Ethereum price prediction – Bulls look to $4k after 43% gains in 7 days

11/13/2024 16:00

The higher timeframe Ethereum price prediction was bullish and a move toward $4k is likely according to the liquidation charts.

Posted:

- Ethereum rocketed past the $2.8k resistance to reach $3.4k within a week

- The liquidation levels building up at and below $4k were reasonable targets for ETH prices

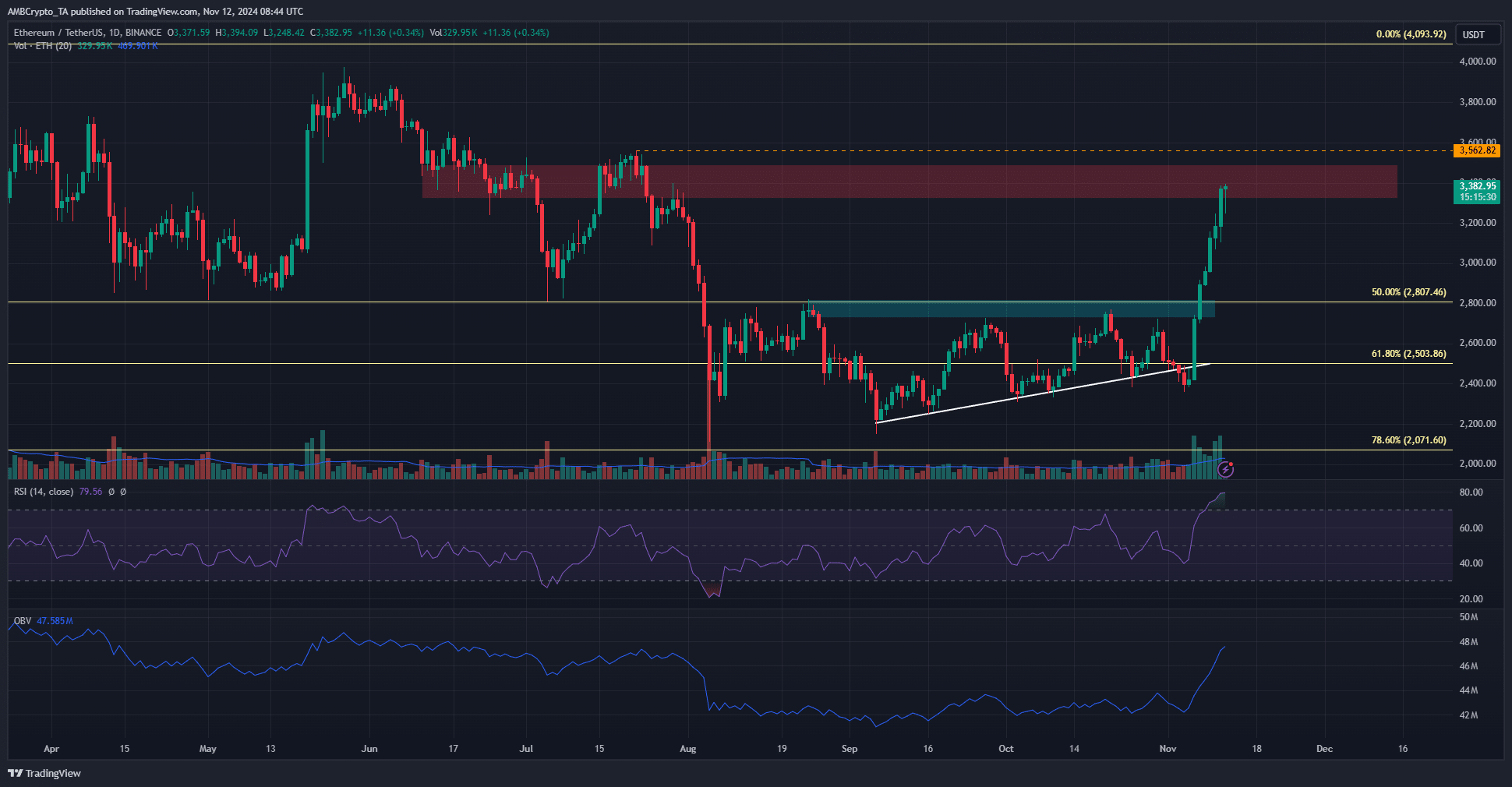

Ethereum [ETH] bulls have passed the $3,200 test and targeted the $3.5k and $4k psychological levels. AMBCrypto’s technical analysis showed that the $3,562 area could be key to the next impulse move.

The increased network activity and high transaction volume highlighted demand for the network. The Ethereum price prediction is strongly bullish on the higher timeframes after the recent rally.

The importance of $3,562 on the higher timeframes

A week ago, Ethereum appeared to break down beneath the ascending triangle pattern. This was a bearish sign, but the price was quick to reverse, and has had 43.1% gains since last Tuesday.

This showed that the breakdown was a fake move, and reading the past two months as a range formation would have been more accurate.

The OBV surged past three-month highs and was near the levels from June. The RSI was at 79.5 to show intense bullish momentum.

ETH may require a few days to consolidate, especially as it encountered resistance from June and July.

On the weekly timeframe, the $3,562 was the lower high that heralded the downtrend after July. A move beyond this level would make $4k the next price target for ETH.

Further gains highly likely for Ethereum

AMBCrypto analyzed the six-month look-back period liquidation heatmap and found that there were bands of liquidity that reached up to the $4k mark.

Read Ethereum’s [ETH] Price Prediction 2024-25

Of particular importance were the July highs at $3,562- important on the weekly chart as well as being a concentrated liquidity pool.

The sparsity of liquidation levels to the south suggested that, in the coming days and weeks, Ethereum is much more likely to be drawn upward. Traders should watch out for volatility on the lower timeframes.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion