Solana’s Uptrend Strengthens, But Investors’ Moves Raise Doubts

11/15/2024 16:00

Solana rises 40% to $210 but struggles at $221 resistance. Sustained momentum depends on stronger network engagement and investor activity.

Solana (SOL) price has seen a remarkable 40% surge in recent weeks, climbing to $210. Despite this bullish uptrend, SOL is encountering challenges at the $221 resistance level, which could signal a potential reversal.

Investor activity on the Solana network suggests the momentum might face hurdles in sustaining further gains.

Solana Investors Need Motivation

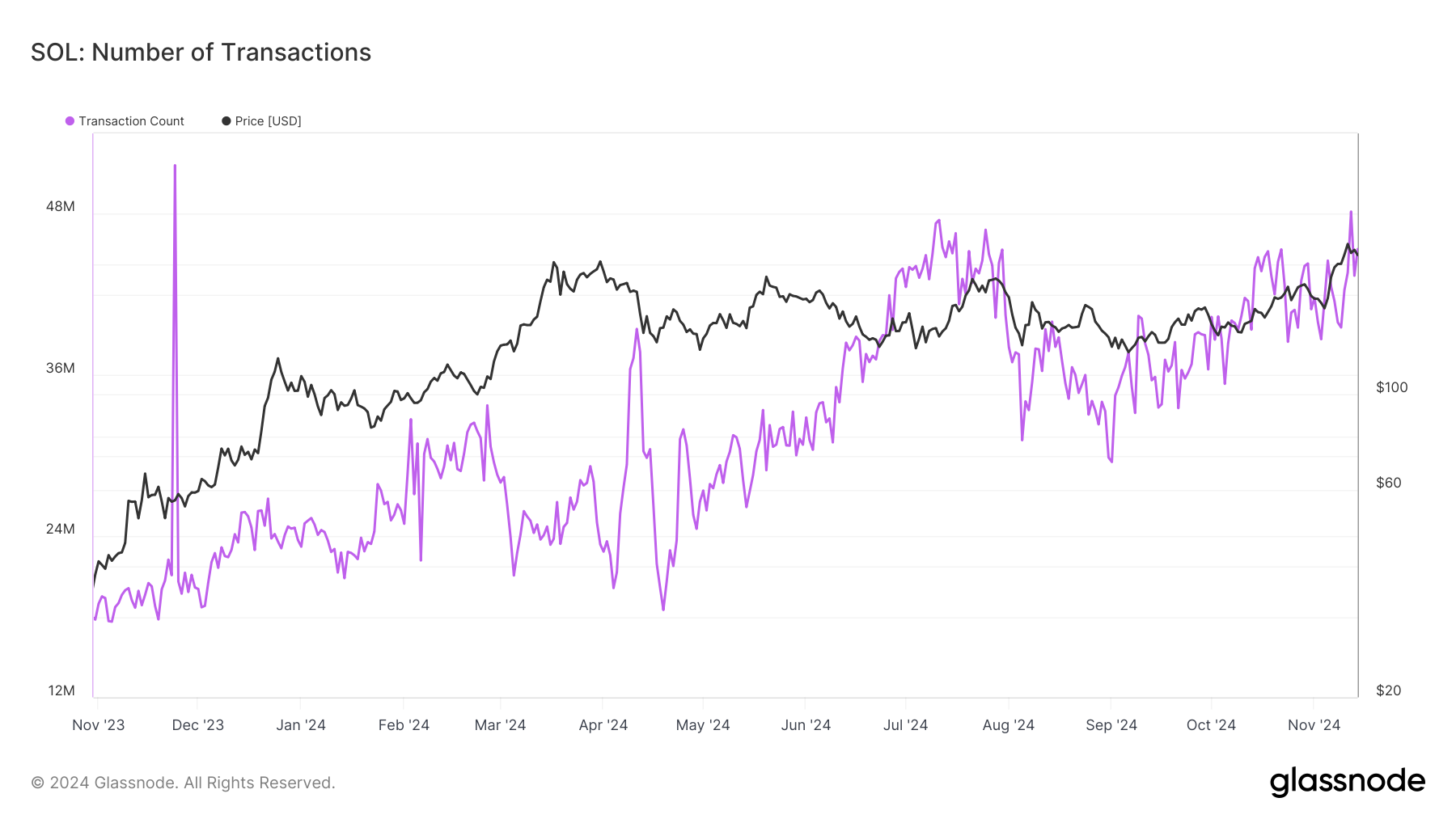

Transaction activity on the Solana network has increased significantly during the recent price rally. The network recently hit a yearly high in transaction count, highlighting growing interest among participants. However, this increase falls short of expectations, given the current hype surrounding Solana ETFs and broader market bullishness.

This moderate network activity raises concerns about the sustainability of the rally. If Solana fails to attract more significant user engagement, its price momentum might falter, especially as broader market cues begin to stabilize.

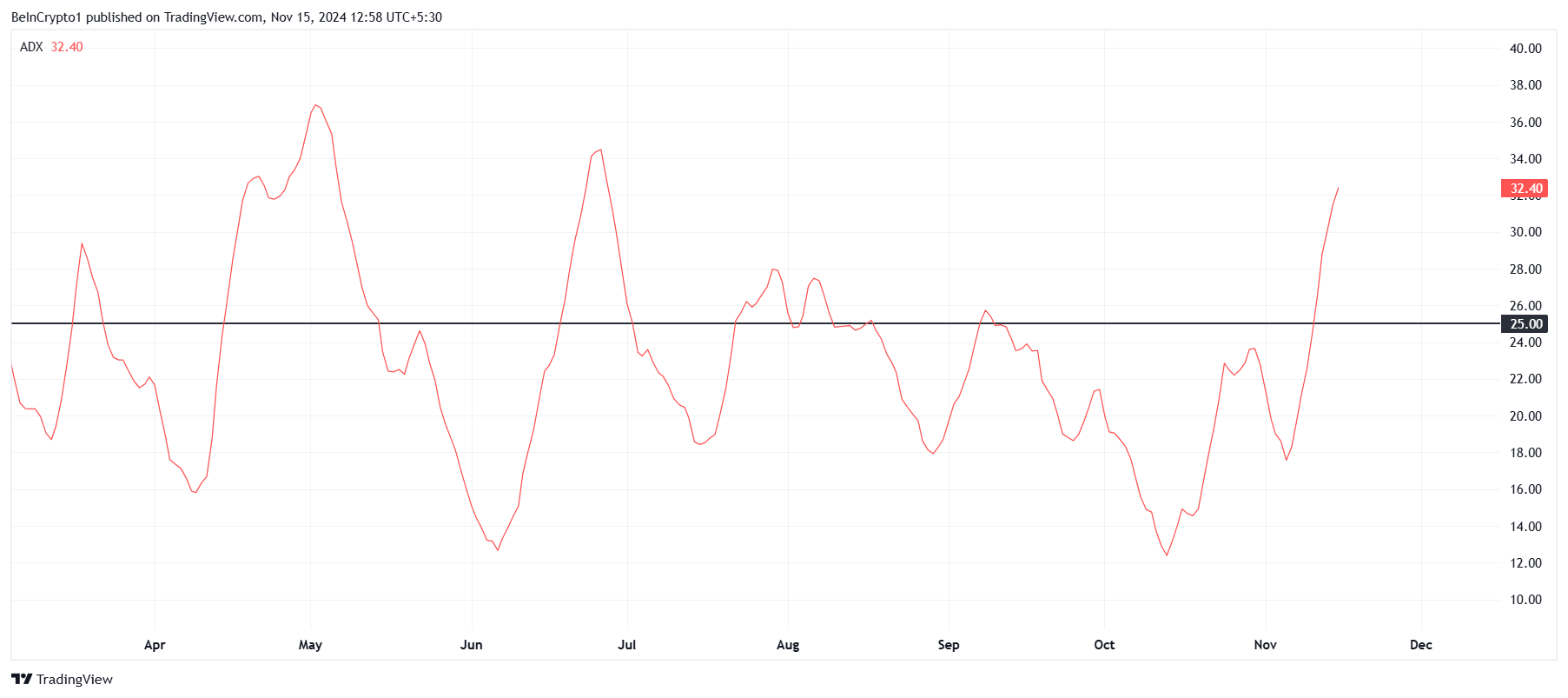

Solana’s macro momentum remains strong, supported by technical indicators. The Average Directional Index (ADX) is at 32, well above the 25.0 threshold, confirming a strong uptrend. This suggests that Solana could continue its upward trajectory if investors remain active.

However, investor participation will be crucial in sustaining this momentum. Should engagement wane, the current uptrend could lose its strength, potentially triggering a correction in SOL’s price.

SOL Price Prediction: Barriers Halt Growth

Solana is currently trading at $210, holding steady above its support level of $201. Despite the recent rally, the “Ethereum killer” is struggling to break past the $221 resistance level, which remains a significant barrier to reaching $245.

The mixed sentiment indicates that SOL may consolidate between $201 and $221 until a clearer directional trend emerges. This range-bound movement could dominate the short-term outlook unless broader market conditions shift dramatically.

However, if investors opt for profit-taking, Solana could see a decline below the $201 support level. Such a drawdown would invalidate the current bullish-neutral outlook, potentially sending SOL to $186, marking a significant setback for the altcoin’s rally.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.