Cronos, the native token of Crypto.com and the Cronos EVM chain, saw a notable surge to a 30-month high of $0.23, thanks to the increasing whale activity.

Cronos (CRO) recorded a 186% rally in the last seven days. The asset gained 45% in the past 24 hours and is trading at $0.205 at the time of writing. CRO’s market cap is currently hovering at $5.46 billion, making it the 24th-largest digital asset.

This is the first time for Cronos to reach this level since May 2022.

Moreover, its daily trading volume skyrocketed by 340%, reaching $1.21 billion, as its whale activity gained momentum.

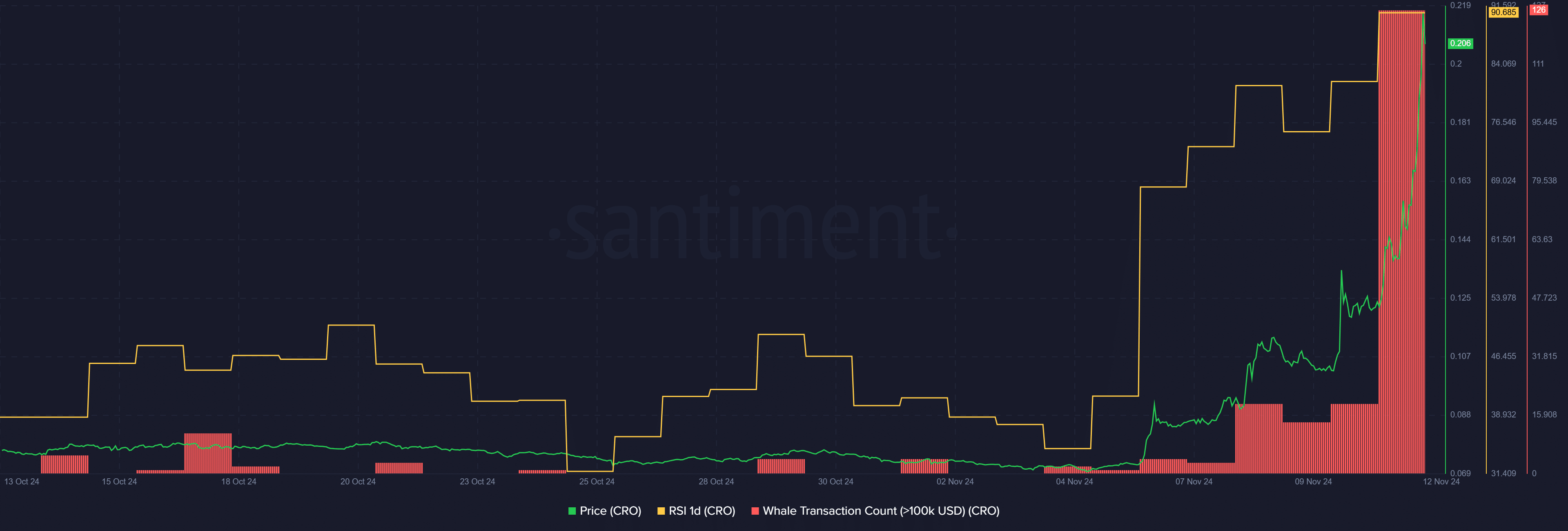

According to data provided by Santiment, the number of whale transactions consisting of at least $100,000 worth of CRO tokens rose from 19 to 126 over the past day.

Increasing whale activity usually hints at strong bullish sentiment among investors, triggering high price volatility.

However, the CRO Relative Strength Index hiked to the 90 mark, per Santiment. The indicator suggests the asset is highly overbought at this point. This could hint at a potential cooldown for Cronos before starting a further rally.

Sentiment remains positive

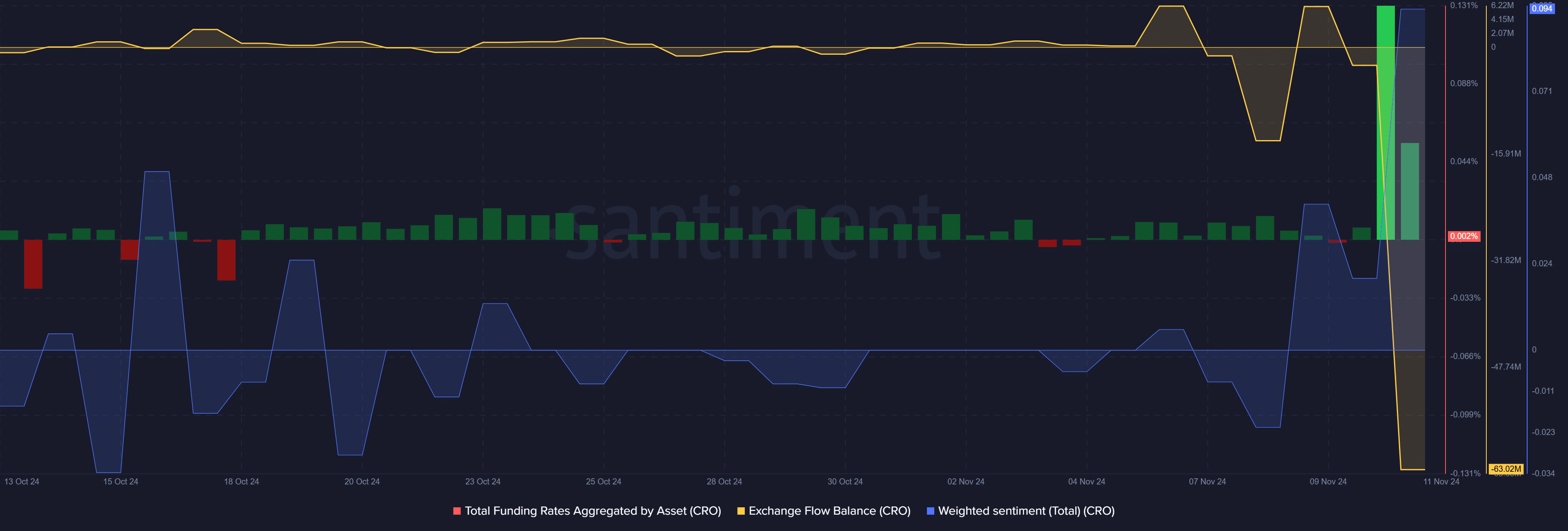

Data from Santiment shows that the weighted sentiment around Cronos is still very high as the asset is still down by 78% from its all-time high of $0.969 in November 2021.

The total funding rate aggregated by CRO dropped from 0.13% to 0.001% over the past two days — suggesting a cool-down in the derivatives market activity.

The start of short liquidations could potentially push the CRO price higher in normal market conditions.

In addition, Cronos witnessed an exchange net outflow of 63 million tokens in the past 24 hours, showing increased accumulation, according to the market intelligence platform.

Another major catalyst for the CRO price surge was the Cronos partnership with Google Cloud, becoming the platform’s primary validator.