Swell crypto gains 46% in 16 hours – Should you bet on more gains?

11/09/2024 10:00

Swell crypto saw a minor dip from $0.0483 but retained its bullish short-term market structure, and more gains are anticipated.

- SWELL is likely to consolidate below $0.045 in the coming hours.

- The small market cap and high trading volume pointed to further gains.

Swell [SWELL] crypto has ascended past the short-term resistance at $0.4 and is in the price discovery phase once more. As a recently launched token, the bullish sentiment across the market is likely to aid the altcoin’s gains.

Swell crypto breaks past recent highs

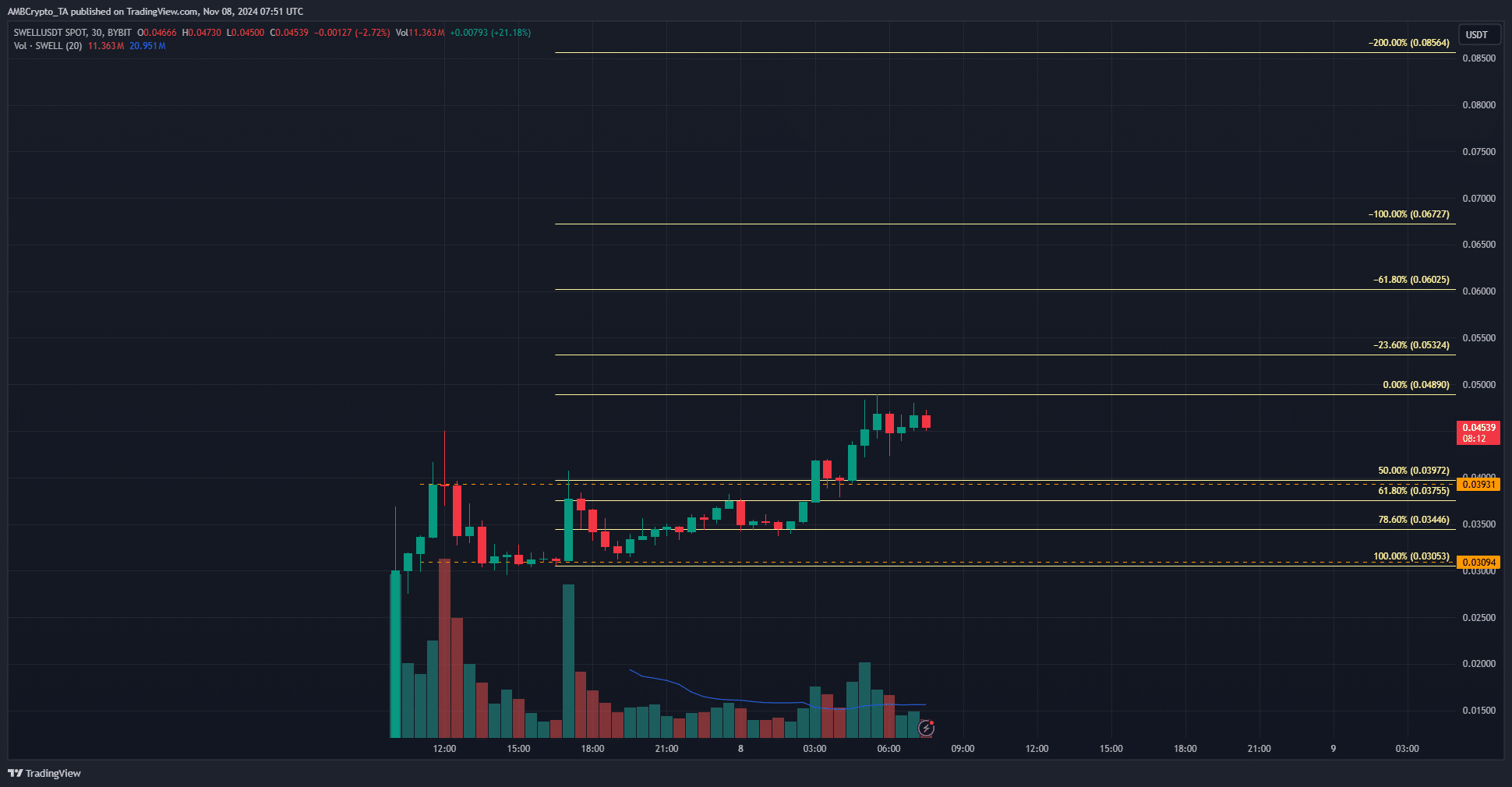

Since the token has been trading for a very short while, the price action data is extremely limited. On the 7th of November, SWELL was stuck below the $0.0393 level and unable to close a trading session above it.

The volume also declined toward the end of the day. This began to turn around on the 8th, and the $0.039 region was retested as support before Swell crypto rallied by 25.2% in two hours.

At press time, the market price was hovering around $0.0453. A drop below $0.039 would flip the short-term structure bearishly. It could lead to a retracement toward $0.0375 and $0.0346, the next significant Fibonacci levels.

Chances of a Swell consolidation

In the early hours of the 8th of November, the price of Swell hovered around the $0.035-$0.038 region. This saw a build-up of short liquidation levels around $0.0382-$0.0394 that was swept in recent hours.

Realistic or not, here’s SWELL’s market cap in BTC’s terms

To the south, there was a sizeable cluster of liquidity at $0.033. It is possible that Swell crypto would fall to this area before a bullish reversal. The more likely scenario is SWELL consolidating around the $0.043-$0.047 area and building liquidity just beyond these extremes.

A deviation below $0.04 followed by a strong bullish move would be the ideal outcome, but this is not a guarantee. Traders will have to be prepared for this and other, less ideal scenarios.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion