Bitcoin Rally Sparks Coinbase, IBIT Surge at US Market Open

11/12/2024 00:09

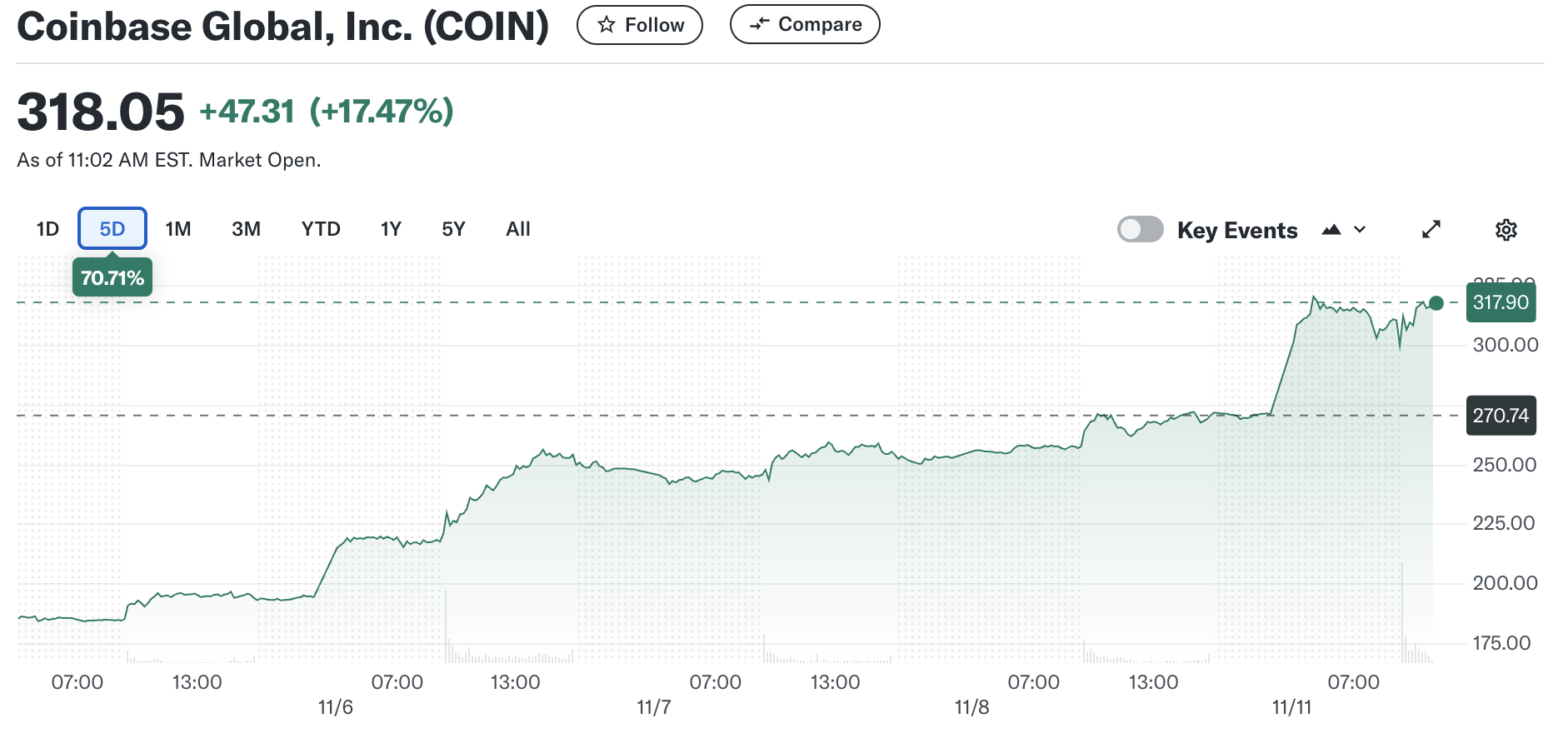

Coinbase surges 13% as U.S. markets open amid Bitcoin's bull run. BlackRock's IBIT ETF sees gains, signaling lasting TradFi crypto interest.

Coinbase’s stock surged by 13% as US markets opened on Monday, reflecting a strong response to Bitcoin’s recent rally. BlackRock’s IBIT ETF also gained, signaling sustained bullish momentum for Bitcoin-linked traditional finance (TradFi) products.

Bitcoin’s impressive gains over the past week appear to be driving growth across related sectors, strengthening investor confidence in the broader crypto market.

Coinbase’s Morning Spike

Since Donald Trump’s re-election and a cocktail of other bullish market factors, Bitcoin has been booming. Its all-time high has surpassed $80,000, and many other areas of the crypto space have come along for the ride. This strong momentum has carried into another new sector today, as trading data shows that popular exchange Coinbase spiked 13% at market open.

Coinbase saw a dramatic jump as soon as trading began Monday morning, and it has continued to rise. At the time of writing, The firm’s stock value is nearly at $320 a share, the highest level since its ATH in November 2021. Binance, another leading crypto exchange, has also jumped since Trump’s election, but this rally is less immediately pronounced.

This 9 AM trade bump has impacted several Bitcoin-adjacent TradFi offerings. For example, Bloomberg analyst Eric Balchunas noted that ETF gains over the weekend will only be visible once traditional markets open, and they cannot take advantage of Bitcoin’s 24/7 trades. However, BlackRock’s IBIT quickly made up for lost time.

“IBIT has seen $1 billion in volume in first 35 minutes. [The] day after [the] election, it did that in 20 minutes, so a bit less than last Wednesday, but still pretty intense. Pretty good early indicator of strong inflows this week,” said Balchunas.

IBIT, BlackRock’s Bitcoin ETF, was already enjoying a commanding lead over the wider market. These continued strong gains suggest an enduring momentum for crypto TradFi products, as opposed to a temporary burst of hype. Coinbase is also enjoying this pattern of delayed gains, suggesting that exchanges may also see prolonged benefits.

Coinbase’s CEO, Brian Armstrong, already anticipated that US election results would bring friendly regulation to the industry. However, Coinbase might have a new avenue for profit here earlier than expected. Obviously, exchanges will benefit from heightened trade volumes and new users, but resurgent stock prices could turbocharge the positive effects.

As of yet, it is unclear which other exchanges might post similar gains from Bitcoin’s rally. Binance, another leading exchange, was hit with a major lawsuit, possibly complicating its immediate price trajectory. In any event, however, this trade spike is clear evidence of a continued bullish pattern for the industry.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.