Cardano (ADA) Eyes Further Gains After 65% Weekly Surge, Historical Data Shows

11/16/2024 20:00

Cardano (ADA) jumps 65%, with bullish metrics suggesting a rally to $2.30 possible. Explore ADA’s key indicators and price outlook.

Cardano (ADA) rally may be poised to continue following its impressive 65% price surge over the past week. This outlook stems from its historical performance and anticipated investor behavior.

Currently trading at $0.72 — its highest level since March — ADA could see further gains. This on-chain analysis reveals why this might happen, even though some analysts have called for a significant correction.

History Suggests Cardano Breakout May Be Just Beginning

One key indicator suggesting this outlook is the Market Value to Realized Value (MVRV) ratio. The MVRV is a metric that compares the market value of a crypto asset to its realized value. This ratio identifies potential market tops and bottoms and offers insights into investors’ behaviors.

Typically, the higher the MVRV ratio, the higher the profitability of holders and their willingness to sell. However, when the ratio decreases, it means unrealized gains have reduced, and investors might not be inclined to liquidate their assets.

For ADA, the 30-day MVRV ratio is -7.27%, indicating that if all Cardano holders sell, the average return on investment could be a loss. Historically, when the ratio is at this level, it means that ADA’s price could continue to climb.

As seen below, it took an MVRV ratio of 55.56% for ADA to experience a correction in March. Therefore, if history repeats itself, Cardano’s price might rise much higher than $0.72 in the short term.

Furthermore, Robinhood’s relisting of the cryptocurrency suggests that demand for ADA might surge — particularly from the US. If that is the case, then the prediction of a higher value could become reality.

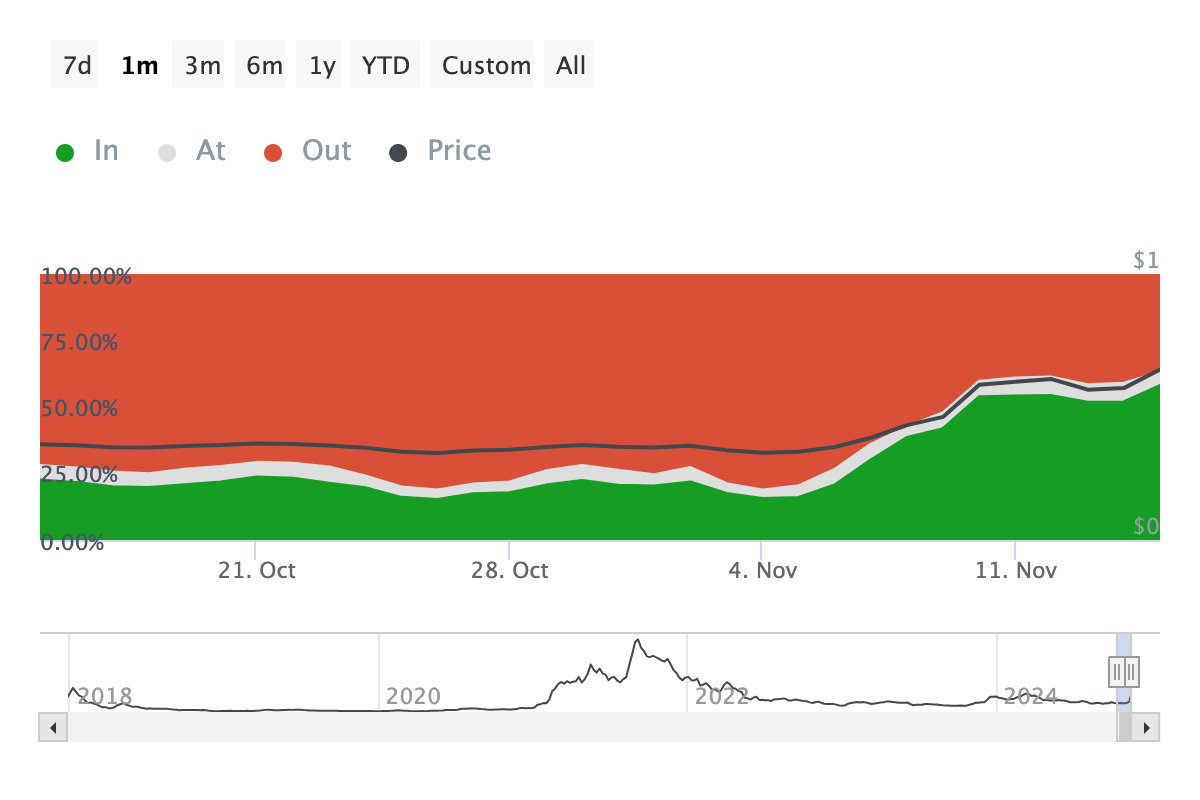

Also, the Historical In/Out of the Money (HIOM) metric, which assesses the difference in profitable addresses to gauge market momentum, supports this outlook. A decline in the metric indicates that more holders are out of the money, often discouraging new investments.

However, in Cardano’s case, the percentage of addresses in profit has risen, potentially encouraging sidelined investors to buy ADA in the short term. If this buying pressure materializes, it could drive the cryptocurrency’s value even higher.

ADA Price Prediction: 500% Hike in View?

On the weekly chart, the Cardano rally appears to be mirroring a trend from 2020–2021, during which ADA soared by 3,653%. This previous surge was triggered by a bullish crossover of the 20-week Exponential Moving Average (EMA) above the 50-week EMA.

During that period, ADA climbed from $0.061 to $2.29. Currently, the 20 EMA (blue) has just crossed above the 50 EMA (yellow), signaling renewed bullish momentum for the token. While a similar percentage rally may be unlikely, ADA could still see a substantial gain of up to 500% over the coming months if past performances influence future trends.

If that happens, ADA could rise to $2.03. This could also be accelerated by the rise in Bitcoin’s (BTC) price, especially as Cardano seems to have a strong correlation with it. However, if selling pressure intensifies, this might not happen. Instead, ADA could drop to $0.33.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.