RNDR’s price charts confirm bullish breakout – Is $12.05 the next target?

11/17/2024 02:00

Render surged across the market, drawing significant attention from traders as it broke critical resistance levels...

Posted:

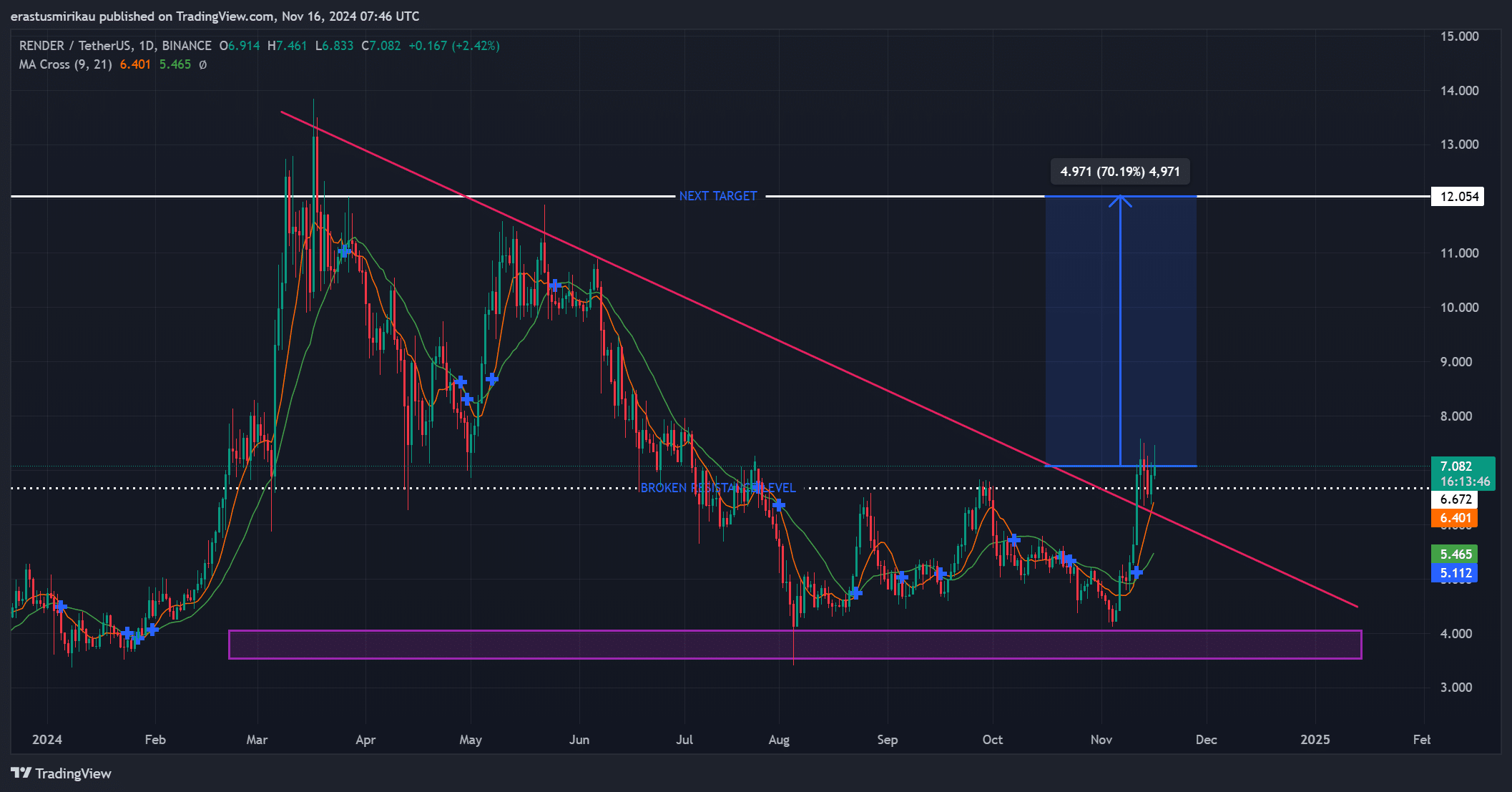

- Confirmed retracement and breakout above $6.67 set RNDR on a bullish path, targeting $12.05

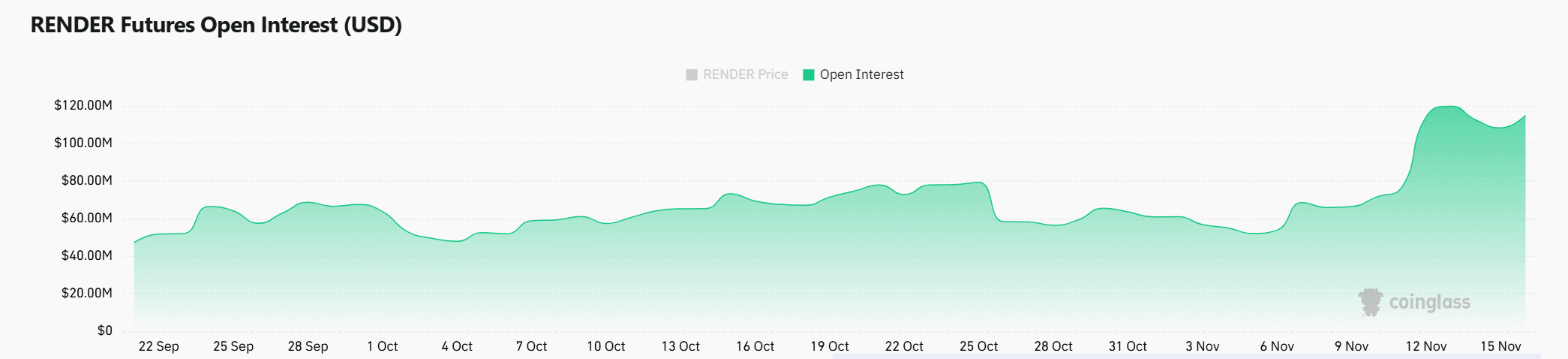

- Market sentiment strengthened as Open Interest rose, despite declining daily active addresses

Render [RNDR] has surged in the market, drawing significant attention from traders as it decisively broke through critical resistance levels – A sign of renewed bullish momentum.

At press time, RNDR was trading at $7.08, following a 5.23% hike in the last 24 hours. This move followed a confirmed retracement in the daily timeframe, signaling the end of its prolonged downtrend.

The next key target of $12.05 will present a potential 70% upside. Hence, the question – Does the prevailing market momentum justify the optimism?

Retracement drives breakout beyond resistance

RNDR exited its descending channel, a technical structure that had capped its upside for months. After bouncing from a solid support zone near $4.00, the token gained bullish momentum, one fueled by consistent buy volume.

Breaking above $6.67, a crucial resistance level, confirmed the retracement and initiated a new uptrend. Therefore, with a clear path towards $12.05, RNDR might be poised to challenge higher levels in the coming days.

However, challenges remain as a retracement breakout alone cannot guarantee sustained upward movement. The $12.05 resistance, a historical level of seller strength, will test the durability of RNDR’s momentum.

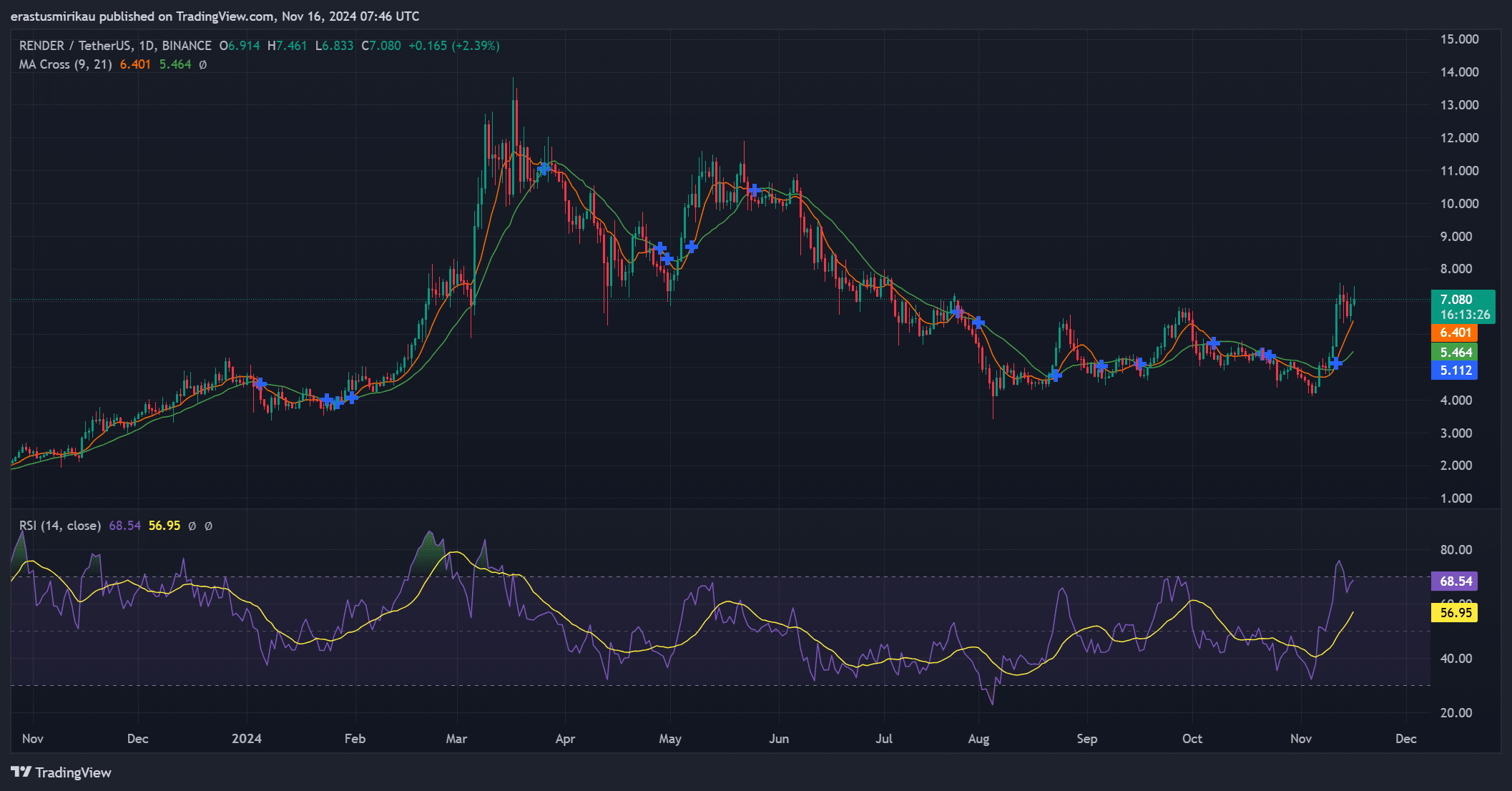

Render’s technical indicators reveal growing strength

The technical indicators provided additional reasons for optimism. Recently, the 9-day and 21-day Moving Averages(MA) crossed over – A clear signal of bullish momentum.

Furthermore, at the time of writing, the Relative Strength Index (RSI) was at 68.54. This indicated strong buying activity, but nearing overbought conditions. This pointed to the potential for short-term consolidation, before any further upward movement.

Additionally, volume trends supported the ongoing price breakout on the charts. Higher trading volumes during the upward move confirmed strong market interest. And, these could sustain RNDR’s push towards its next target.

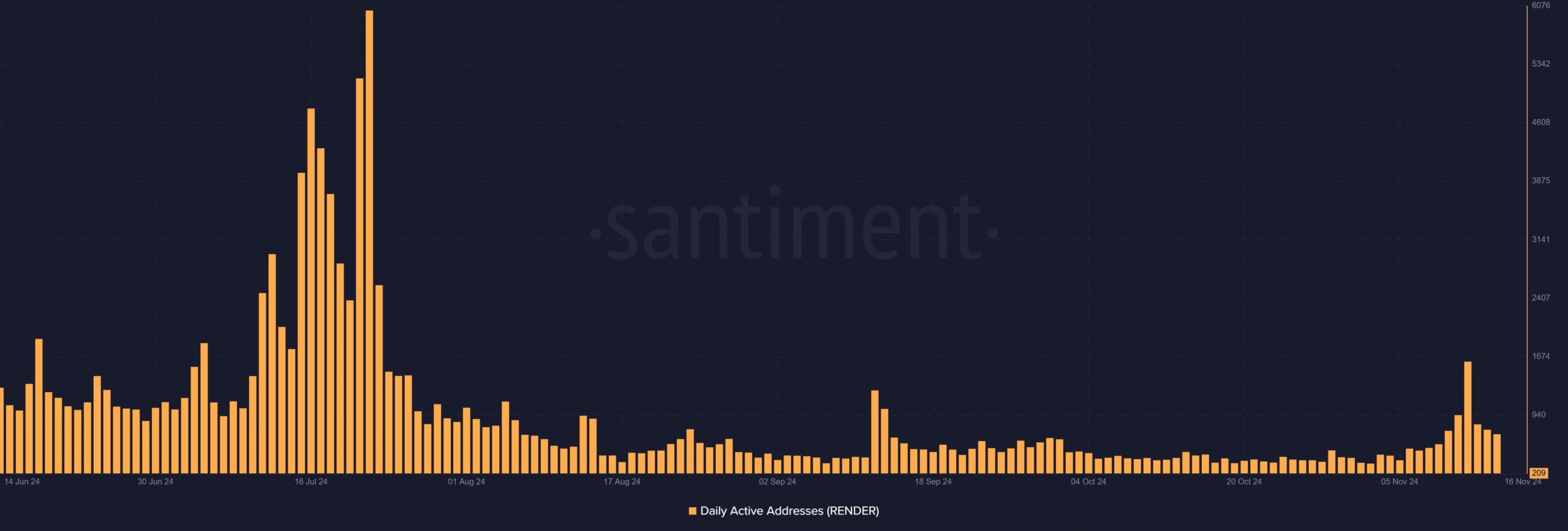

On-chain data hints at caution

Despite the bullish price action, on-chain data revealed a sharp decline in daily active addresses. Activity dropped from 703 to just 209, signaling a possible fall in user engagement.

Needless to say, this raises questions about whether speculative interest alone is driving the rally. However, a fall in active addresses often coincides with price consolidation and may not affect long-term prospects.

Growing market metrics

Finally, traders’ sentiment has improved significantly, reflected by a 9.79% hike in Open Interest (OI), with the same flashing figures of $121.79 million.

This uptick suggested that more traders are positioning themselves for RNDR’s next major move. Therefore, the alignment between market sentiment and price action supported the case for further gains.

Read Render’s [RNDR] Price Prediction 2024–2025

Ultimately, RNDR’s breakout above $6.67 confirmed its bullish retracement, with technical and market sentiment aligning for a push towards $12.05.

While declining active addresses warrant caution, the overall outlook remains strong. Consequently, RNDR may be well-positioned to sustain its rally, barring unexpected market shifts.