Ethereum (ETH) Sees Abnormal 1,652% Spike in Flows Amid $1.98 Billion Boom

11/11/2024 22:36

Massive $1.98 billion flowed into crypto funds last week, with Ethereum ETFs leading way with staggering 1,652% spike

Massive $1.98 billion flowed into crypto funds last week, with Ethereum ETFs leading way with staggering 1,652% spike

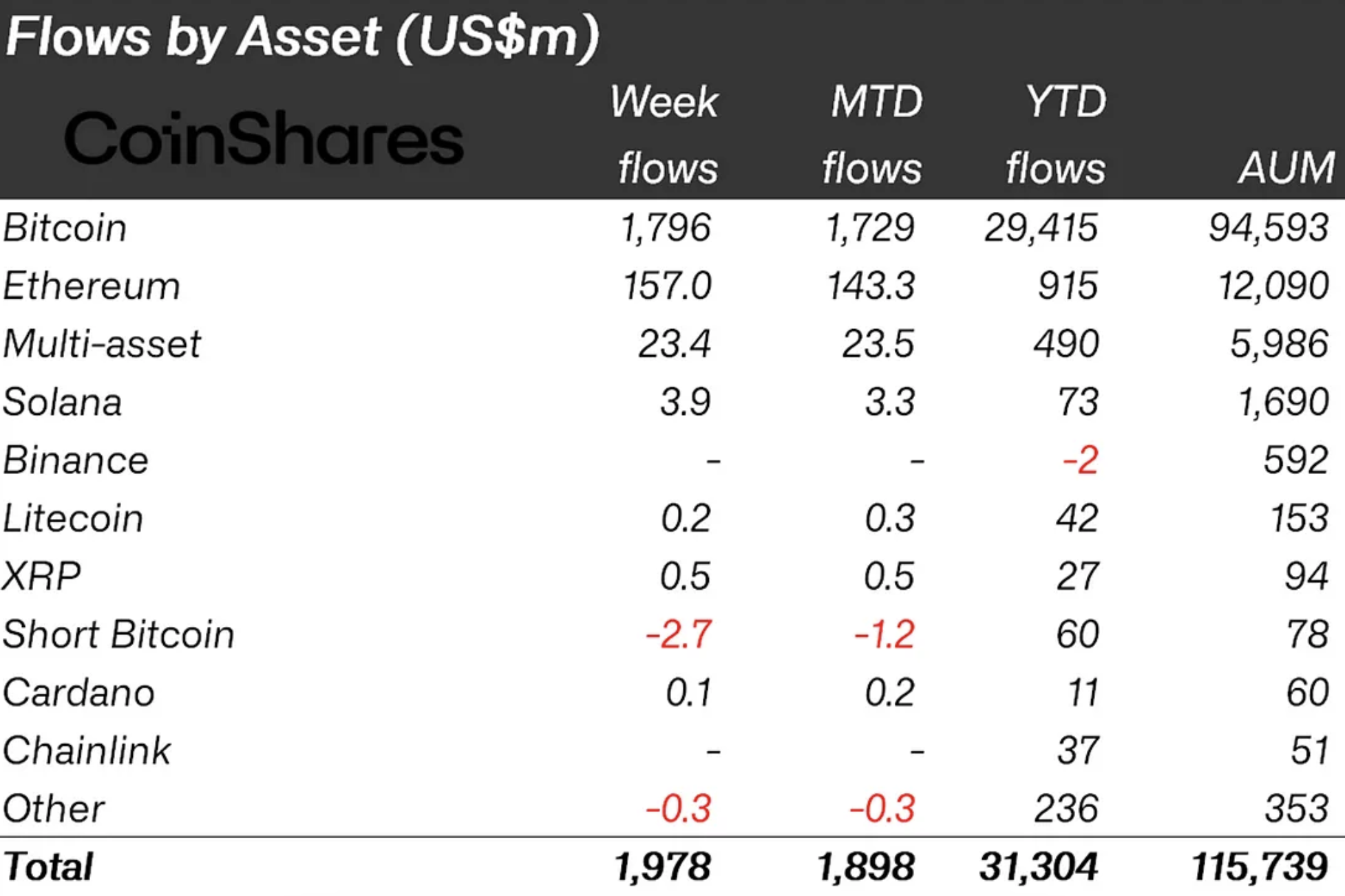

New weekly research from CoinShares bought fresh insights to the current conjecture on the cryptocurrency market. As it turns out, last week saw an astounding $1.98 billion in inflows into cryptocurrency-focused investment products.

Among the major highlights is $157 million in inflows to exchange-traded products, mostly funds, of course, linked to Ethereum (ETH). In fact, this amount is 1,652% higher than what ETFs on the major altcoin saw a week earlier.

As a result, Ethereum ETFs now command 915 million in flows since the beginning of the year. Another interesting statistic is the massive 12.09 billion ETH in assets under management for issuers of these ETFs.

As CoinShares analyst James Butterfill notes, these are the largest inflows since Ethereum ETFs launched in July this year, as more investors seek exposure to major cryptocurrencies through traditional financial products.

The change of heart toward the largest altcoin, which recently reached a market capitalization of $382 billion, may be caused by recent events on the U.S. political scene. Many market participants expect major administrative changes on the way, many of which are expected to be pro-crypto.

In this light, Ethereum is seen as the main beneficiary, as it is the largest cryptocurrency alternative to Bitcoin. The scale of the inflows could also point to a broader adoption of Ethereum as both a speculative asset and a store of value, driven by its wide range of applications in decentralized finance (DeFi) and other blockchain-based innovations.

About the author

Gamza Khanzadaev

Financial analyst, trader and crypto enthusiast.

Gamza graduated with a degree in finance and credit with a specialization in securities and financial derivatives. He then also completed a master's program in banking and asset management.

He wants to have a hand in covering economic and fintech topics, as well as educate more people about cryptocurrencies and blockchain.

Advertisement

TopCryptoNewsinYourMailbox

TopCryptoNewsinYourMailbox