Whales control Bitcoin’s fate: How they can keep BTC above $80K

11/11/2024 04:00

Bitcoin is nearing $80K, but steady support from large HODLers is crucial. This will be a key factor to watch in the coming days.

Posted:

- Bitcoin at $80K means higher stakes, setting the stage for massive market volatility.

- Now, more than ever, it’s crucial for whales to act.

As anticipation builds over Trump’s next policy move regarding the crypto market, Bitcoin [BTC] is experiencing a massive surge of euphoria, driving it close to $80K.

Although the market hasn’t hit an overextended phase yet, its high-risk nature could deter some investors.

Renowned investor Robert Kiyosaki has weighed in, emphasizing the need to avoid wishful thinking and focus on sound investing principles, regardless of the current price.

On the flip side, another well-known analyst has expressed caution as Bitcoin approaches a historic range.

With these extreme conditions, AMBCrypto has analyzed the current market trends and concluded that a hidden catalyst is necessary to keep Bitcoin from facing a potential pullback.

The market is primed for volatility

In the last presidential election, it took two months of inconsistent price action to push Bitcoin to a $40K value for the first time, with noticeable pullbacks along the way.

However, this time, while the surge has been more consistent with green candlesticks over the past 5 days, there is much more at stake, considering the current value Bitcoin holds.

So, with the price nearing $80K, the stakes are higher, and any pullback could trigger significant market reactions.

One factor fueling this uncertainty is the high leverage ratio in perpetual trades, as highlighted by another AMBCrypto report, making BTC vulnerable to sudden swings.

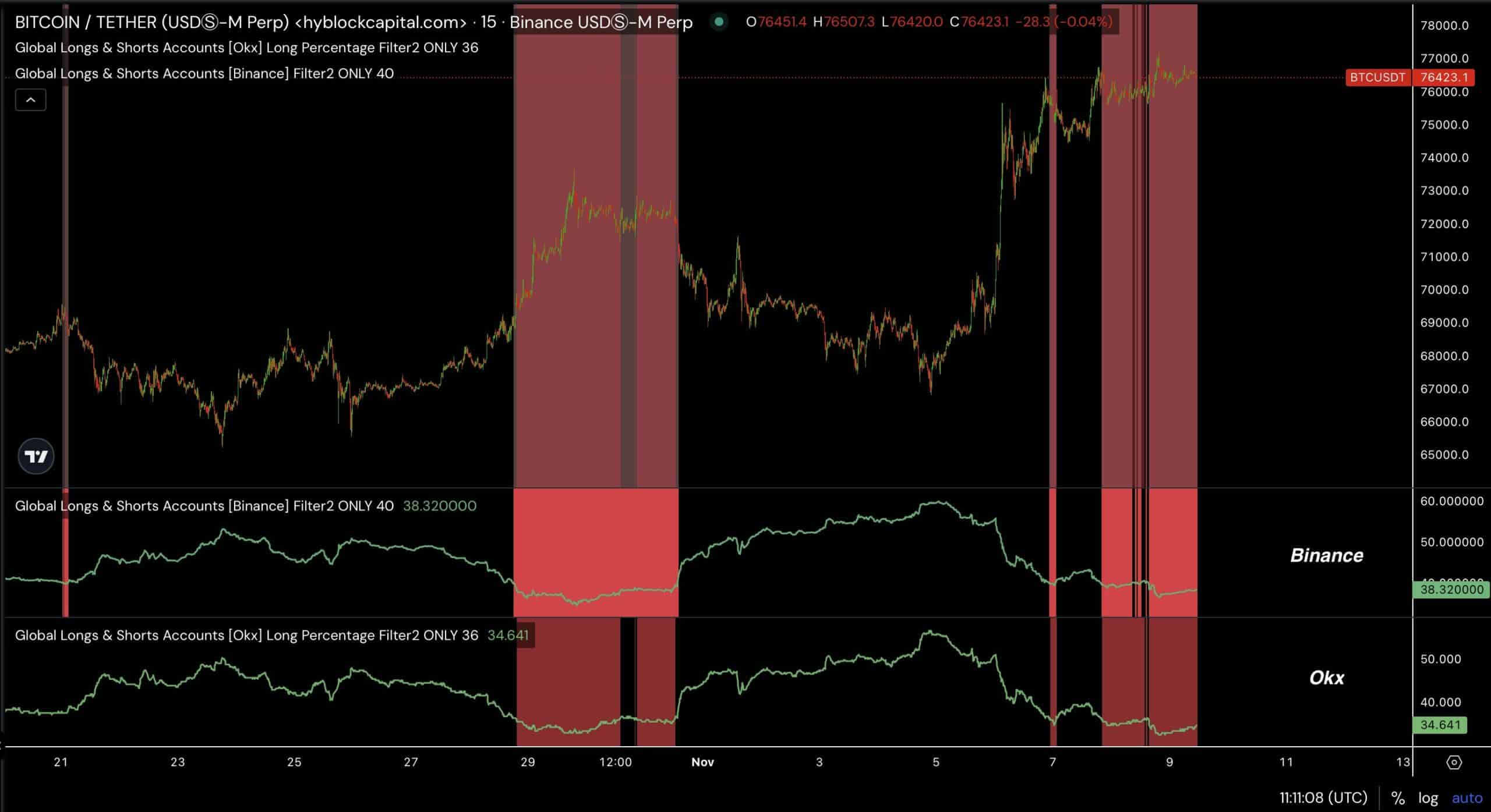

Currently, much of the volatility is driven by activity on major trading platforms like Binance and OKX.

The percentage of traders taking long positions has significantly declined, while short positions are seeing a strong resurgence – creating conditions ripe for a potential long-squeeze.

This setup resembles the late October period when BTC surged to $72K, only to fall back to $67K within a week, as seen in the chart above.

Additionally, during the election buildup, a surge of investors went long on Bitcoin, sparking record-breaking short liquidations of around $371 million.

However, these long positions could be at risk if FOMO fades, buying interest weakens, and the market overheats – especially as the RSI hovers in overbought territory. Therefore,

Bitcoin needs a catalyst to absorb the pressure

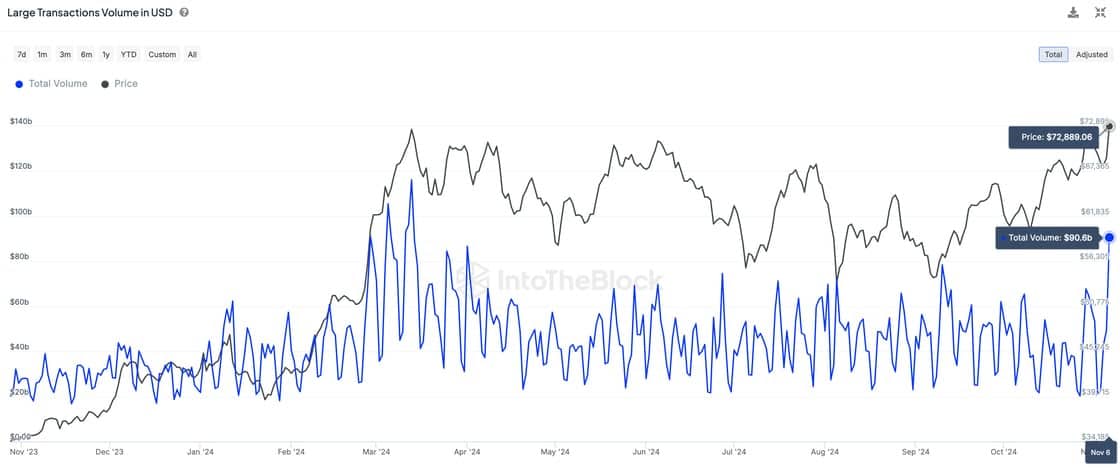

Following the election, large Bitcoin transactions surged, reaching a peak of $90 billion, signaling a sharp uptick in whale activity. Their perspective on the current price as the right entry point is more crucial than ever.

AMBCrypto’s chart analysis reveals that the current accumulation by whales mirrors the March peak when BTC hit its ATH of $73K.

However, that peak was followed by a pullback, partly driven by swings in the derivative markets, as discussed earlier.

Therefore, for Bitcoin to stay above $80K, consistent support from large HODLers is essential. This is something to watch closely in the coming days.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Overall, Bitcoin remains bullish, with a potential short-term surge above $80K.

But with rising volatility and increasing short positions, whales’ steady accumulation is crucial to absorbing the pressure and maintaining a risk-free market sentiment – especially with the stakes so high.