Can Bitcoin reach $1M? Arthur Hayes thinks so, and here’s why

11/14/2024 12:00

BitMEX co-founder predicts Bitcoin could hit $1M, driven by inflation and economic policies under a potential Trump administration.

Posted:

- BitMEX co-founder envisioned Bitcoin rising to $1 million.

- Arthur Hayes believed that BTC’s deflationary nature made it an attractive hedge against inflation.

Amid the latest bull run, analysts have released a series of Bitcoin [BTC] price predictions. The most recent forecast comes from Arthur Hayes, co-founder of BitMEX.

In his new essay titled, “Black or White?”, the exec delved into the factors that could drive the king coin to a seven-figure valuation.

His prediction centered around the future economic landscape under the returning Donald Trump administration and its potential impact on traditional financial markets, inflation, and the U.S. dollar.

Trump’s policies and economic impact

In the essay, Hayes suggested that the Trump administration will likely engage in quantitative easing (QE).

For the uninitiated, QE is a central bank policy where the bank buys government bonds to inject cash into the economy, lowering interest rates and encouraging lending and spending.

This strategy of credit creation, aimed at strengthening U.S. manufacturing and industrial sectors, is expected to have inflationary effects. Thus, leading to a depreciation of the dollar.

The BitMEX co-founder likened this debt-driven model to aspects of China’s economic growth strategy, dubbing it,

“American Capitalism with Chinese Characteristics.”

Hayes’ $1 million Bitcoin target

But how will that impact BTC? Well, Hayes argued that if inflation surpasses traditional returns, investors may increasingly turn to assets like Bitcoin.

Unlike fiat currencies, which can be printed to respond to economic pressures, Bitcoin has a capped supply of 21 million, making it inherently deflationary.

This scarcity and independence from central banks enhance Bitcoin’s appeal as a store of value. He added,

“As the freely traded supply of bitcoin dwindles, the most fiat money in history will be chasing a safe haven from not just Americans but Chinese, Japanese, and Western Europeans. Get long, and stay long.”

Highlighting Bitcoin’s potential as a hedge against fiat devaluation, Hayes noted its impressive 400% growth since 2020.

He further explained that reducing the debt-to-GDP ratio from its current 132% to 115% would require around $4 trillion, while returning to pre-2008 levels (around 70%) would necessitate $10.5 trillion.

Such credit expansion, the exec suggested, would fuel BTC’s growth, stating,

“This is how Bitcoin goes to $1 million.”

BTC market state

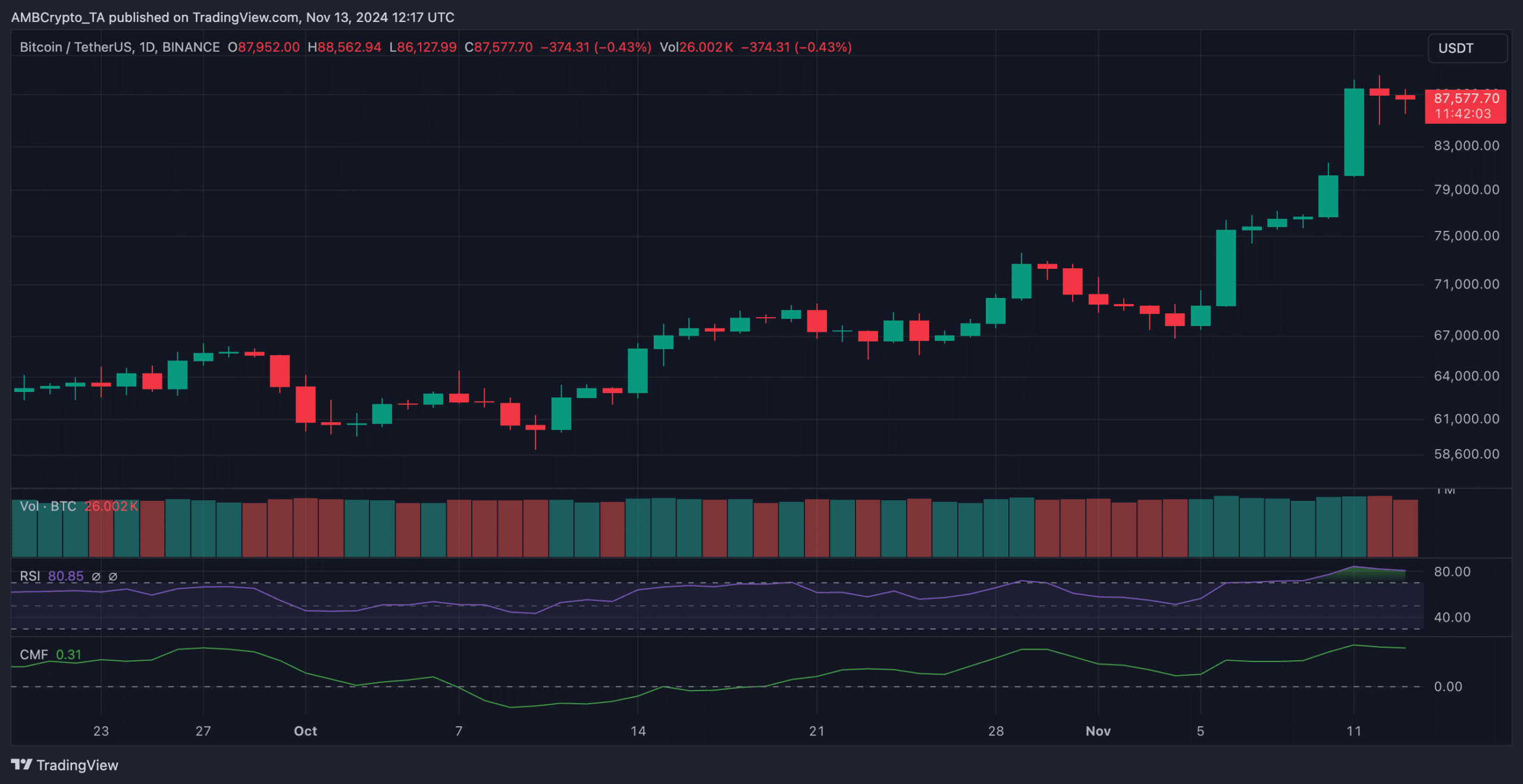

Meanwhile, after inching closer to the $90,000 mark, the king coin has dipped. At press time, it traded at $87,577. This represented a depreciation of 2.63% from the latest ATH of $89,940.

Data from CoinMarketCap showed a 0.17% increase in BTC’s price over the last 24 hours, with weekly gains holding steady at around 17%.

However, technical indicators signal a potential cooldown. The RSI fell from the previous day’s high of 84.51 to 80.85, suggesting that bullish momentum may be easing.

The CMF also dipped, though it remained positive at 0.31, indicating reduced capital inflows compared to recent days.

Together, these indicators pointed to a potential short-term slowdown or minor correction as some investors take profits following Bitcoin’s strong weekly rally. Nonetheless, the overall bullish trend for BTC appeared robust.