POL risks dropping to $0.20 as whale sell-offs intensify

11/14/2024 14:00

Lack of confidence in POL has triggered heavy selling from major holders, casting doubt over the asset’s price stability.

Posted:

- Whale activity has intensified, with substantial POL sell-offs leading to a steep price decline.

- A break below the key support level of $0.3634 could lead to a further significant drop.

Polygon [POL] saw a 13.74% gain over the past week, but shifting market sentiment has turned the asset’s trajectory bearish.

In the last 24 hours alone, POL’s price has fallen 8.12%, with indications of further downside ahead.

Whale sell-off accelerates POL’s slide

POL is under intense selling pressure, with whale activity driving a steep decline and paddling a bearish shift.

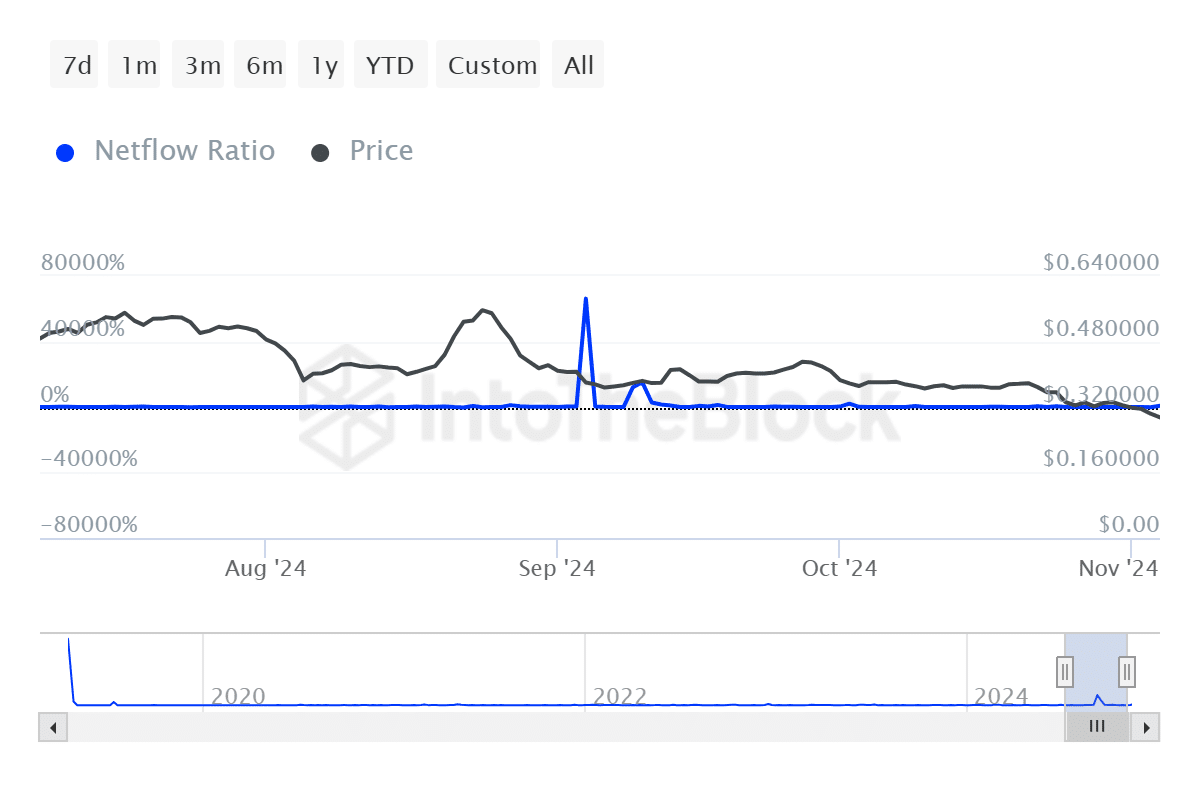

Two key indicators from IntoTheBlock—Large Holders Netflow to Exchange Ratio and Large Transaction Volume—highlighted this trend.

The Large Holders Netflow to Exchange Ratio measures the flow of assets from large holders (or “whales”) to exchanges. A spike in this ratio, alongside a price drop, often indicates increased selling pressure.

For POL, the ratio surged 737.00% in the last 24 hours and 2,474.58% over the past seven days, aligning with a broader bearish sentiment as whales offload their holdings.

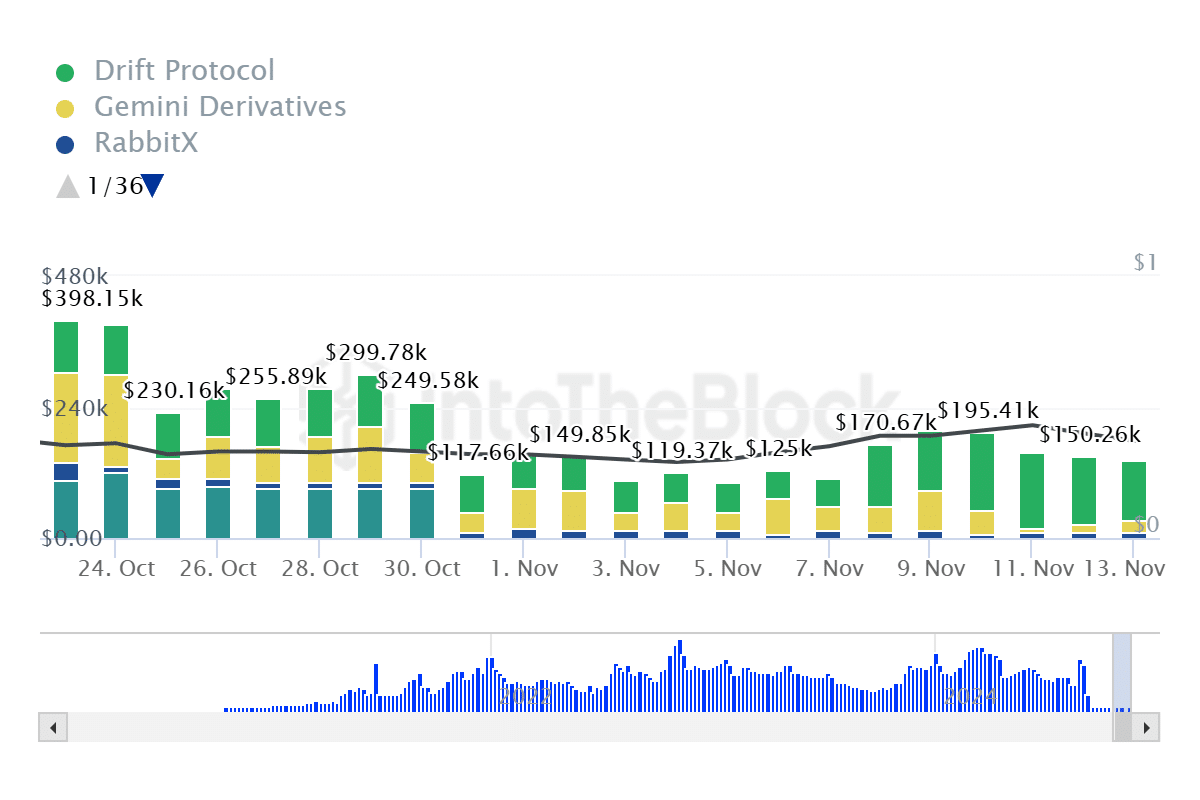

This bearish sentiment is further reinforced by a rise in large transaction volume, with 78 major transactions recorded within this period.

Possible halt to fall or rally?

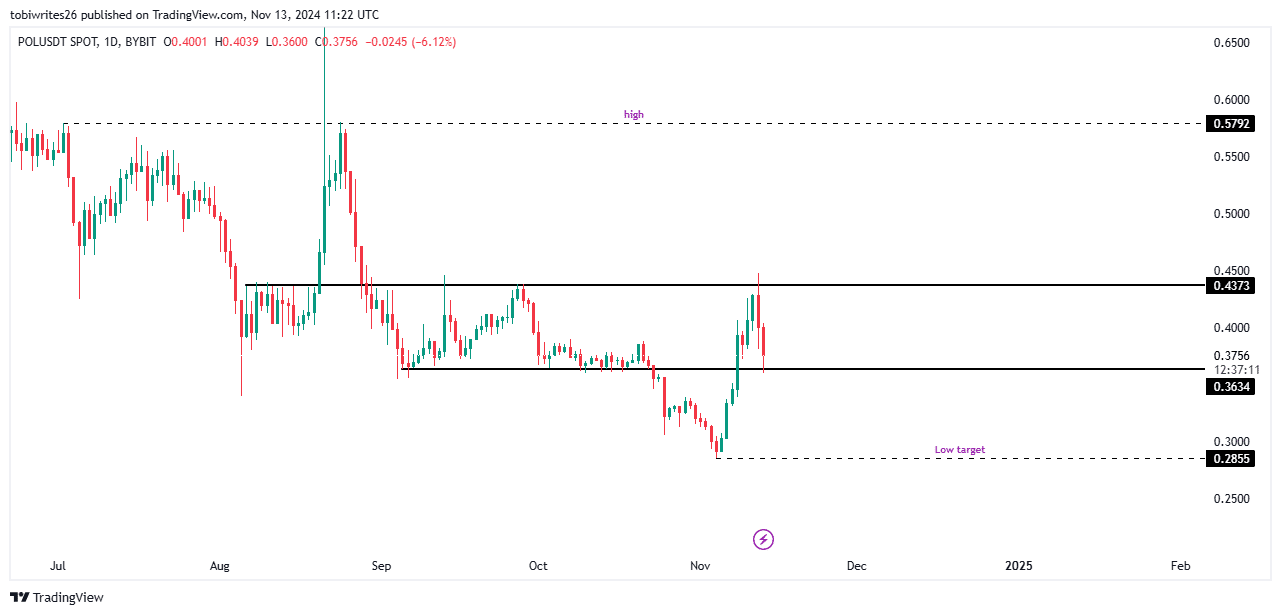

The daily chart suggests that, despite continued whale sell-offs, POL may find a temporary floor at a critical support level, potentially setting the stage for a rally.

The support level at $0.3634 could exert enough buying pressure to shift momentum, with a potential price rebound targeting $0.5792.

However, if selling pressure from large holders persists, POL risks further downside, potentially sliding to $0.2855.

Retail selling pressure intensifies

POL’s Open Interest, according to IntoTheBlock, has dropped sharply in the past 24 hours to $142.53K after peaking at $198.56K on the 9th of November.

So, bears now hold a dominant position in the market’s unsettled derivative contracts.

Liquidation data on Coinglass further reflected this bearish sentiment: only $24.98K in short contracts have closed, while closed long contracts have surged to $685.75K.

Read Polygon’s [POL] Price Prediction 2024–2025

This imbalance highlighted the prevailing bearish momentum, with a higher number of long trades being liquidated.

Given this shift, the likelihood of a further decline in POL appears higher than any anticipated rally.