Cronos’ price surge by 35%— Here’s what’s driving It

11/08/2024 12:00

Cronos jumped 35% as Crypto.com revealed its 2025 roadmap, including stock trading, expanded services, and AI tools.

- Crypto.com’s new roadmap spurred a rally in Cronos.

- The futures market points to a dominant bullish sentiment.

In a notable development, Cronos [CRO] surged by double-digits following the unveiling of Crypto.com’s ambitious roadmap.

The announcement propelled it upwards by over 35% according to CoinMarketCap.

At the time of writing, CRO exchanged at $0.085, down by 1.20% in the past day.

Its 24-hour trading volume also dropped by 46.70%, settling at $40.48 million.

Unpacking the roadmap

AMBCrypto delved deeper into Crypto.com’s roadmap and found that the platform is set to introduce new services such as stock trading, banking, and enhanced card offerings.

Starting in Q4 2024, Crypto.com will launch the Level Up program and Cronos AI development tools to boost user engagement and enhance platform features.

A web-based app will be introduced for easier user interaction. Additionally, debit card services will expand to Latin America, the Middle East, and Africa, extending through Q2 2025.

Throughout 2025, Crypto.com will enhance accessibility and investment options.

In Q1, it plans to extend exchange services to the U.S. and global markets, improve fiat on/off ramps, and introduce Bitcoin [BTC] rewards, stock, ETF trading, and personal multi-currency accounts.

Q2 will feature a rewards maximizer, yield-generating cash options, institutional custody solutions, stock options trading, and upgraded credit card services.

In Q3, Cortex AI, a proprietary stablecoin, Cronos One, FX commodities trading, derivatives, and rapid global transfers will be deployed.

By Q4, offerings will include margined derivatives, a Cronos ETF proposal, the Singularity API, international accounts, and a 10% travel rebate program.

CRO’s market dynamics in the crypto sphere

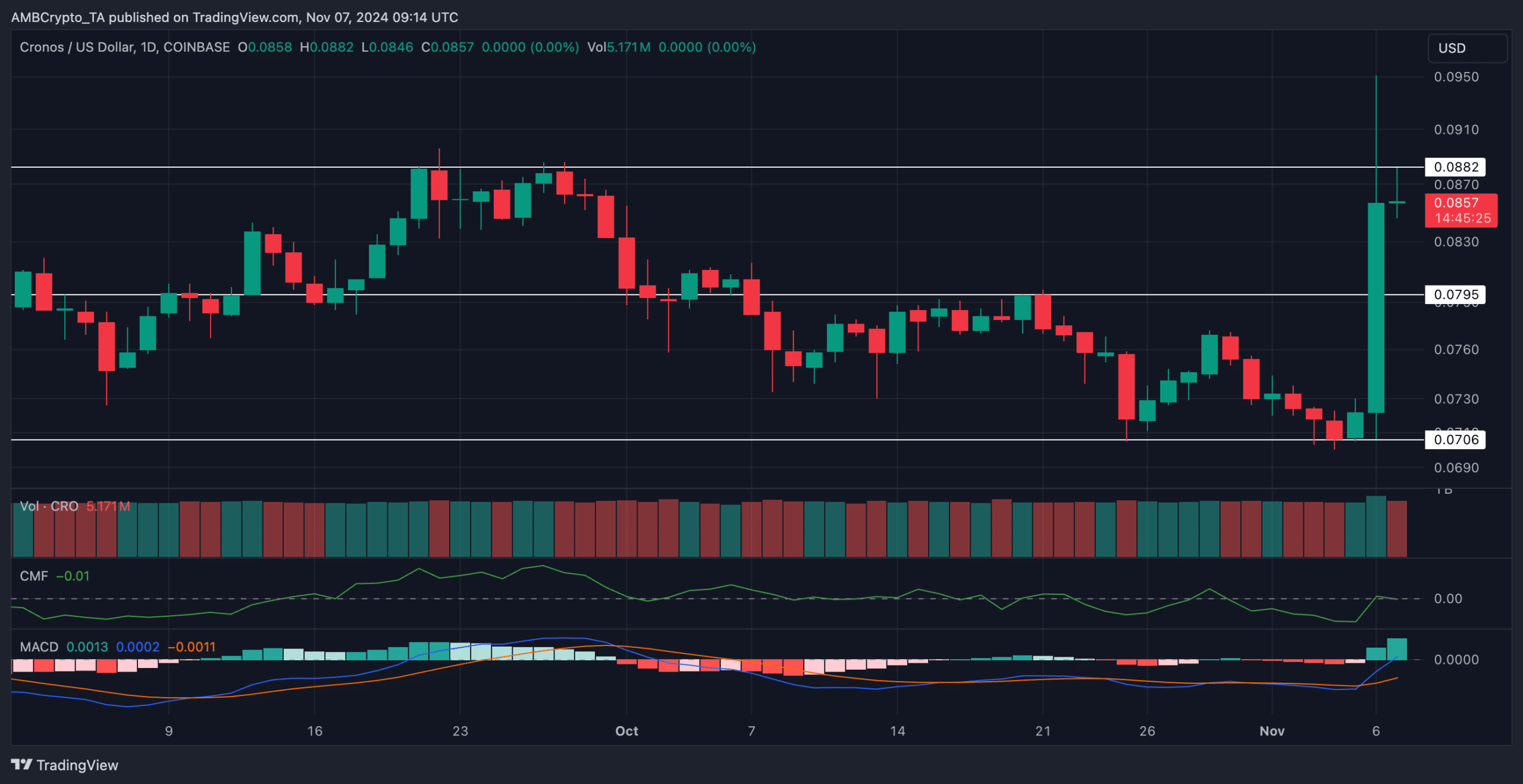

Meanwhile, on the daily chart, CRO’s fortunes shifted dramatically as the token surged from $0.070 to a peak of $0.095. Thus, reversing the long-standing downtrend.

The rise was preceded by a continuous decline triggered by a rejection at $0.088 in late September.

This bearish trend intensified when attempts to break $0.079 failed, leading to a drop to $0.070 by late October.

Despite the surge, technical indicators suggested caution.

The CMF was at -0.01, indicating reduced buying strength. The MACD showed a bullish crossover and turned positive, yet the signal line remained below zero, signaling weak trend strength.

Given the previous rejection at the $0.088 level, the price could face difficulties surpassing it. Overcoming it would necessitate substantial buying momentum.

Derivative data findings

Interestingly, things in the futures market looked better. According to data from Coinglass, Open Interest (OI) increased by 7.63%, signaling growing engagement.

Furthermore, the dominance of short liquidations over long indicated upward pressure.

The long/short ratio of 1.38 further reinforced that the market sentiment leaned positive, with expectations for continued upward momentum.

CRO’s next targets

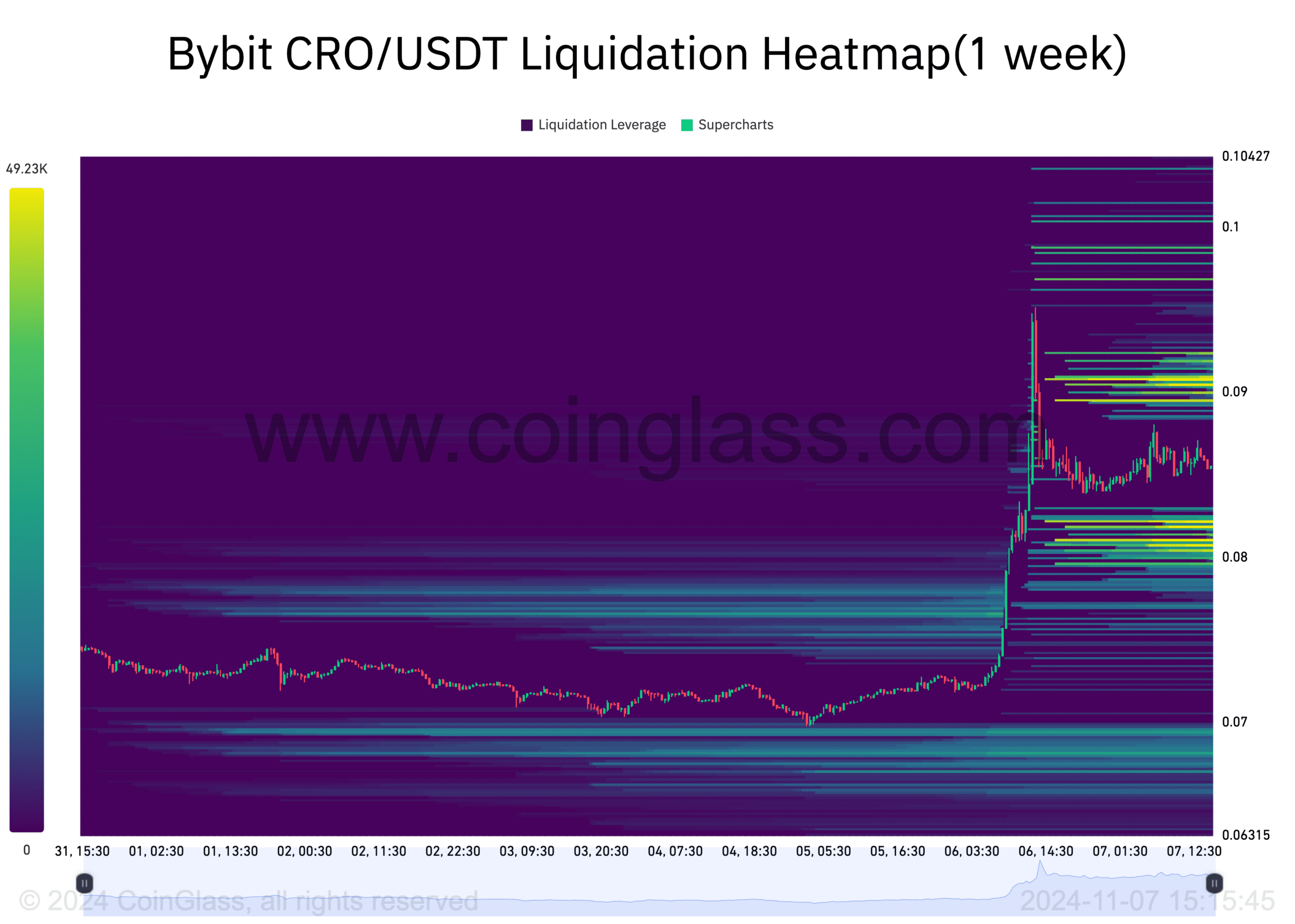

To examine the token’s prospects, AMBCrypto analyzed the one-week liquidation heatmap from Coinglass.

It showed significant liquidity clusters for CRO in both upward and downward directions.

On the upside, a notable band of liquidity was observed around the $0.090 level.

This suggested a key target for price movement if bullish momentum persists and can even trigger a correction.

On the downside, the $0.080-$0.082 range was a magnetic zone. A drop to this zone might lead to a rebound.