquidity, and price stability.

TRON has become a major driver in Tether’s growth, holding 51% of USDT’s $120 billion supply, with Ethereum closely following at 45%.

Therefore, these networks are essential for sustaining liquidity in the crypto ecosystem. Large mints, such as the recent $1 billion issuance on Ethereum, align with Tether’s strategy of maintaining reserves to meet sudden liquidity demands.

The effect of previous USDT mints on market dynamics

The recent TRON mint is not the first to attract market attention. In September, Tether minted $1 billion on Ethereum, drawing speculation about future market moves. Some viewed it as a bullish indicator, while others saw it as a routine inventory adjustment.

Nevertheless, past mints have frequently aligned with bullish sentiment. Analysts observe that these issuances often coincide with increased trading volumes, as traders see them as signals of rising liquidity and potential gains.

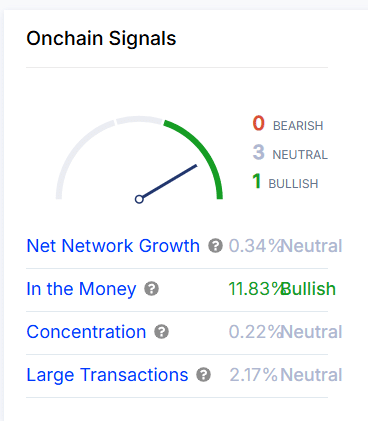

Current onchain data supports the optimism surrounding recent USDT mints. The “In the Money” metric indicates that 11.83% of Tether holders are currently profiting, reflecting bullish sentiment.

Meanwhile, metrics like net network growth, concentration, and large transactions remain neutral, suggesting a stable but optimistic outlook.

As more holders stay “In the Money,” market confidence in Tether grows, anchoring its role as a primary liquidity provider.

Can Tether’s peg stability endure the expanding supply?

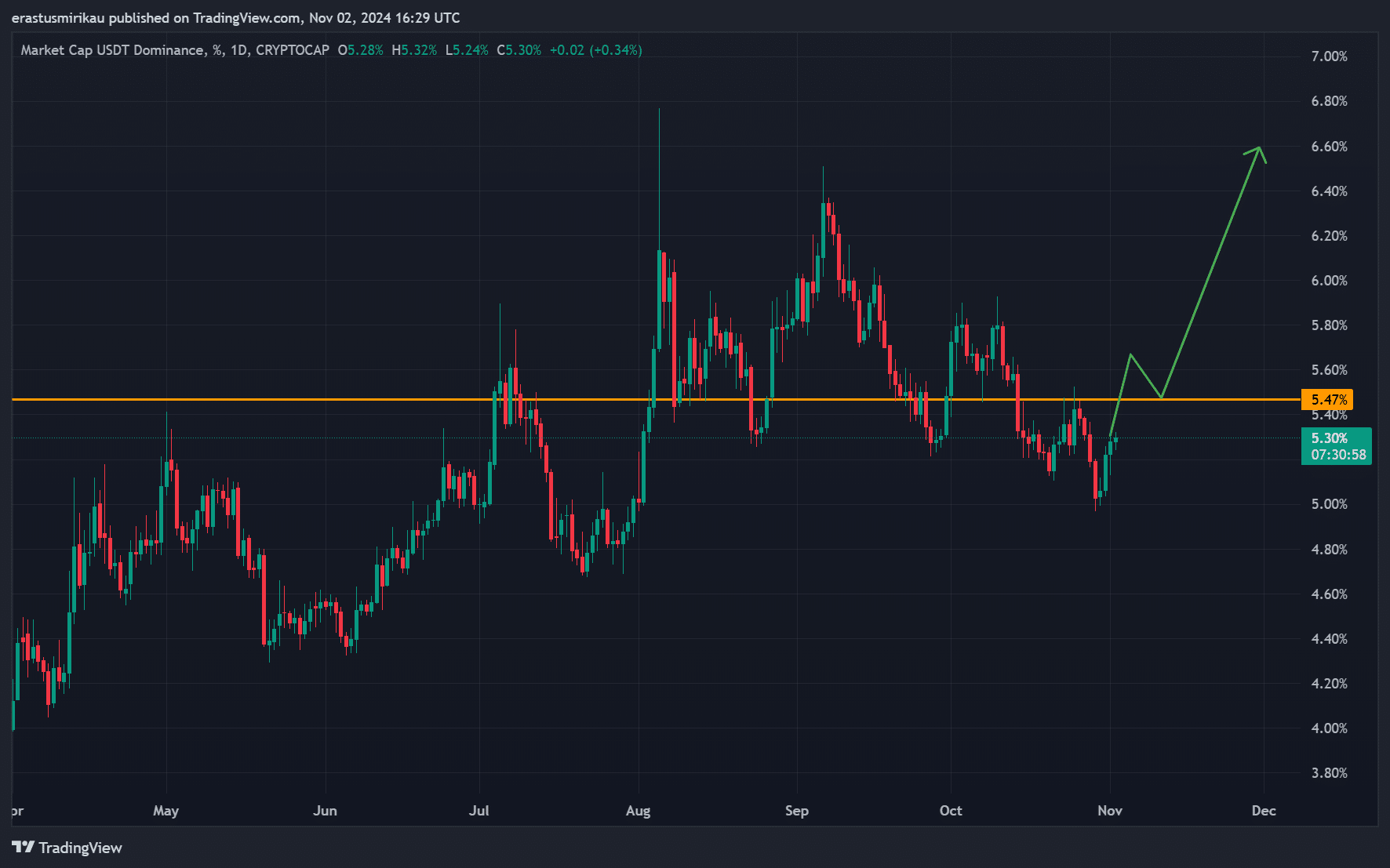

While USDT’s $1 peg provides stability, rapid supply growth could challenge this equilibrium during volatile conditions. Tether’s market dominance, now at about 5.30%, shows signs of moving toward the 5.47% resistance level.

This rising dominance supports the peg in bullish conditions. However, a sudden downturn could test Tether’s ability to hold the peg, especially as the larger supply introduces added volatility.

Tether’s ongoing surge in mints across TRON and Ethereum emphasizes its role as a primary liquidity provider. Each issuance strengthens market liquidity and reflects heightened demand from key players.

Onchain signals support a bullish outlook, with a significant number of holders “In the Money.”

Nonetheless, Tether’s ability to maintain peg stability amid expanding supply will be essential, especially during downturns.