Ethereum: $89.72M whale dumps spark fears of price correction – What now?

11/07/2024 22:00

ETH long term holders sells $89.72 million worth of Ethereum. Flow indicators suggest a potential price correction with high exchanges inflows

- Ethereum long-term holders sold $89.72 million worth of ETH.

- Market fundamentals suggested a potential price correction as transfers into exchanges spiked.

In the past 48 hours, the crypto market surged, with Bitcoin [BTC] hitting a new ATH of $75K. This upsurge pushed some altcoins to new highs.

Ethereum [ETH] reached a three-month-high, creating opportunities for profit-taking. Inasmuch, most long-term and dormant whales have come out to take profits while maximizing their profits.

Ethereum long-term whales dump

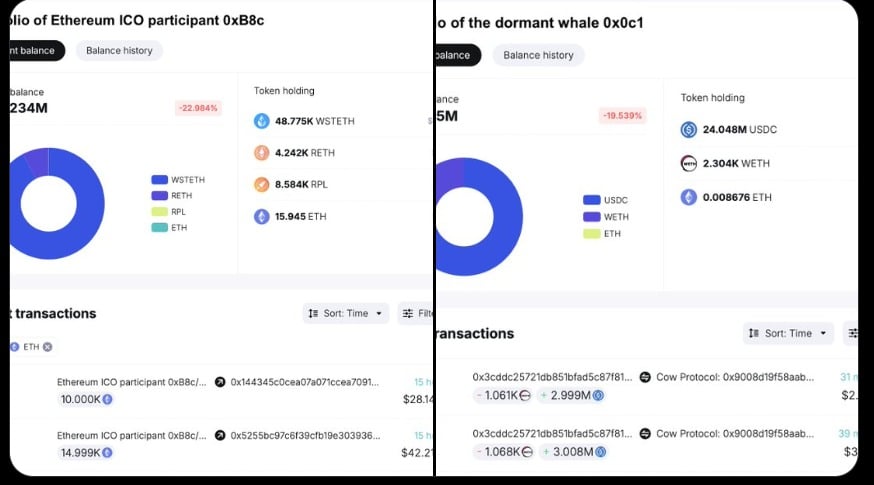

According to a recent report by SpotonChain, three ETH holders have started unloading, following price hikes over the past 24 hours.

As such, two ETH holders have unloaded 33,701 ETH worth $89.72 million. This was followed by a 13.75% surge in Ethereum price charts.

At press time, the first ICO whale sent 25,000 ETH valued at $2,627 per token, to Kraken, leaving behind 64,450 ETH.

Another whale reappeared after eight and a half years to sell 8,701 ETH for 24.05 USDC valued at $2,764 per token, leaving behind 2,304 ETH worth $6.48 million and making $30.48 million in profit.

Following these two massive sell-offs, another Ethereum whale with 12,001 ETH worth $34.1 million ended an eight-year dormancy and began selling on-chain.

The increased whale activity caused fears of potential sell-offs that could push ETH prices towards correction. This is because, massive transfers into exchanges and selling by whales cause selling pressure, which negatively impacts prices.

Impact on ETH’s price charts?

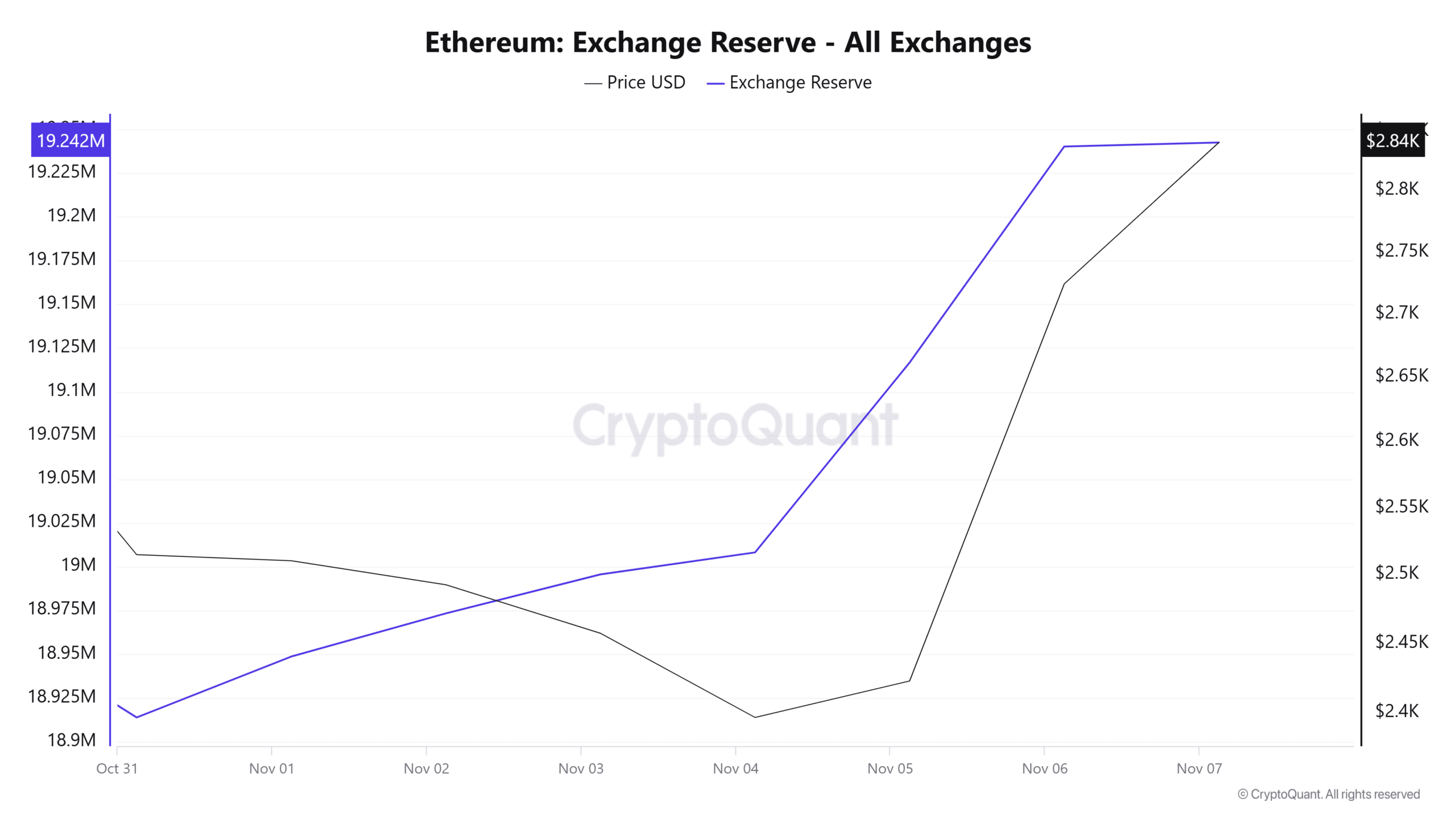

According to AMBCrypto’s analysis, ETH was experiencing an exponential surge in deposits into exchanges. Such a market scenario causes increased supply, which further threatens price stability.

For example, Ethereum’s supply exchange ratio has spiked over the past week.

This implied that investors were transferring their tokens into exchanges and preparing to sell, leading to downward price pressure.

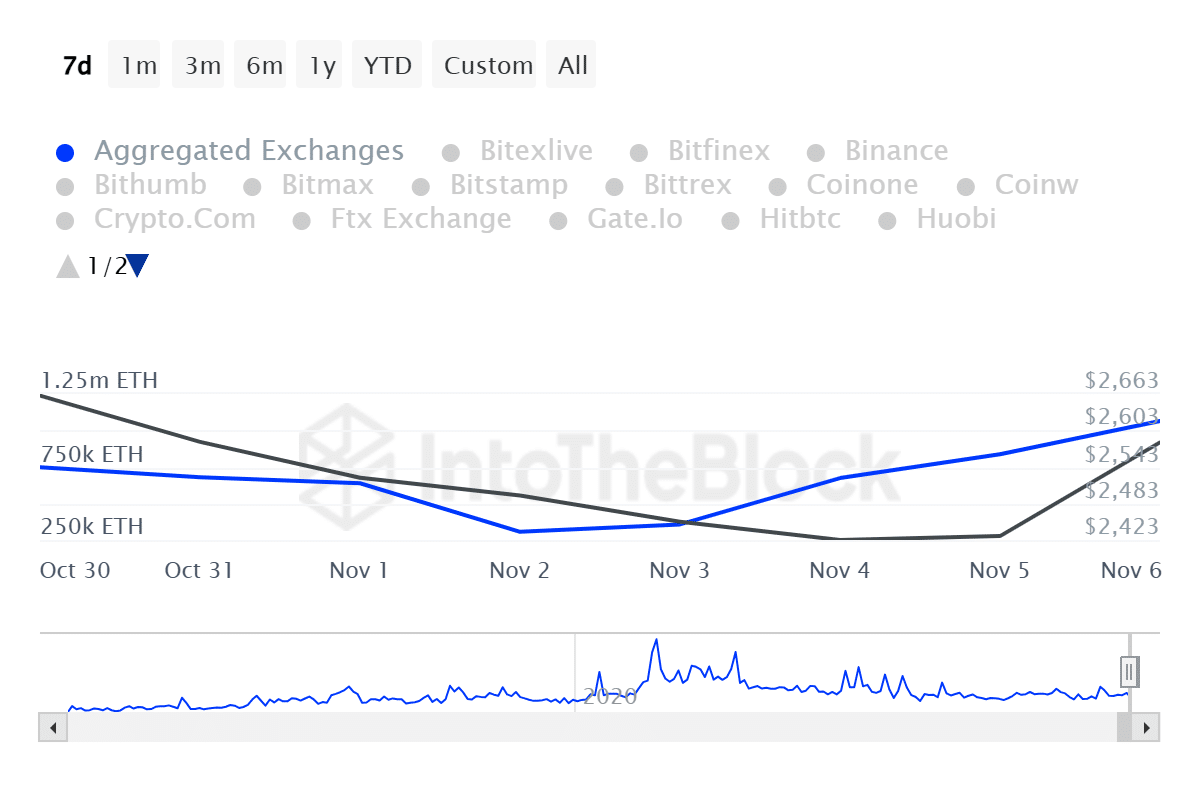

Additionally, Ethereum’s inflow volume has surged over the past week from a low of 306,020k to 1.07 million.

This suggested that as ETH prices have made a significant recovery on price charts, most investors are preparing to sell to maximize profits.

What next for Ethereum?

Notably, ETH has experienced a strong uptrend over the past week.

In fact, at the time of writing, Ethereum was trading at $2804. This marked an 8.11% rise in 24 hours, with the altcoin gaining 6.31% on weekly charts.

The recent upsurge has put the altcoin to reach a 3-month-high, signaling a strong upward momentum.

Therefore, if the bulls can continue to hold the market, the altcoin could register more gains, reaching the $3000 resistance level.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Therefore, for the uptrend to hold, the markets have to absorb the latest whale sales without resulting in higher losses.

However, if the recent whale dumps bring negative impacts to the market, the altcoin could see a market correction before attempting another uptrend.

Thus, if this dump reflects on price charts, Ethereum could decline to $2670.