Altcoins See Window of Opportunity as Bitcoin Dominance Fails to Hit 62% Amid Extreme Greed

11/18/2024 03:00

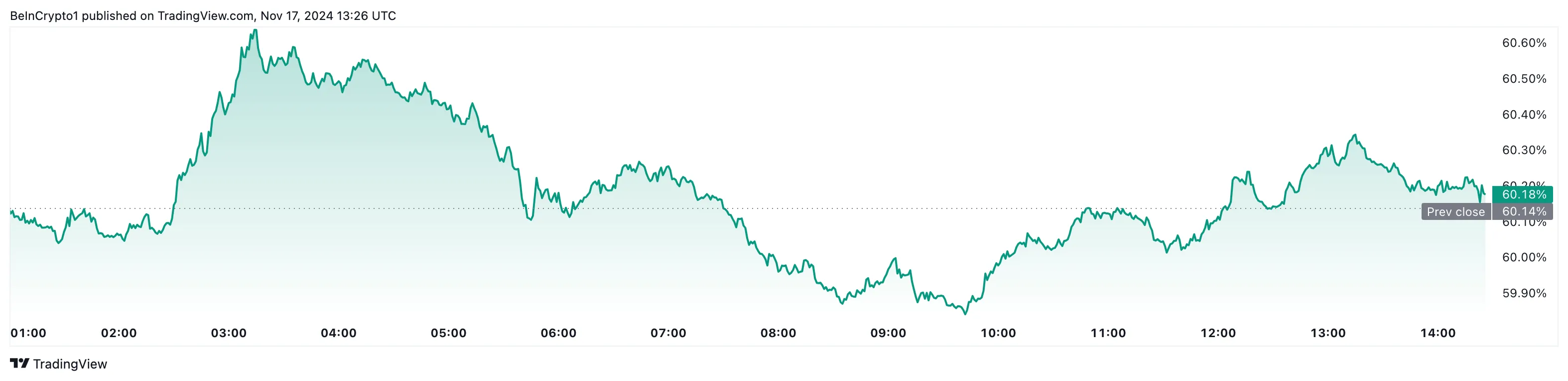

Bitcoin dominance dips to 60% as other cryptos gain momentum, suggesting potential altcoin season. What's next after this

On Friday, November 15, Bitcoin’s (BTC) dominance — a metric tracking the cryptocurrency’s share of the overall market — showed readiness to climb to 65%. However, this scenario did not happen as Bitcoin’s price fell short of retesting $93,000, suggesting that the altcoin season cycle could be here.

This stagnation seems to have created an opportunity for altcoins, which have lagged significantly behind BTC. The pressing question now is whether Bitcoin dominance will continue to decline as altcoin prices surge.

Bitcoin Steps Back Amid Greedy Market

As of this writing, Bitcoin’s dominance has dropped to 60%. This decline contradicts some analysts’ expectations that Bitcoin’s price might rise as high as $100,000 within a few days.

According to BeInCrypto’s findings, this fall could also be linked to the rising performance of altcoins. Some days ago, the altcoin season index was 33. Today, according to data from Blockchaincenter, it has risen to 39.

This increase suggests that more altcoins within the top 50 are outperforming Bitcoin (BTC). Tokens like Bonk (BONK) and Ripple (XRP) have maintained their upward momentum, contributing to both the rise in altcoin’s market cap and the subsequent decline in Bitcoin dominance.

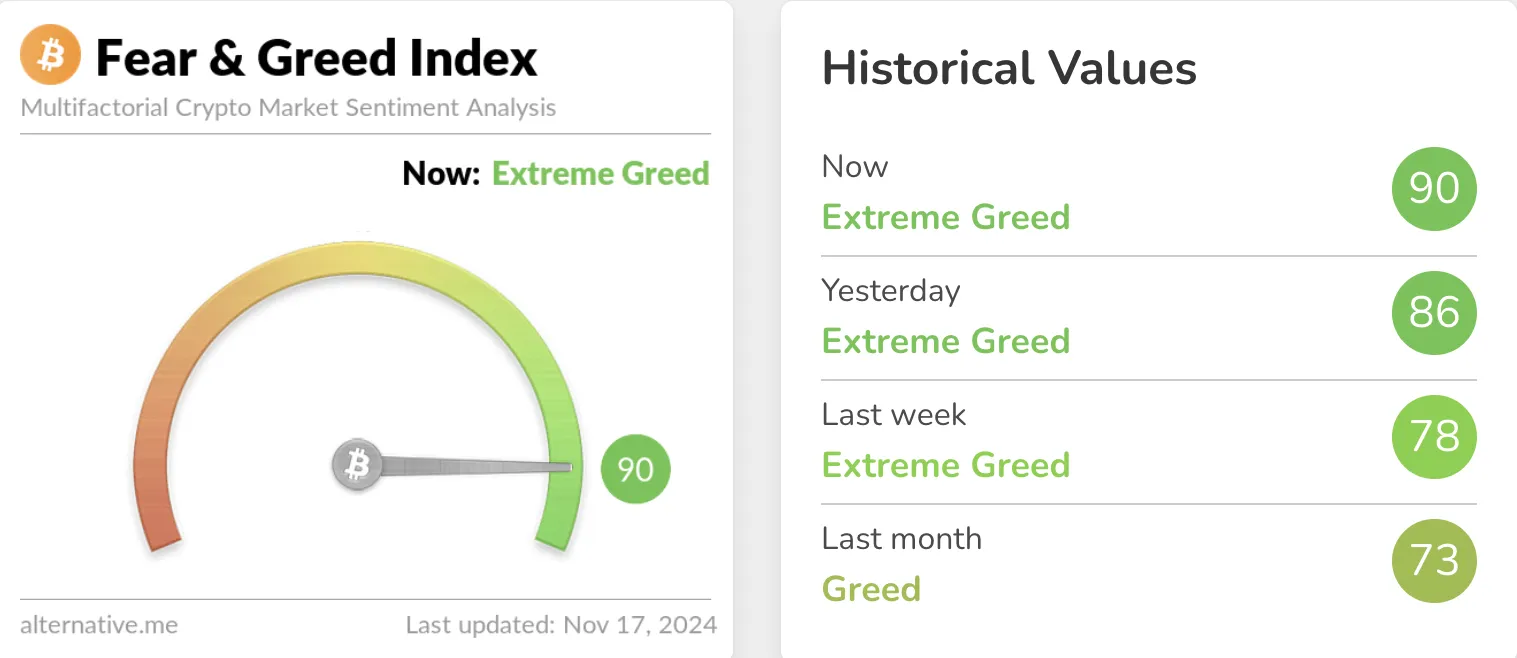

Further, the market’s extreme greed could have implications for Bitcoin’s trajectory. Currently, the Crypto Fear and Greed Index, which primarily gauges Bitcoin sentiment, has reached a striking “Extreme Greed” level of 90.

“Extreme Fear” typically indicates heightened investor anxiety, which can present a potential buying opportunity. Conversely, when investors become overly greedy, it typically indicates that the market may be ripe for a correction.

Therefore, considering the current outlook, it is likely that Bitcoin’s price could be due for a correction. This assertion also aligns with the sentiment of analyst Rekt Capital. According to him, altcoins might soon begin to break out as a result of Bitcoin’s dominance fall.

“Bitcoin Dominance — We are seeing the effects of the best-case scenario in full force. It’s Altcoin season.The pullback in BTC DOM to 57.68% is enabling this Altcoin Window. Continued dips to green will enable Altcoin breakouts,” Rekt Capital shared on X (formerly Twitter).

Altcoins Look to Hit Higher Highs

Meanwhile, the TOTAL2, which is the total market cap of the top 125 altcoins, including Ethereum (ETH), has reached $1.19 trillion. The last time it reached such a value was in June.

Based on the daily chart, TOTAL2 reached this point due to massive interest in altcoins and a breakout of a descending triangle. A descending triangle is typically viewed as a bearish pattern. However, it can also signify a bullish reversal if the price breaks out in the opposite direction, which is the case with the altcoins’ market cap.

Should this position accelerate, then the altcoin season could begin. But for that to happen, Bitcoin dominance has to keep falling, and the altcoin season index has to move much closer to 75 from 39.

If that happens, then the TOTAL2 could rise to $1.27 trillion. However, if Bitcoin’s price bounces above its all-time high, the altcoin season cycle may be delayed, and this prediction may be invalidated.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.