MKR eyes 2.2K mark, but what’s limiting its momentum?

11/08/2024 07:00

MKR eyes a 54% gain as bullish momentum builds, with a potential target of $2,203. AMBCrypto analyzes MKR’s upward trend and strong interest.

- MKR was showing strong upward momentum after breaking out of a bullish pattern, though it was facing a minor resistance level.

- Market metrics suggested high trader interest, with increased buying activity signaling confidence in further gains.

In the past 24 hours, Maker [MKR] surged by 11.20%, reaching $1,416.32, at press time. Indicators like Funding Rates and Open Interest (OI) pointed out that the rally may have more room to run.

Consistent accumulation reflected sustained demand from market participants.

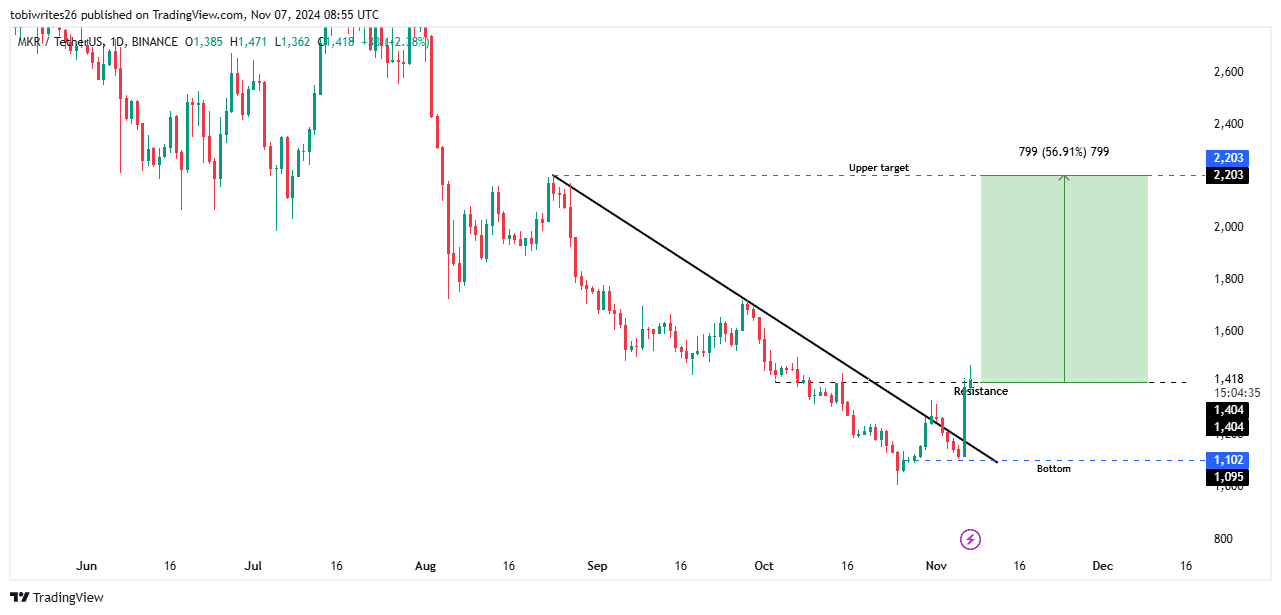

MKR set for 54% gain?

Since August, MKR has been trading within a descending trendline that limited upward movement. Recently, it broke out of this pattern, boosting its market capitalization by 11.48% to $1.24 billion.

At press time, MKR faced resistance at the 1,418 level, where a notable selling pressure has emerged. However, if it breaks through this level, MKR could see a substantial gain of 56.91%, targeting $2,203.

If bearish pressure increases, MKR might see a slight pullback, testing support near $1,102, where previous buying interest has been strong.

AMBCrypto’s analysis of broader market activity indicates an overall bullish outlook for MKR.

Trader bids fuel uptrend

Trader bids are supporting MKR’s upward momentum, driving notable gains in the market.

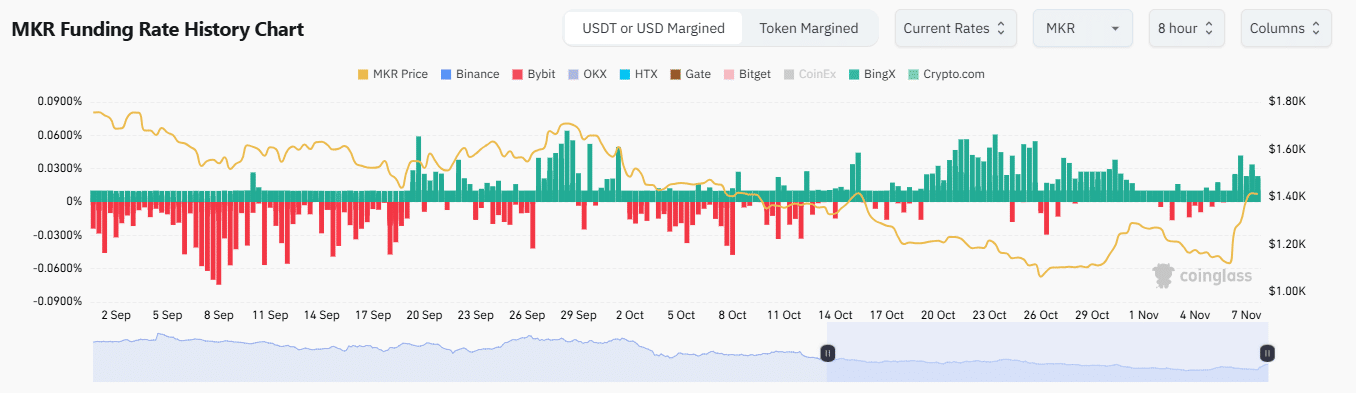

Over the past 24 hours, MKR’s OI has risen by 13.67% to $120.30 million according to Coinglass, signaling a gradual takeover by bullish traders.

OI tracks the volume of active, unsettled derivative contracts, and the increase indicates that long traders currently hold more positions, potentially pushing the asset’s price higher.

Additionally, the Funding Rate, which measures which side of the market is maintaining positions to balance the spot and futures markets, is also being driven by long traders.

As of the latest data, the Funding Rate stands at 0.0211%, a notable increase, suggesting that bullish sentiment is strengthening.

If this trend persists, it indicates continued upside potential as long traders expect further gains.

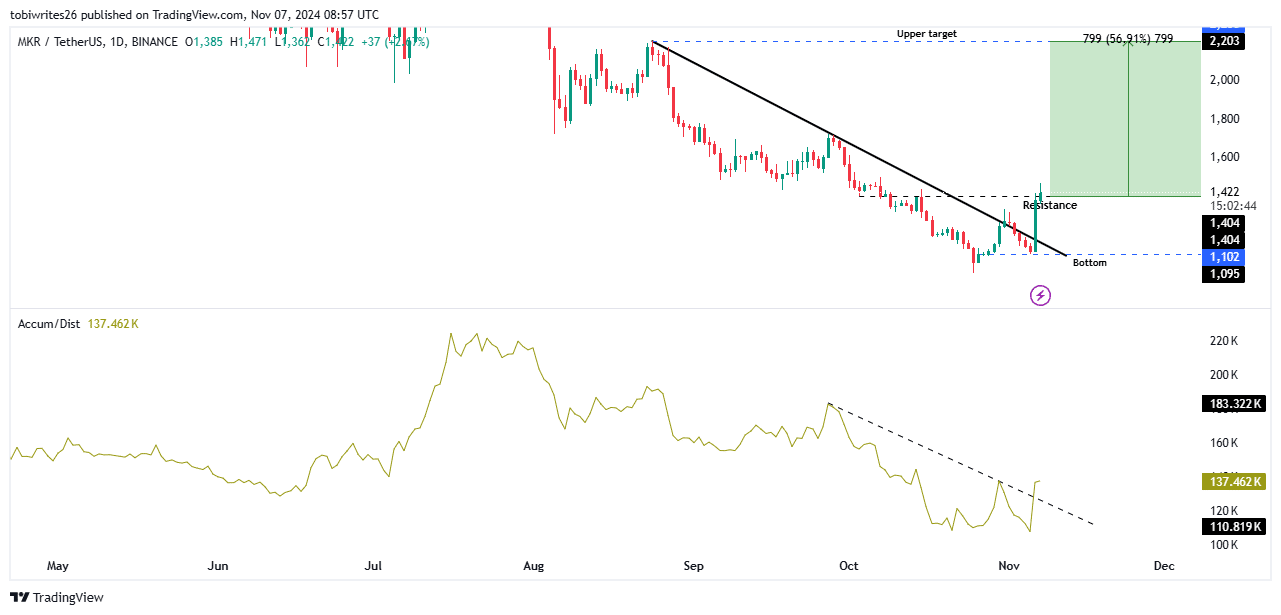

Accumulation phase underway

The coin’s rally was confirmed as its Accumulation/Distribution line broke through a key resistance trendline, setting the stage for further upward movement.

Read Maker’s [MKR] Price Prediction 2024–2025

Following this breakout, increased accumulation is anticipated, which is likely to drive additional gains as MKR continues to trend higher.

This sustained buying interest is expected to have a positive impact on the asset’s price.