Bitcoin Tops $85,000 as CryptoQuant CEO Warns Investors About 2025 Market Risks

11/12/2024 01:00

Bitcoin’s rally to new all-time highs is stoking market greed. Could BTC be primed for a correction or even a 2025 bear market?

Bitcoin’s (BTC) price has once again hit a new all-time high today, rallying above $85,000 briefly for the first time ever. Following this development, the broader market has turned extremely bullish, with some analysts saying that a Bitcoin price correction might not be far away.

This also comes amid growing predictions that BTC could surge to $100,000 by the end of the year. What’s really happening right now?

Bitcoin’s Impressive Performance Leads to Greed

Over the last seven days, Bitcoin’s price has increased by nearly 20%. This price increase was due to Donald Trump’s sweeping victory in the US elections on November 5. The significant rise in institutional appetite for BTC could also be linked to the cryptocurrency’s jump to a new all-time high.

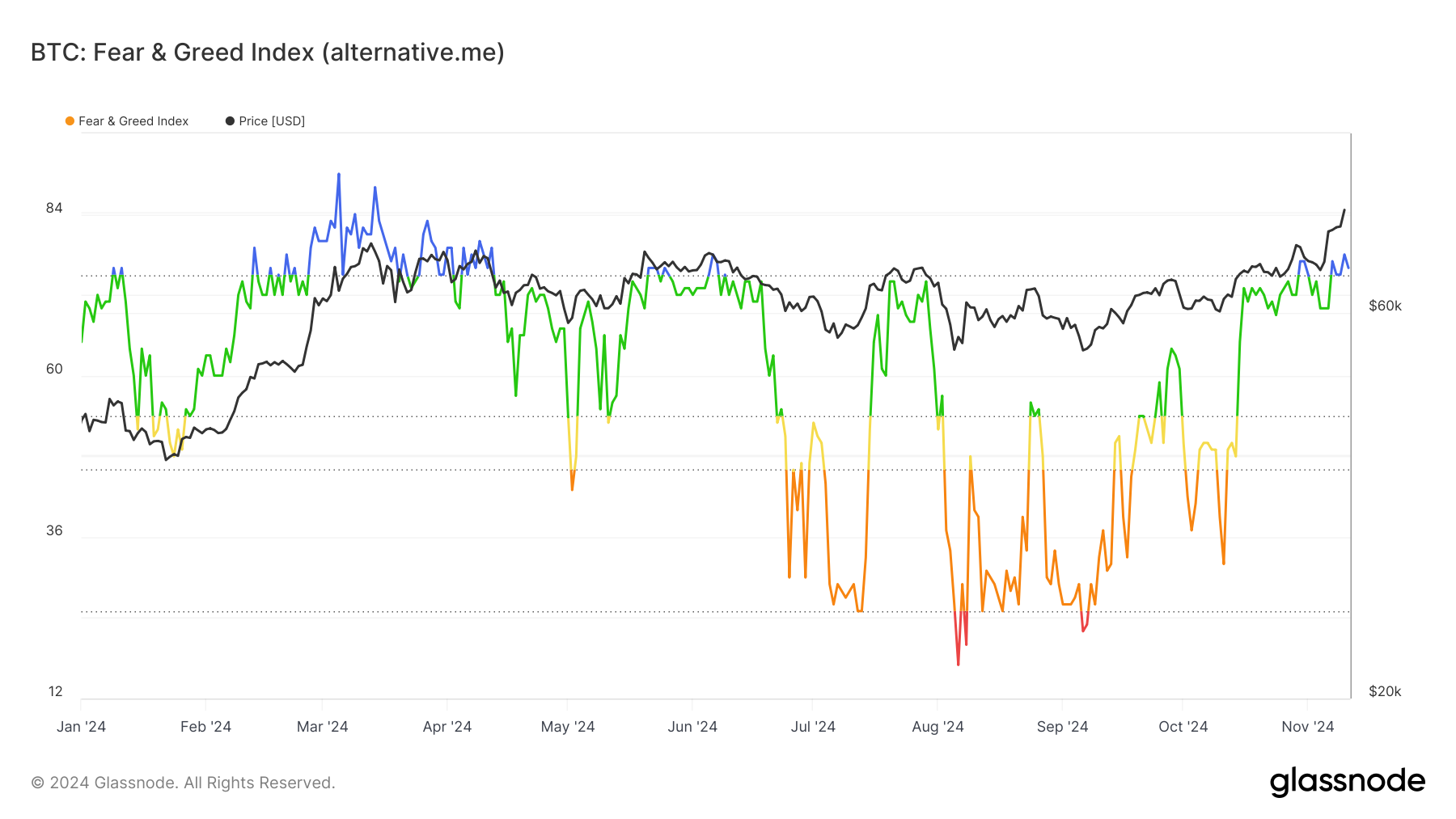

To determine whether Bitcoin could climb higher or if we’ve hit a local top, it’s crucial to spot whether the market is extremely greedy or in fear. According to Glassnode, the Bitcoin fear and greed index has hit the extreme greed level. Created by Alternative.me, this metric measures investor sentiment in a single number by aggregating data from multiple sources.

Ranging from 0 to 100, values close to 0 signify “extreme fear,” reflecting heightened negative sentiment. In most cases, this region indicates an almost perfect accumulation point. On the other hand, a score of 100 or close to it represents “extreme greed,” indicating maximum Fear of Missing Out (FOMO). If sustained, this position, as seen above, could lead Bitcoin’s price to a correction phase.

Year-to-date, the last time the index hit such a level, BTC’s price collapsed weeks later and went on a long correction and consolidation phase. Therefore, if past performance influences recent events, BTC could be close to retracement.

Interestingly, this development coincides with a warning by CryptoQuant CEO Ki Young Ju. On Sunday, November 10, Young Ju posted that the BTC price prediction at the end of the year could be much lower, at $58,974. He also mentioned that the seemingly overheated market could lead to a Bitcoin price correction in 2025.

“I expected corrections as BTC futures market indicators overheated, but we’re entering price discovery, and the market is heating up even more. If correction and consolidation occur, the bull run may extend; however, a strong year-end rally could set up 2025 for a bear market,” Ki Young Ju emphasized on X.

Investors Continue to Buy, but Analyst Advises Caution

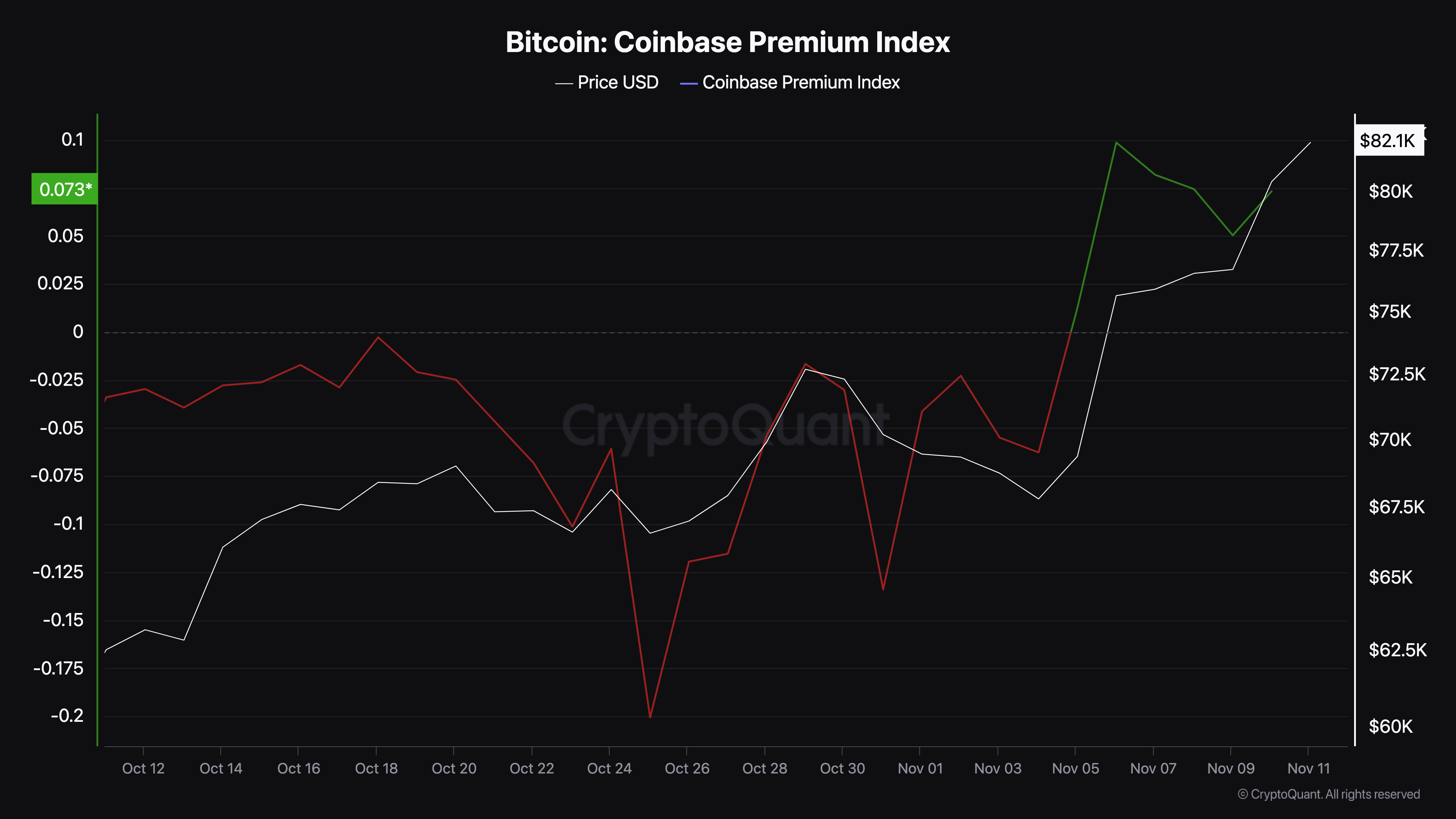

Despite CryptoQuant CEO’s opinion, the Coinbase Premium Index has shown a notable increase. This index measures the activity of US investors. High premium values might indicate strong buying pressure from US investors on Coinbase.

Conversely, a low value might suggest high selling pressure. Therefore, since the current reading suggests otherwise, Bitcoin’s price might continue to climb.

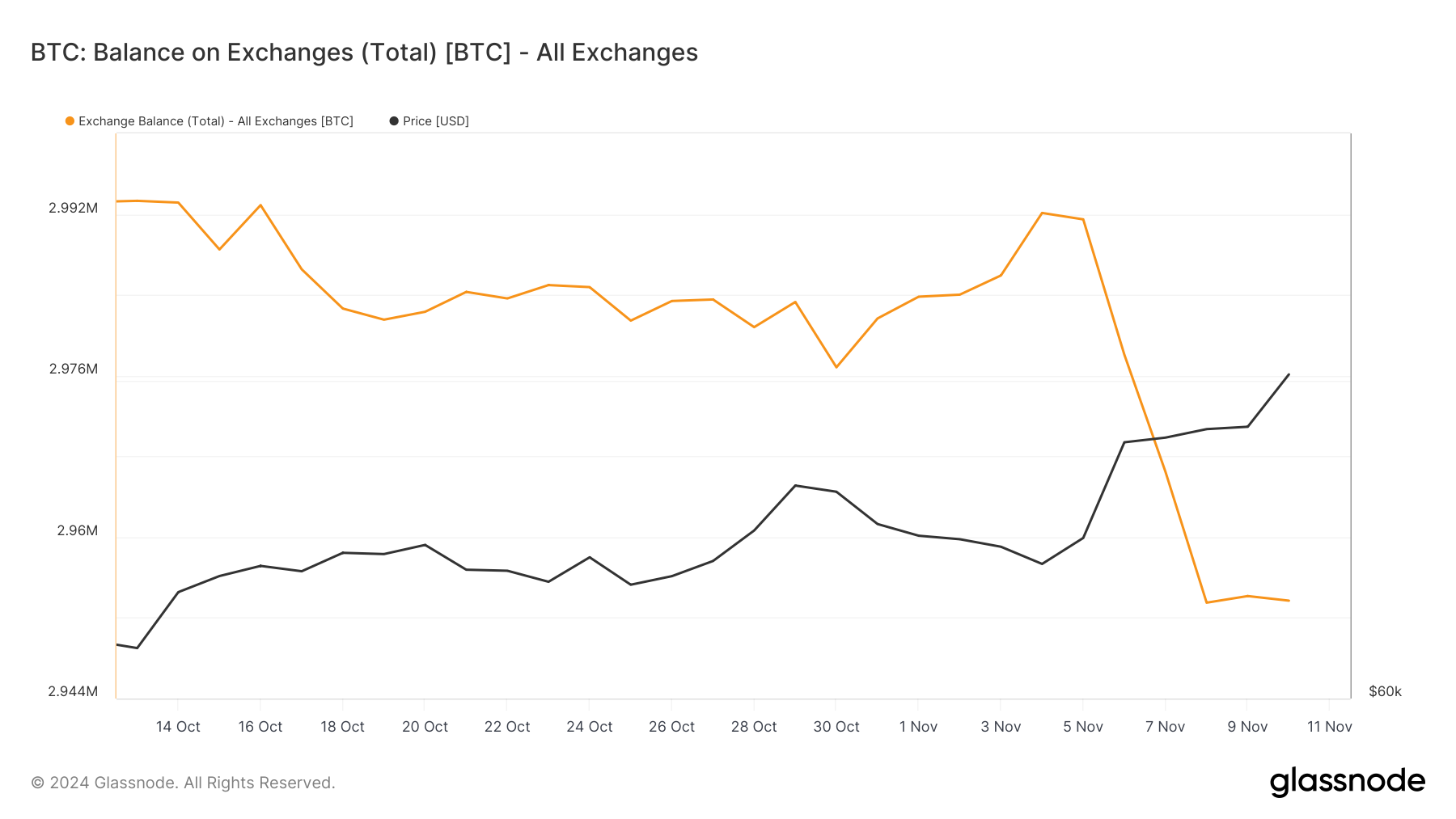

Furthermore, Glassnode data shows that the BTC balance on exchanges has significantly decreased. The balance on exchanges is the total number of coins held in exchange addresses.

When it increases, it means that many holders are prepared to sell, which could lead to a drawdown. Based on the data above, Bitcoin holders have withdrawn nearly 40,000 BTC from exchanges since November 5.

At the current price, this is worth over $3 billion. If sustained, then a Bitcoin price correction might not happen in the short term. Instead, the cryptocurrency’s price might continue to rise.

Crypto analyst Michaël van de Poppe, like Young Ju, also pointed out that the significant increase in futures positions could push Bitcoin’s price down initially before the uptrend resumes.

“Massive futures positions are open and I think we’ll see a flush happening in the coming week before we continue the upward trend.These flushes are tremendous opportunities,” van de Poppe said.

BTC Price Prediction: RSI Steps Into Overbought Zone

Bitcoin is currently priced at $84,760, and the daily chart shows the cryptocurrency trading above both the 20-day and 50-day Exponential Moving Averages (EMAs). Being above these levels suggests that Bitcoin’s trend is bullish.

However, the Relative Strength Index (RSI), which measures momentum, has seen its reading rise above 70.00. Typically, when the RSI is below 30.00, it is oversold. But since it is above 70.00, it means BTC is overbought.

Hence, there is a chance that Bitcoin’s price could undergo a quick correction. If that happens, then the cryptocurrency could drop to $76,571. On the other hand, if bulls do not give bears any breathing space as things stand, this might not happen. Instead, BTC might rally above $86,000 and get closer to $100,000.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.