State of Michigan Pension Pioneers Ethereum ETF Purchases With $11 Million Stake

11/05/2024 12:52

Michigan's pension fund leads in Ethereum ETF investment with an $11 million stake, showcasing evolving state-level crypto adoption.

The State of Michigan Retirement System (SMRS) has set a new precedent as the first US state pension fund to invest in an Ethereum ETF.

This signals a broader interest in digital assets beyond Bitcoin and has bolstered Ethereum’s ETH token price performance, which crossed the $2,400 threshold.

Michigan Becomes First State Pension Fund to Buy Ethereum ETF

According to a recent SEC filing, Michigan disclosed a significant $11 million stake in Grayscale’s Ethereum Trust (ETHE), marking a landmark move in the pension industry, which has traditionally favored Bitcoin.

Michigan’s pension fund now holds around 460,000 shares in the Grayscale Ethereum Trust, valued at roughly $10.07 million. It also holds 460,000 shares in the Grayscale Ethereum Mini Trust (ETH), worth approximately $1.12 million.

Prominent Bloomberg ETF analyst Eric Balchunas highlighted the significance of this move, noting that Michigan’s pension fund purchased more Ethereum ETFs than Bitcoin ETFs.

“Not only did Michigan’s pension buy Ether ETFs but they bought more than they did of Bitcoin ETFs, $10 million vs. $7 million, despite BTC being up a ton and Ether in the gutter. Pretty big win for Ether which could use one,” Balchunas commented.

Read more: Ethereum ETF Explained: What It Is and How It Works.

This decision highlights Michigan’s strategic pivot toward a broader range of digital assets. While Bitcoin has been the primary cryptocurrency held by pension funds, Michigan’s increased allocation to Ethereum reflects a growing interest in the potential of decentralized finance (DeFi) applications, smart contracts, and the versatility that Ethereum’s blockchain offers.

In addition to its substantial Ethereum position, Michigan also invested in Bitcoin, holding 110,000 shares in the ARK 21Shares Bitcoin ETF, valued at approximately $7 million. Though smaller than its Ethereum investment, this allocation displays Michigan’s commitment to a diversified cryptocurrency portfolio.

Matthew Sigel, head of digital assets research at VanEck, also acknowledged Michigan’s pioneering role.

“First State Pension Fund Buys ETH ETF. State of Michigan Files 13F Discloses New ETH ETF Holdings; Becomes Top 5 Holder of ETH & ETHE,” Sigel commented.

Growing Momentum Among State Pension Funds

With this move, Michigan now joins a growing list of institutional investors who see long-term value in holding crypto-related assets. Its move into Ethereum follows broader discussions on cryptocurrency adoption among state pension funds.

As BeInCrypto reported, Florida’s Chief Financial Officer Jimmy Patronis recently advocated for Bitcoin’s inclusion in the state’s retirement system, suggesting a wave of institutional interest may soon follow. Patronis’s endorsement of Bitcoin reflects a sentiment shared by several states considering cryptocurrency as a viable investment vehicle for public funds.

Other states, such as Wisconsin and Jersey, have also explored crypto investments. This reflects a shift in mindset among public pension fund managers who see cryptocurrencies as potential hedges against inflation and a way to diversify portfolios amid economic uncertainty.

Michigan’s pioneering step into Ethereum ETFs could encourage other state pension funds to consider Ethereum and other digital assets as part of their investment strategies. By expanding beyond Bitcoin and into Ethereum, Michigan signals confidence in the broader digital asset ecosystem.

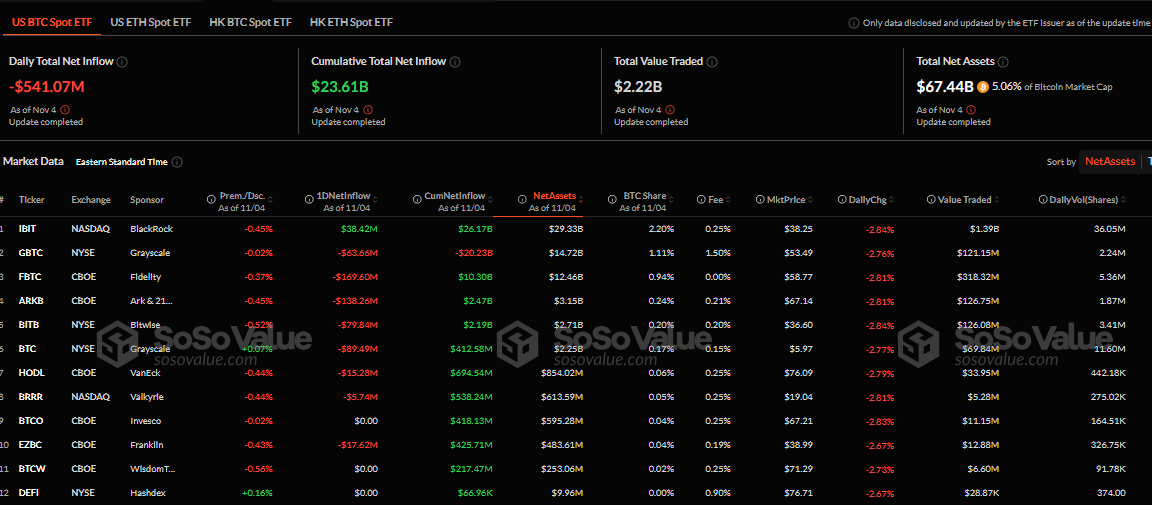

Meanwhile, even as momentum continues to grow, data shows that on Monday, Bitcoin ETFs saw the second-highest net outflow in history.

“Bitcoin spot ETF had a total net outflow of $541 million yesterday, November 4, the second highest single-day net outflow in history. The highest single-day net outflow was $563 million on May 2. Ethereum spot ETF had a total net outflow of $63.2238 million yesterday,” WuBlockchain reported.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Data on SoSoValue corroborates the statement, indicating that BlackRock’s IBIT was the only Bitcoin ETF to see positive flows on November 4.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.