Is Bitcoin dominance waning? Why altcoins like XRP might take over

11/15/2024 20:00

Bitcoin dominance has entered overbought territory, signaling a correction, presenting an opportunity to capitalize on an altcoin rally.

- Bitcoin dominance is a key indicator for determining the future trajectory of altcoins.

- Currently, Bitcoin and altcoins are emerging as two distinct asset classes.

Many prominent analysts have noted that this market cycle is different from previous ones, with a shift from speculative trading to a more sustained, fundamental-driven rally. This optimism is fueled by the belief that Bitcoin’s next phase could lead to a bull run reaching $100K.

As a result, in just under a week, Bitcoin [BTC] surged to a new all-time high of $93K, with its market dominance hitting around 70%. This was driven by a confluence of factors including post-election liquidity, FOMC rate cuts, and, most significantly, the post-halving impact.

However, despite the initial optimism, speculative pressure has emerged, preventing Bitcoin from reaching its target, as it has now consolidated below $90K for two consecutive days.

Typically, such consolidation at this “high-risk” range could signal a shift of capital away from Bitcoin into other lower-risk assets. However, as per AMBCrypto, a hidden pattern suggests that this shift may actually be occurring.

History shows altcoins poised to break resistance

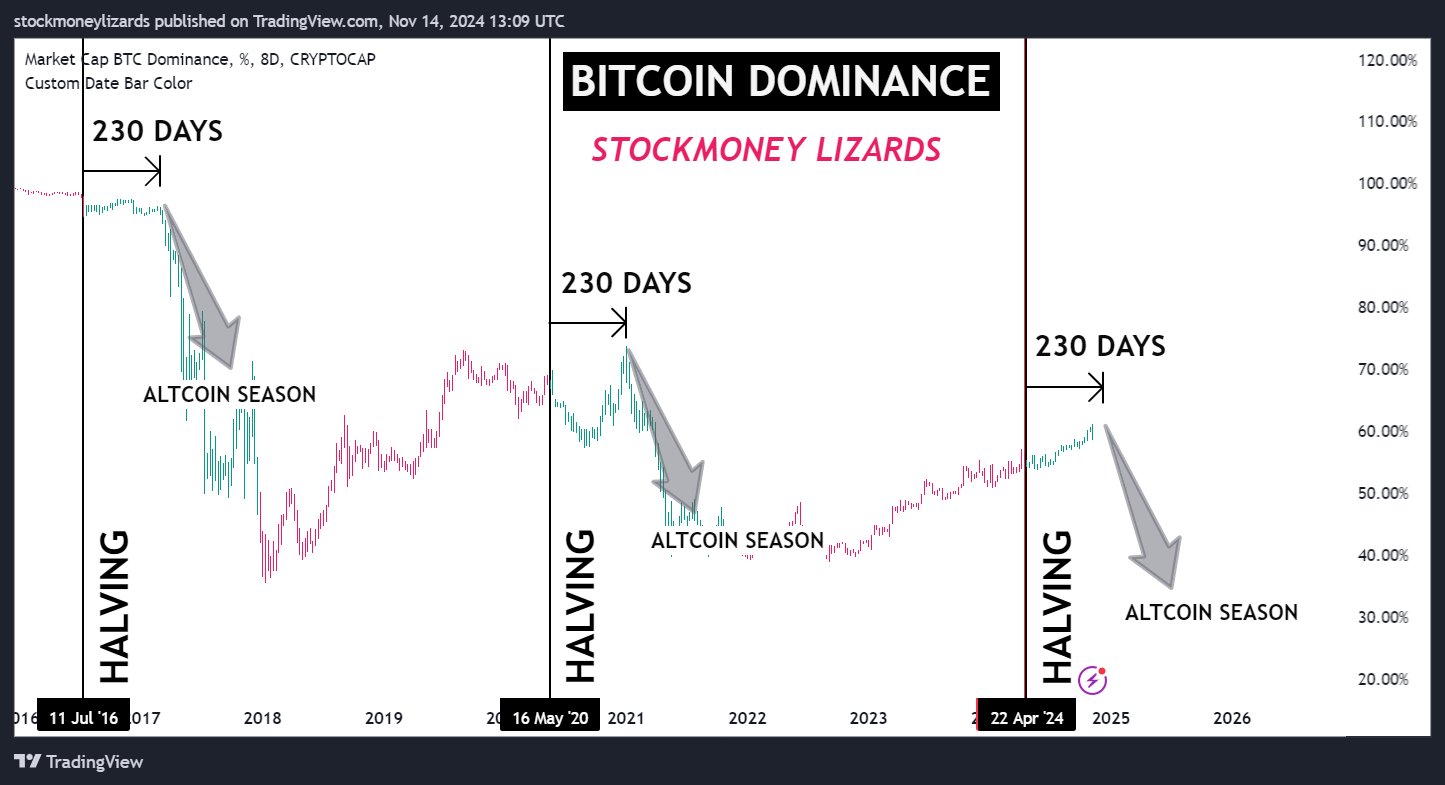

Based on historical patterns observed in previous market cycles, a 230-day pattern has been observed following Bitcoin halvings.

After the initial post-halving bull run, which often drives Bitcoin dominance to new highs, market participants look to altcoins for additional profit opportunities.

In 2020, the supply shock caused by the post-halving event materialized within the first 150 days, with Bitcoin reaching $40K for the first time.

However, after Bitcoin’s momentum slowed, altcoins began to outperform, with many altcoins posting substantial gains about 60 days later.

Similarly, the April halving this year, which reduced the miner reward to 3.125 Bitcoins, triggered an economic imbalance. This caused a sharp increase in demand, fueled by post-election liquidity, while the reduced supply led to tighter market conditions.

The resulting lower liquidity, combined with Bitcoin’s controlled supply, has created the ideal environment for pushing Bitcoin dominance near 70%, further fueling its rise to a new ATH.

Thus, if the aforementioned trend repeats, many altcoins could be positioned to break past major resistance levels before the end of Q4. With Cardano gaining significant traction, this further reinforces AMBCrypto’s hypothesis.

Evidence to back this theory

As noted earlier, Bitcoin’s consolidation below $90K reflects a growing ‘risk-averse’ sentiment in the market.

Despite bulls countering bearish pressure, the failure to trigger a parabolic run – one that many anticipated due to the strong backing from the new administration and the social-media buzz surrounding a $100K target – raises concerns.

In other words, the market’s hesitation to break key resistance levels suggests that Bitcoin’s dominance may be stalling, creating an ideal environment for investors to diversify into high-cap tokens.

These tokens, with strong community support and more attractive valuations, could offer an appealing alternative.

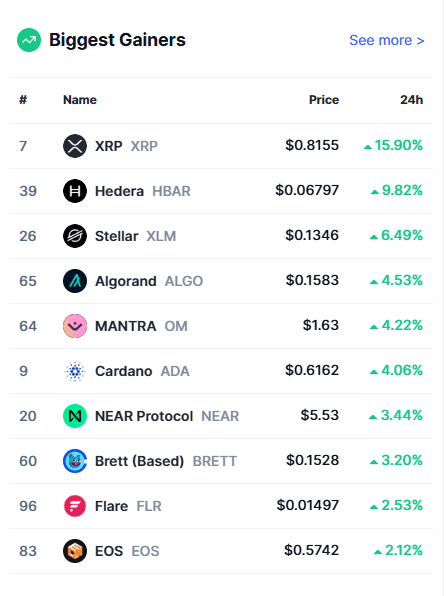

As a result, in the last 24 hours, as Bitcoin posted an approximately 4% decline, dropping to $86K – its lowest point of the day – major altcoins reaped the benefits, with XRP alone gaining over 15%.

Therefore, unless Bitcoin dominance rebounds, supported by both institutional and retail backing to solidify BTC’s long-term prospects, altcoins may continue to dominate the gainer charts.

However, on the flip side, altcoins could experience short-term gains if Bitcoin dominance climbs back to near 70%. Yet, a full-fledged altcoin season might remain limited, raising the critical question:

Will Bitcoin regain its weakening dominance?

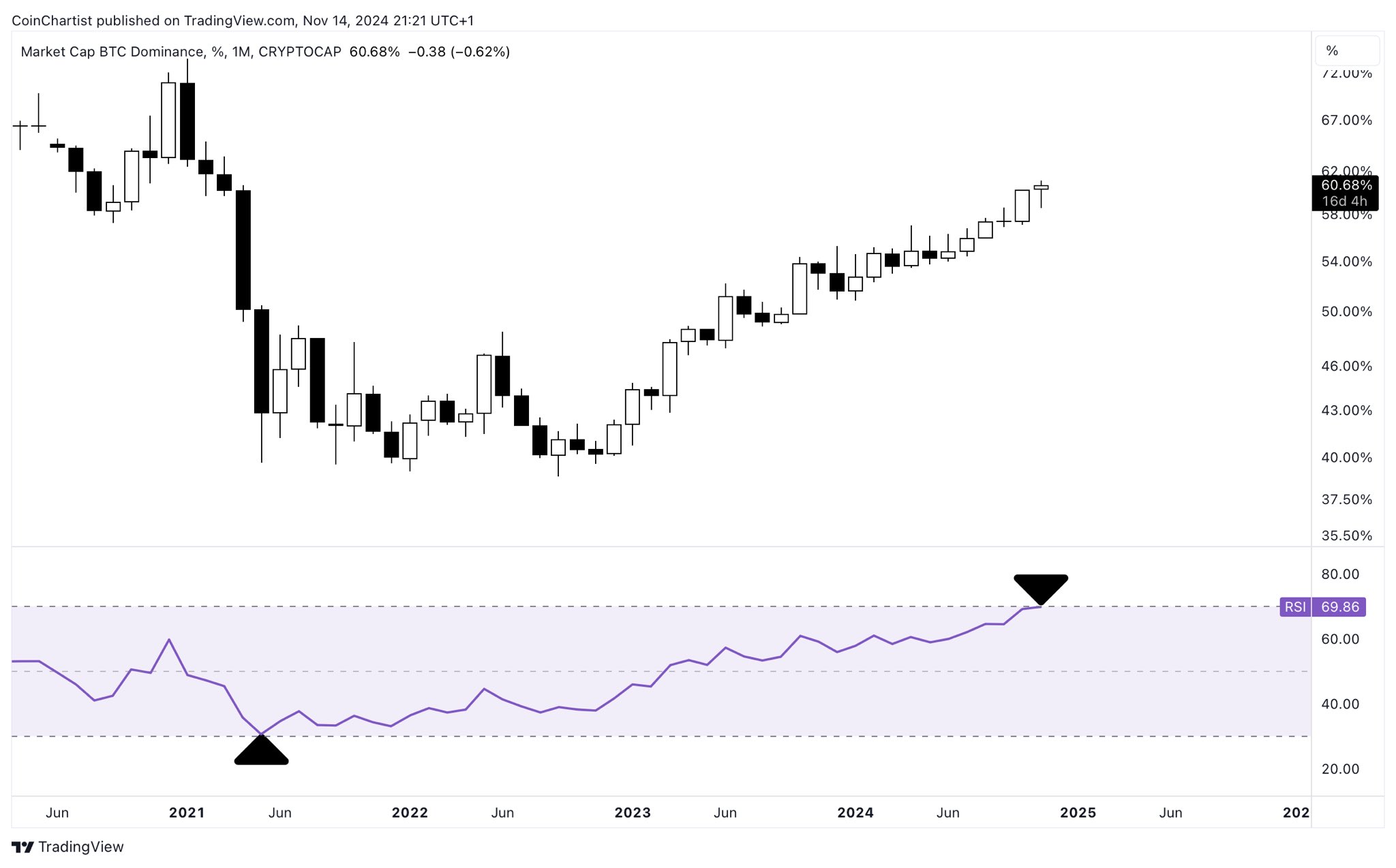

On the monthly RSI, Bitcoin dominance has entered overbought territory, signaling a potential correction. This could indicate that the dominance of Bitcoin may soon experience a pullback, possibly paving the way for altcoins to gain traction.

Meanwhile, institutional support for Bitcoin is weakening, as major players exit the cycle after locking in massive gains from this bull run. For Bitcoin dominance to regain control, these players are likely waiting for a “dip,” where prices are more feasible for re-entry.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Until then, it presents a prime opportunity for bulls to capitalize on an altcoin rally.

With historical patterns supporting this trend, altcoins look set to break key resistance levels in the coming days, potentially triggering an altcoin season by the end of Q1 next year.