TRON surges: Key factors driving the price increase are…

11/13/2024 15:00

TRON hits $0.18 with a 7% surge, sparking speculation on reaching 2018 highs.

Posted:

- TRON gains 7% today, setting a positive tone for the week ahead.

- A breakout above the Bollinger Bands on the 4-hour chart suggests further gains for the token.

Tron [TRX] is mirroring gains across the broader cryptocurrency market. At press time, TRON was trading at $0.1778, up over 7% in the past 24 hours.

During this period, TRON’s 24-hour trading volume has surged by 121%, reaching $1.62 billion. Investor interest in the token continues to grow, with its market cap rising 7.58% to $15.35 billion.

On the monthly chart, Tron has shown strong bullish momentum, reaching the highs last seen in April 2021. This move reflects Tron’s potential to revisit its 2018 all-time highs amid the ongoing cryptocurrency bull cycle, which has intensified following Trump’s recent election win.

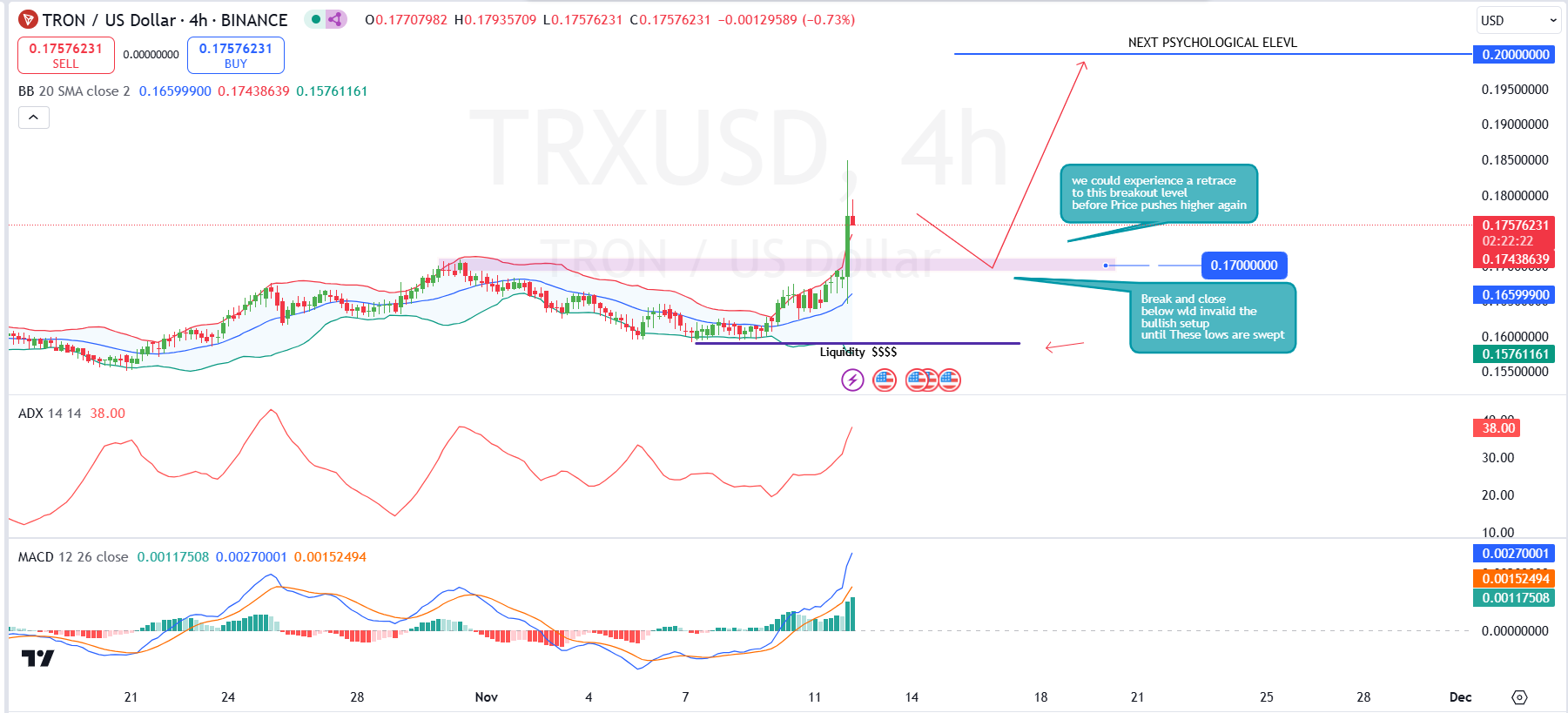

On the 4-hour chart, the price recently surged above the $0.1700 breakout level, reinforcing a bullish trend, with a potential retracement suggested back to this level. This area could serve as new support, providing an opportunity for buyers to push the price towards $0.20, a key psychological resistance level.

Bollinger Bands indicate increased volatility as the price extends toward the upper band, highlighting strong buying pressure. However, a retracement back into the bands may occur to consolidate recent gains.

An important invalidation level lies near $0.1600. A break and close below this point would negate the bullish setup, potentially leading to further declines, especially if it moves to capture liquidity around the $0.1590 lows, which might attract more buyers for a bounce.

Supporting this bullish outlook, the ADX indicator, currently at 36.44, shows strong trend strength, validating the momentum in this recent move. This ADX level suggests that the trend is robust but overextended, and a pullback could still occur.

The MACD line crossing above the signal line with expanding histogram bars further indicates bullish momentum, suggesting that buying pressure remains strong.

However, the distance between the MACD and the signal line could imply that the trend may need to cool down slightly or consolidate before attempting another rally.

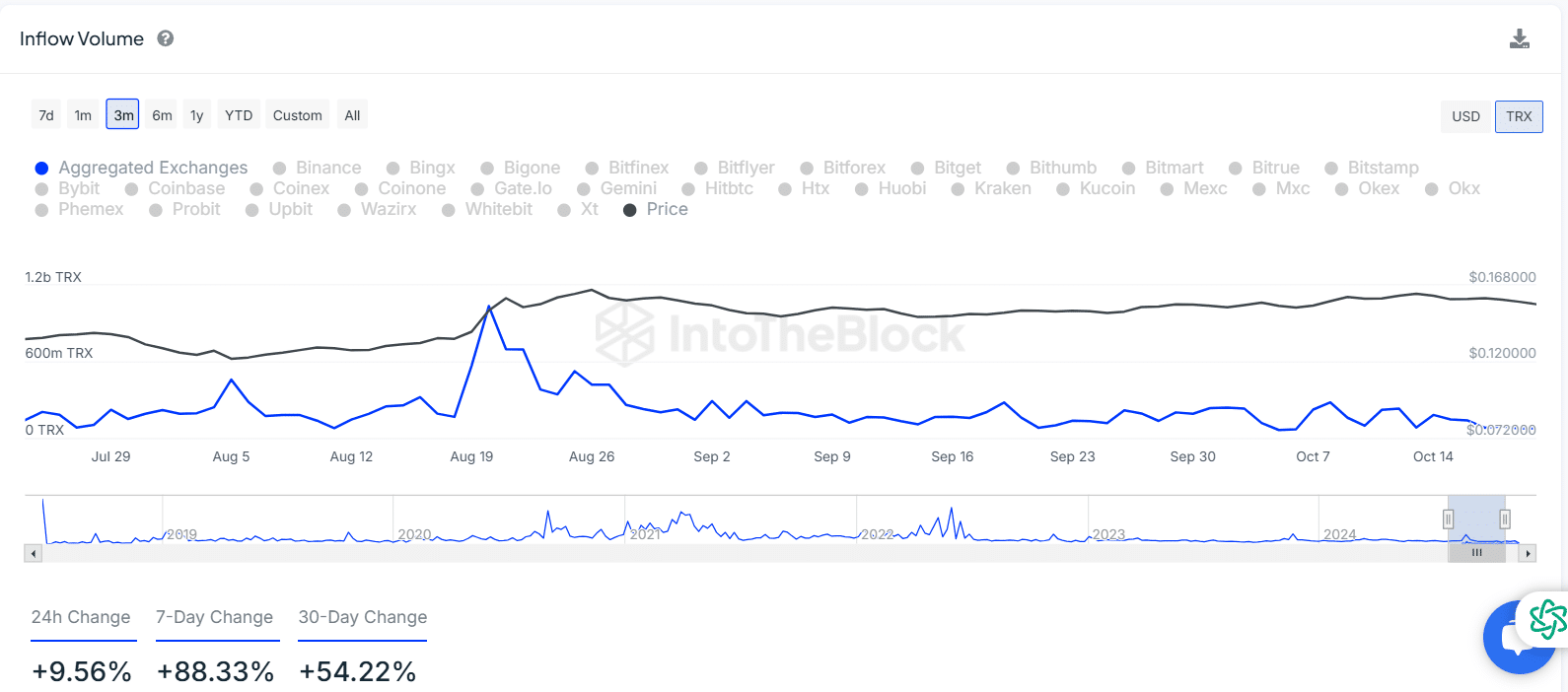

Steady TRX volume growth since August signals renewed market interest

Since August, TRX inflow volume has been rising steadily, with notable peaks around mid-August where volume and price spiked simultaneously, suggesting strong buying interest and increased trading activity.

Following the August peak, inflow volumes gradually decreased but maintained a steady baseline through September and October, during which the price also stabilized.

This period of lower inflows and reduced price volatility likely reflects a consolidation phase or reduced speculative activity in the TRX market.

Recent data shows an uptick in inflow volume, with a 9.56% increase in the last 24 hours, an 88.33% rise over the past 7 days, and a 54.22% increase over 30 days.

This upward trend in inflow volume indicates renewed interest in TRX, which could drive further price movements if the trend persists, potentially breaking the current range and aiming for the 2018 all-time highs.

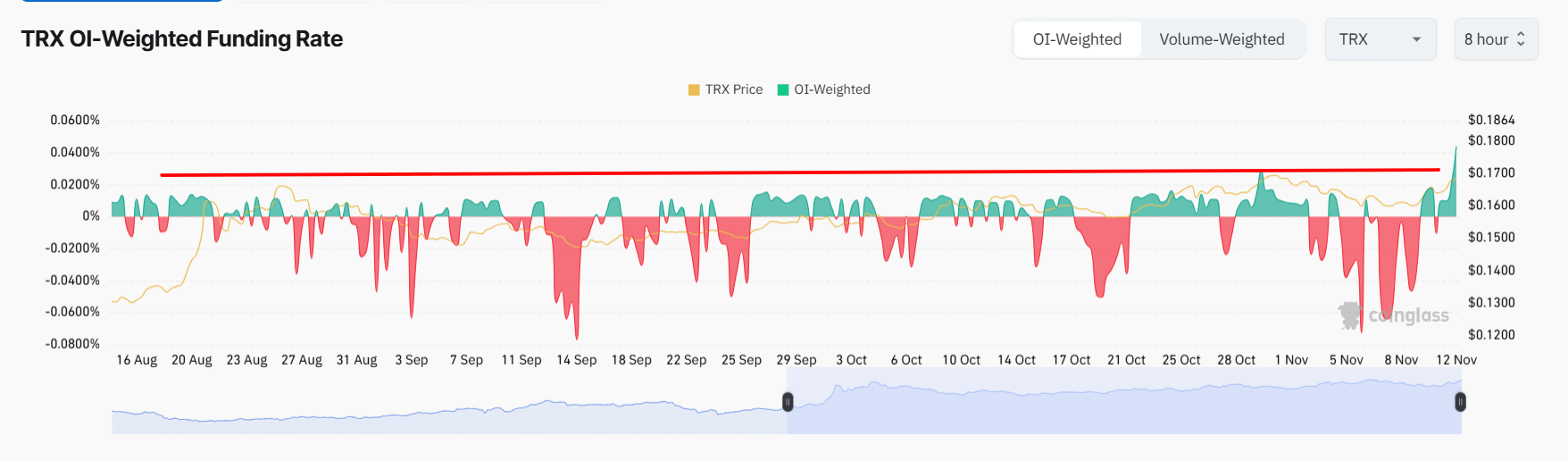

Sustained positive funding rate in TRX hints at price rally

The TRON funding rate reflects a strong shift toward bullish sentiment, with the funding rate recently reaching 0.04%, the highest level since August.

Throughout August and September, the funding rate oscillated around neutral, fluctuating between -0.02% and 0.02%, indicating mixed trader sentiment.

Read TRON’s [TRX] Price Prediction 2024-25

However, recent data in early November shows a steady increase, with the funding rate consistently holding above 0% and now spiking to 0.04% as Tron prices approach $0.2.

This sustained positive funding rate suggests that traders are increasingly paying premiums to hold long positions, signaling strong confidence in further price gains.