Crypto week ahead: Market braces for US elections, FOMC meeting – What’s next?

11/04/2024 07:00

The crypto market is bracing for a volatile week due to the upcoming US elections and possible interest rate cuts by the Federal Reserve.

- More than $238 million was liquidated from the crypto market in 24 hours after prices plunged.

- Next week’s US elections and upcoming FOMC meeting could cause a surge in market volatility.

The cryptocurrency market is headed for one of the most crucial weeks this year. Speculation on the week’s events has triggered price declines. At press time, all the top 50 cryptos by market capitalization, apart from Celestia [TIA] were trading in the red.

Over the weekend, Bitcoin [BTC] dropped from $71,000 to trade at $68,380 at press time. Ethereum [ETH] also traded at $2,440, after a 2% dip.

The declining prices resulted in massive liquidations in the derivatives market. Data from Coinglass showed that in the last 24 hours, more than $238 million was liquidated from the market.

The liquidations affected more than 104,000 traders, with the largest liquidation order of $9.9 million happening on the OKX exchange.

Besides the typical weekend volatility, the US election polls on Polymarket might have stirred the recent price moves. The election is now less than two days away, and former US President Donald Trump has dropped by 6% in the polls within three days.

A Trump win is expected to have a net positive impact on the crypto market due to his pro-crypto campaign policy.

Upcoming FOMC meeting

The Federal Open Market Committee (FOMC) will hold its next meeting on 7th November. During the previous meeting, the committee slashed interest rates by 50 basis points, which set the stage for a recovery in risk assets such as crypto.

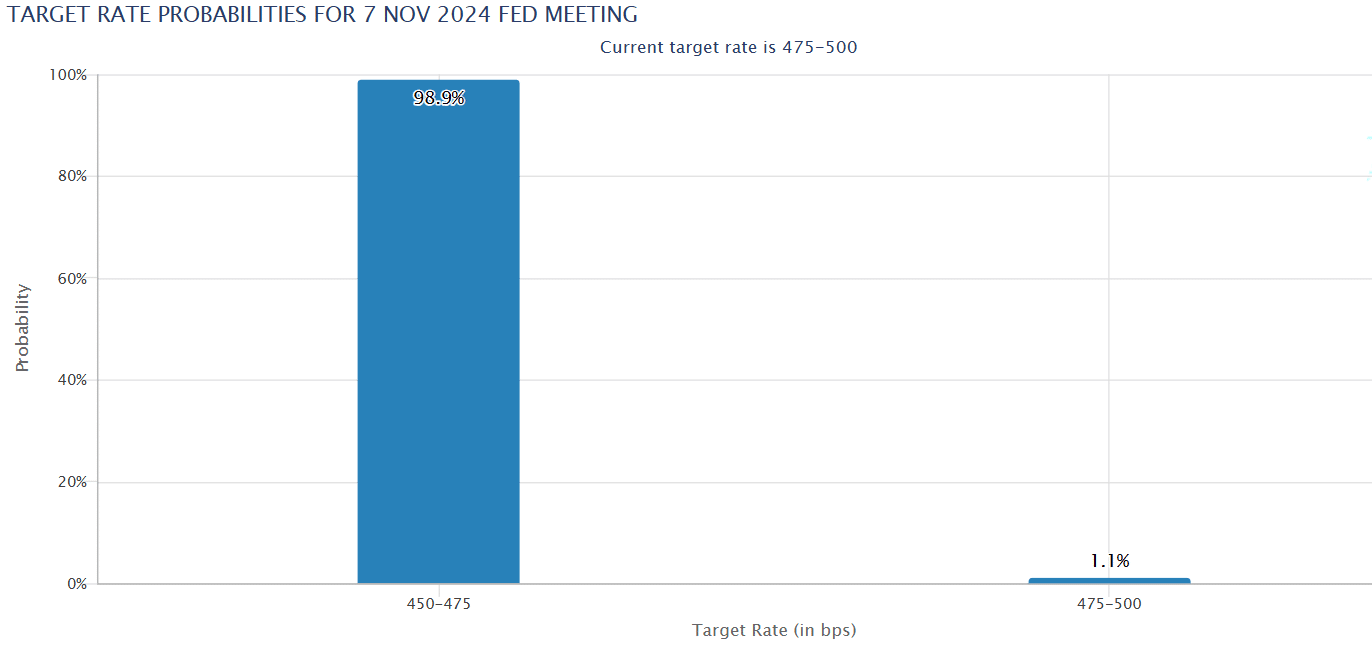

Data from the CME FedWatch Tool shows that 98% of investors are anticipating another rate cut, of 25 basis points, during the November meeting.

If the Federal Reserve trims rates per the market expectations, crypto prices are poised for an uptrend. This is because a loose monetary policy increases investors’ risk appetite, which boosts demand for assets such as crypto.

As AMBCrypto reported, the US September inflation rate came in at 2.1%, inching closer to the Federal Reserve’s target of 2%. This supports the argument for further rate cuts.

After the September meeting, Bitcoin gained by around 8% within a week. A similar upward move could propel BTC to record highs given that at its current price, it is 7% shy of its all-time high.

Crypto market sentiment is still bullish

Despite the recent drop in prices and rising volatility, the crypto market sentiment remains positive as seen in the Fear and Greed Index, which had a value of 74 at press time.

At its current value, this index shows that the market is in a state of greed. This sentiment tends to spur buying activity, which in turn leads to price gains.

This shows that crypto traders are still looking towards more gains after the recent pullback. Some catalysts of this positive sentiment include the FOMC meeting and expectations that Q4 has historically boded well for crypto prices.