Early Ethereum Investor Transfers 15,000 ETH to Kraken — Should Holders Be Concerned

11/07/2024 06:00

An Ethereum ICO participant moves 15,000 coins to Kraken, signaling potential sell pressure. Here’s what it could mean for ETH’s price.

An Ethereum (ETH) ICO participant made its first transaction in two years today, transferring approximately 15,000 coins to the Kraken exchange. This transaction comes amid ETH’s rebound, which saw the altcoin climb above $2,600.

One question ETH holders might be asking is whether other early investors will follow this path. If that happens, Ethereum’s recent price increase could be retracted. If it does not, the cryptocurrency may continue to climb.

Sell Pressure Builds for Ethereum Amid Significant Exchange Deposits

According to Arkham Intelligence, the Ethereum ICO participant last made a transaction two years ago. During that period, the addresses added 15,000 ETH to their wallets, which was valued at $29.74 million.

However, the recent transfer to Kraken shows that the coins are now worth $39.38 million, suggesting that the holders appear to be selling for profits.

Typically, when investors send their assets into exchanges, it implies that they are ready to sell, possibly putting downward pressure on the price.

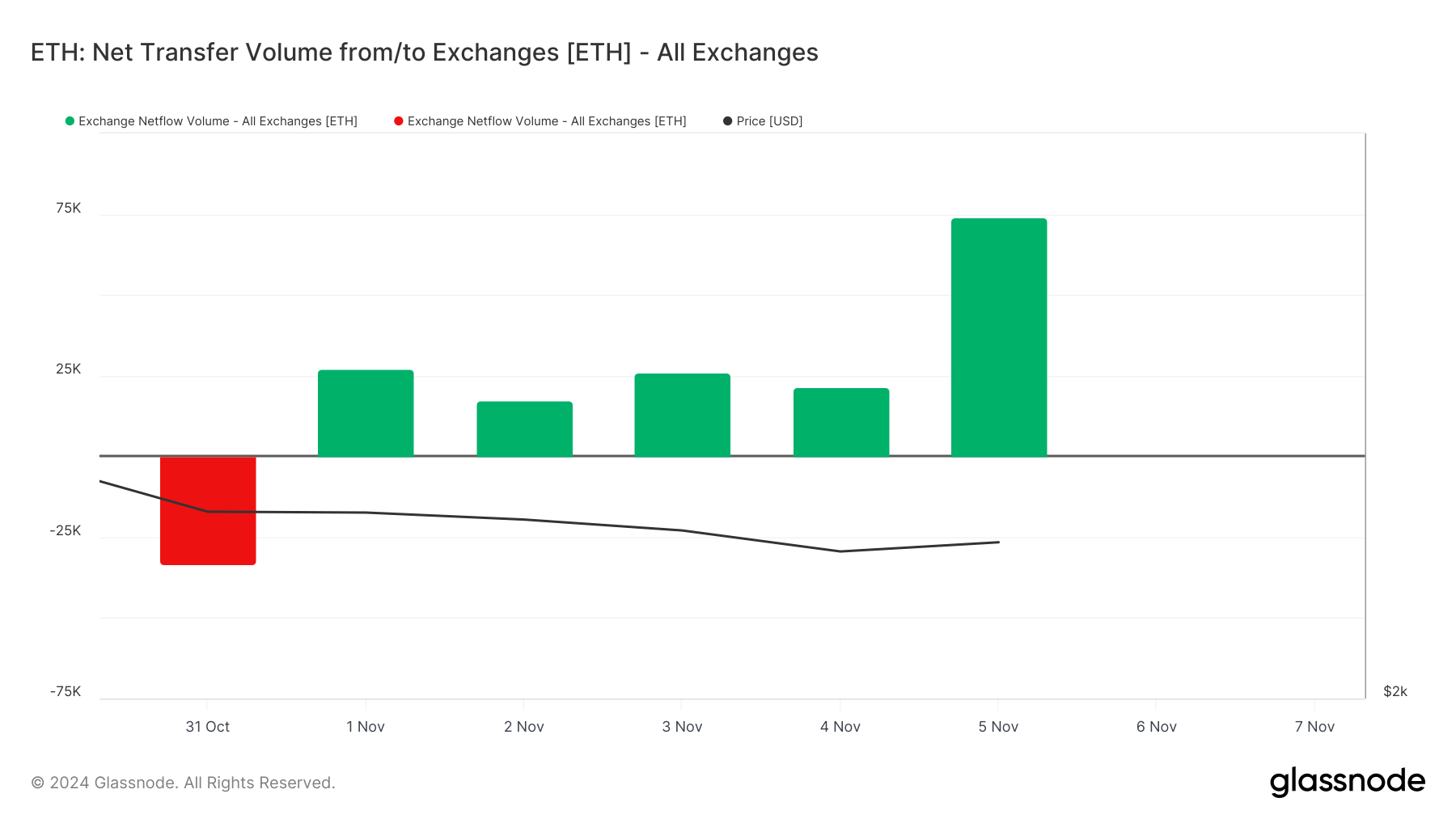

Further, Ethereum’s recent uptrend might face resistance, as suggested by the current exchange netflow volume. The exchange netflow measures the difference between coins in and out of exchanges.

When there’s a higher inflow than outflow, it suggests selling pressure may be on the rise as more coins are being moved to be sold. Conversely, a net outflow indicates buying interest as holders withdraw coins, potentially anticipating higher prices.

Currently, Glassnode data shows that Ethereum’s exchange netflow has risen to $74,266. At the cryptocurrency’s current value, this is worth nearly $200 million. So, if this trend continues, ETH could struggle to maintain its recent gains, as the influx of supply onto exchanges could temporarily cap the price.

Read more: How to Buy Ethereum (ETH) With a Credit Card: Complete Guide

ETH Price Prediction: Coin Still Stuck

Despite Ethereum’s price rise to $2,662, it remains confined within a descending channel. This channel is a technical pattern often indicating continued downward pressure. In this formation, price movements are typically restricted between two parallel downward-sloping trendlines, which represent potential resistance and support levels.

To break free from this bearish trend, Ethereum would need a significant upward push to break above the channel’s upper trendline. However, that has yet to happen.

Until then, it’s likely to face resistance at higher levels within the channel, which could limit the potential for sustained price gains. If that remains the same, ETH could decline to $2,554.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

On the flip side, if buying pressure increases, this forecast could be invalidated. Should that be the case and no other Ethereum ICO participants come out to sell, the price could jump to $3,264

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.