Popcat, the third-largest Solana meme coin, has been left behind in the ongoing crypto bull run, with a potential risk of a bearish breakout.

Popcat (POPCAT) retreated to $1.43 on Tuesday, Nov. 12, down 18% from its highest level this year.

While Popcat has risen by just 14% over the past seven days, Dogecoin (DOGE) has surged 128% in the same period, and tokens like Shiba Inu, Pepe, Dogwifhat, and Bonk have all jumped by over 40%. These tokens rallied following Donald Trump’s election win, which raised hopes for friendlier regulations in the U.S.

A possible reason for Popcat’s underperformance is investor rotation into other coins. Despite this, Popcat remains one of the best-performing cryptocurrencies of the year, having surged over 250,000% from its lowest level.

Some analysts see potential upside for Popcat in the near term. In a post on X, popular analyst Professor Astrones, who has over 187,000 followers, suggested the coin could reach between $10 and $20.

Popcat price may be at risk of a big dive

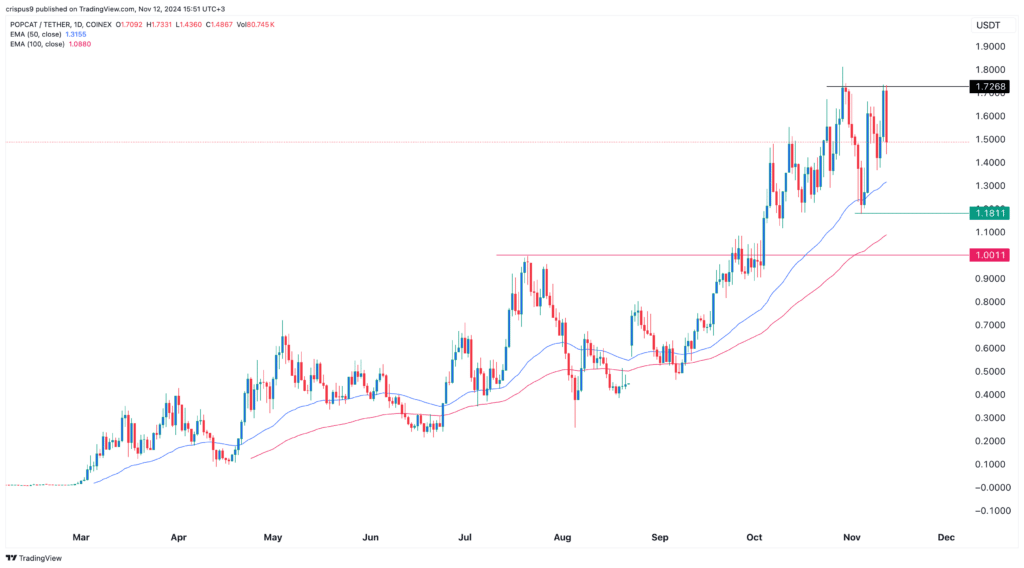

Popcat’s token price has performed well this year, reaching a record high of $1.8132. It flipped the key resistance level at $1 on Oct. 4, signaling bullish control.

Popcat remains above its 50-day and 100-day Exponential Moving Averages, which is generally a bullish sign. However, it has formed a double-top pattern at $1.7268 with a neckline at $1.1810, one of the most common bearish reversal signals in the market.

Additionally, it is in the process of forming a bearish engulfing candlestick pattern, indicating potential for a downward trend. If this bearish pattern holds, Popcat could fall to the neckline at $1.18, approximately 21% below the current level. A drop below this neckline could lead to further downside toward $1.

On the other hand, a move above the double-top level of $1.7270 would suggest potential gains, possibly up to the resistance level at $2.