Degen crypto soars 172% in 5 days, but THIS could pull prices down

11/14/2024 11:30

Degen crypto saw a 172% surge in the space of four-and-a-half days, but has fallen by 21.66% from the local highs- will this dip contine?

Posted:

- Degen crypto rallied beyond the psychological level of $0.02.

- The token was unable to defend this level during the retracement, and could fall another 14%.

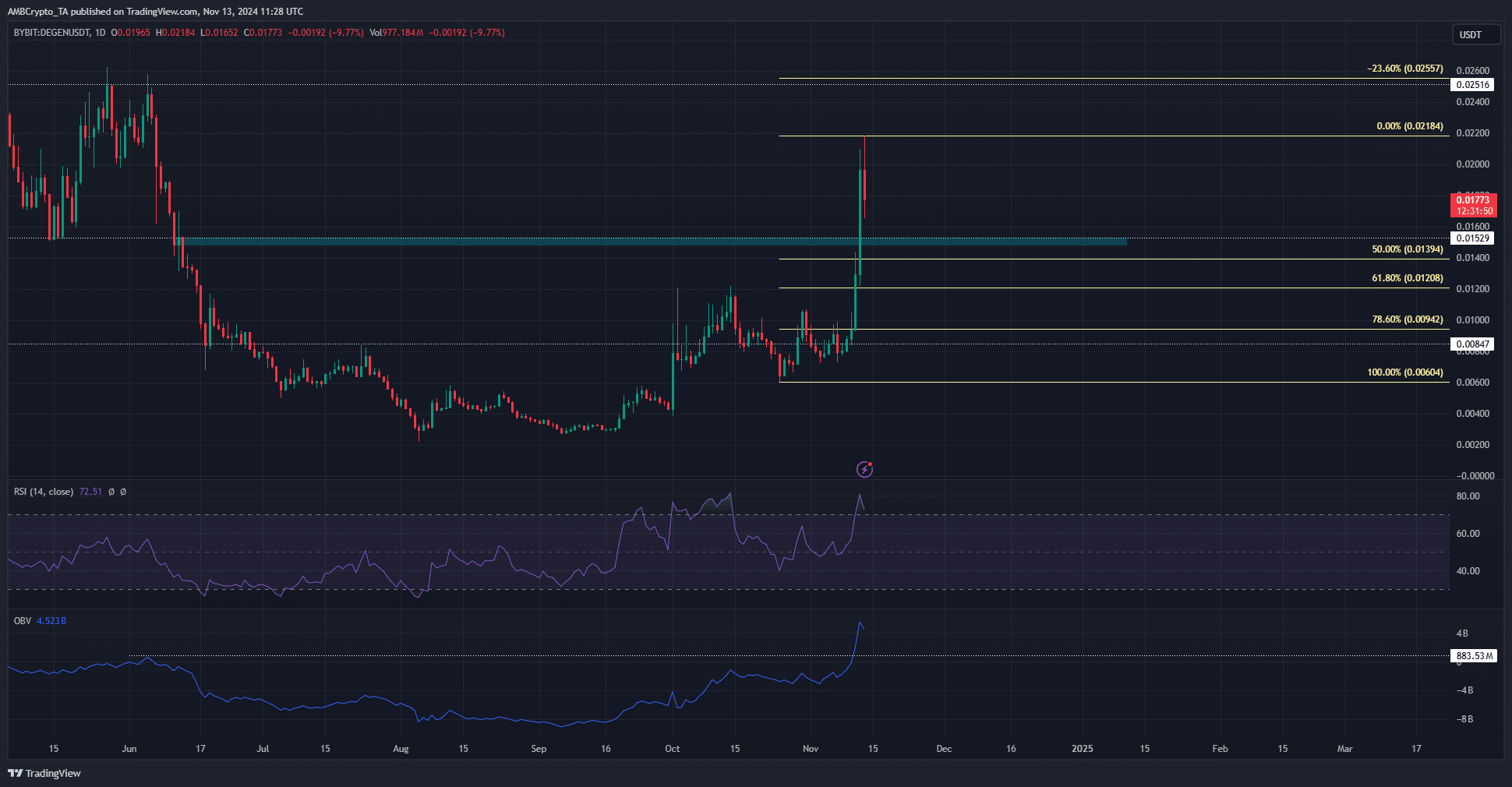

Degen [DEGEN] was successful in its attempt to break the local resistance zone at $0.012, which had kept the bulls at bay since early October. The Degen crypto rally started at $0.0079 on the 8th of November.

In just over four days, DEGEN pumped by 172%, reaching a new local high of $0.0218 as Bitcoin [BTC] made new all-time highs.

The $0.02 level has some historical significance, but the bulls were unable to defend this level as support.

How deep will DEGEN retrace?

Degen crypto has been trending higher since the 1st of October, when the local resistance zone at $0.0055 was broken decisively.

The bulls encountered some pushback at the $0.0085 region, but eventually reclaimed the zone as a support.

The recent rally originated from this region, starting at $0.0079 and going to $0.0218. The RSI was still in overbought territory despite the pullback in recent hours.

The RSI being above 70 does not guarantee a retracement by itself.

Contextually, the Bitcoin dip from $87k has led to a wave of profit-taking, but DEGEN is likely to run much higher. This is because the OBV has climbed past the high it made in June, when the price was at $0.0153.

The market structure was firmly bullish, and the overhead targets next are at $0.0255 and $0.0316 based on the Fibonacci levels plotted for the recent rally.

To the south, the $0.015 area is expected to be retested as support.

Will DEGEN crypto move to $0.012?

Is your portfolio green? Check out the DEGEN Profit Calculator

At press time, a drop to the liquidity pool at $0.0117 appeared unlikely. Yet, the cluster of liquidation levels there was potent, and the magnetic zone could pull DEGEN down to it.

Prices are attracted to liquidity, and a deeper dip for BTC would likely panic altcoin traders and force over-leveraged positions to liquidate, cascading prices lower.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion