Bitcoin Crosses $92,000 After CPI Shows US Inflation Rising to 2.6%

11/13/2024 23:29

Bitcoin soars to $92,000 as U.S. CPI inflation rises to 2.6%. Explore how inflation impacts Bitcoin's price and market trends.

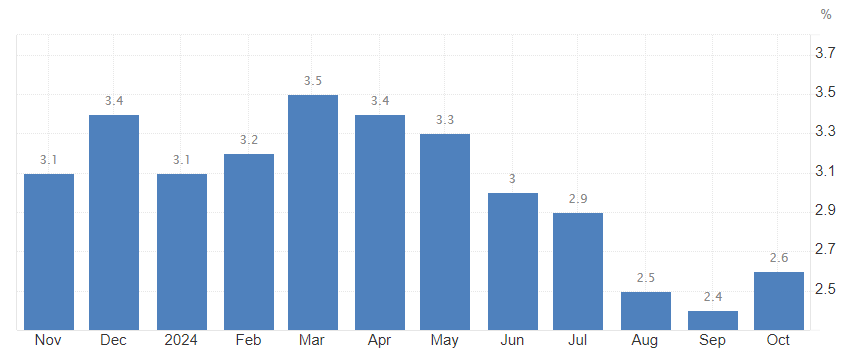

Bitcoin surged to an all-time high of $92,000 after the US Consumer Price Index (CPI) revealed inflation rose to 2.6% year-over-year in October, up from 2.4% in September.

The latest inflation figures heightened concerns about the Federal Reserve’s monetary policy, hinting at potential volatility in the crypto market.

Will the CPI and Bitcoin Correlation Change Amid Pro-Crypto Sentiment?

Bitcoin’s rally, despite rising inflation, can be attributed to the increasingly positive sentiment in the crypto market after the US election. The market is anticipating significant regulatory shifts in the US financial system.

At the same time, today’s CPI data came in lower than expected, as previous reports suggested inflation could be higher.

The Labor Department reported that monthly CPI inflation held steady at 0.2%, matching September’s figure. However, the annual increase of 2.6% marked the first uptick in eight months.

Core CPI, which strips out volatile food and energy prices, remained unchanged at 0.3% on a monthly basis and 3.3% annually, aligning with expectations.

However, even with today’s Bitcoin rally, an aggressive stance from the Federal Reserve could inject volatility into the market. A potential rate hike could weigh on investor sentiment, impacting the broader financial markets, including cryptocurrencies.

It’s also important to consider the legacy perspective that inflation fears often lead investors to seek assets with limited supply, such as Bitcoin. Additionally, while higher CPI figures increase the likelihood of tighter monetary policy, they also signal ongoing economic uncertainty.

Bitcoin all-time high and ongoing rally also reflect market optimism about its long-term potential. This is largely because institutional adoption and positive sentiment around crypto-assets continue to grow, even amid inflationary pressures.

BTC Had Remained Stable Throgout Earlier Inflation Drops

Bitcoin’s behavior in August and September reflected its sensitivity to macroeconomic signals, particularly inflation and Federal Reserve policy expectations. In August, CPI inflation dropped to 2.5%, below both July’s 2.9% and market expectations of 2.6%.

This cooling inflation suggested easing price pressures, prompting speculation about a potential 25 basis point rate cut in September.

Bitcoin’s muted reaction during this period indicated that the market had largely anticipated the favorable inflation data, pricing in the potential monetary easing ahead of the CPI release.

In September, despite inflation rebounding slightly to 2.9%, Bitcoin maintained its position above $61,000. The market viewed this figure as a continuation of July’s cooling trend, reinforcing expectations that the Fed might hold off on further tightening.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.