Jupiter surges past $2B TVL: Is this the catalyst for JUP’s next rally?

11/18/2024 15:00

JUP, Solana’s leading DEX aggregator, has reached a remarkable milestone, with its TVL surpassing $2 billion.

Posted:

- Jupiter’s breakout from a descending triangle and surging TVL signal strong bullish momentum.

- Social dominance spikes while liquidation data highlight accelerating interest and sustained upward pressure.

Jupiter [JUP], Solana’s leading DEX aggregator, has reached a remarkable milestone, with its TVL surpassing $2 billion. The protocol’s total transaction volume has also exceeded $374 billion, showcasing its growing importance in decentralized finance.

Furthermore, JUP’s price climbed 10.09% to $1.24 at press time, while its 24-hour trading volume skyrocketed by 196.50% to $443.68 million. Consequently, this unprecedented momentum has drawn significant attention from traders and analysts alike.

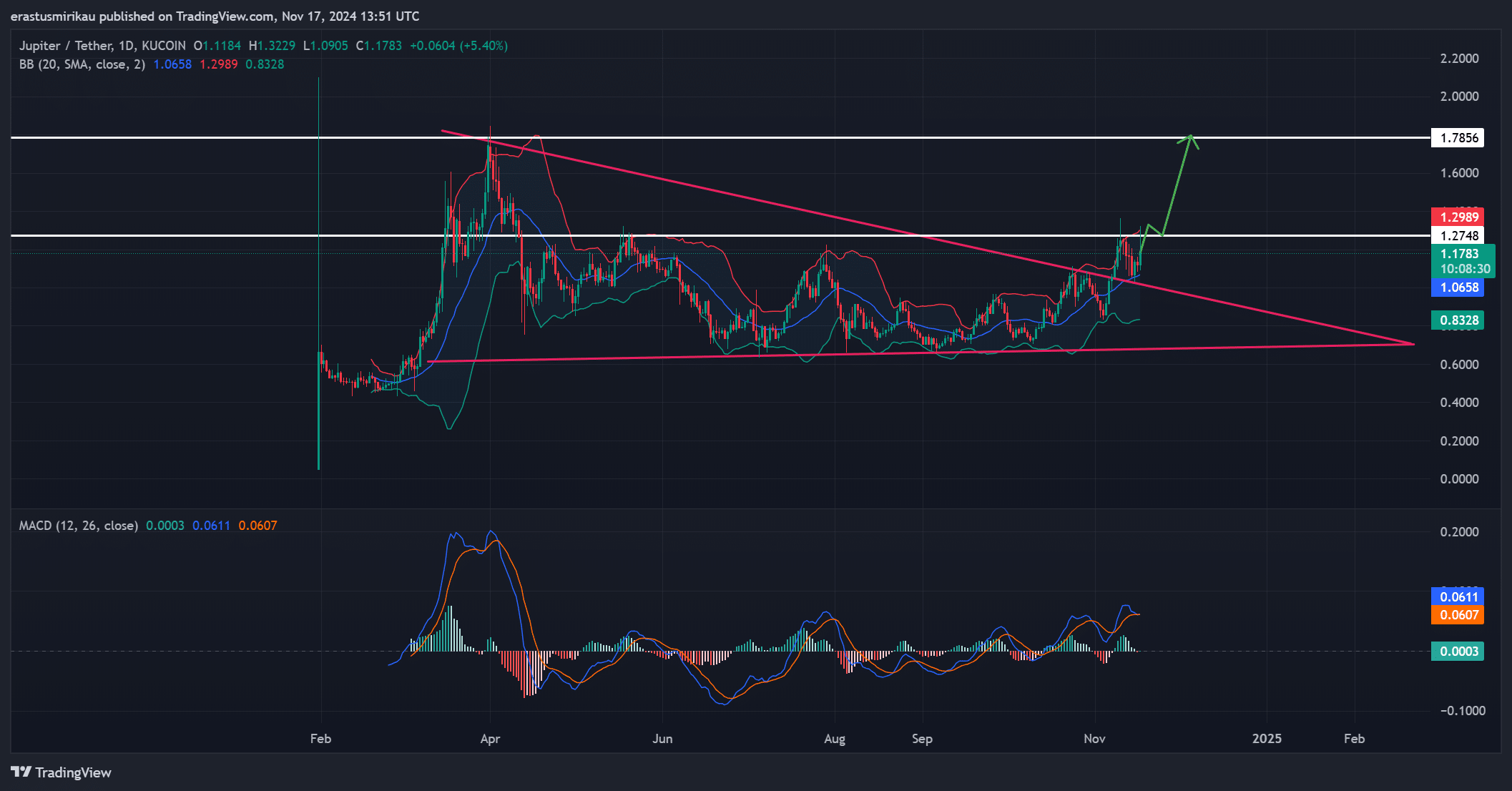

JUP technical analysis reveals bullish momentum

Jupiter’s price has broken out of a descending triangle, signaling strong bullish sentiment. After touching an intraday high of $1.3229, the price settled at $1.24, maintaining its upward trajectory.

The Bollinger Bands (BB) indicate rising volatility, with JUP’s price piercing the upper band, a sign of strong buying activity.

Additionally, the Relative Strength Index (RSI) has reached 70, reflecting intense buying pressure but also cautioning that the asset might be overbought in the short term.

Moreover, the MACD indicator reinforces the bullish case, as the momentum line has crossed above the signal line. Therefore, JUP appears primed for further upside, with the next significant resistance at $1.7856.

However, short-term retracements cannot be ruled out, given the current overbought conditions.

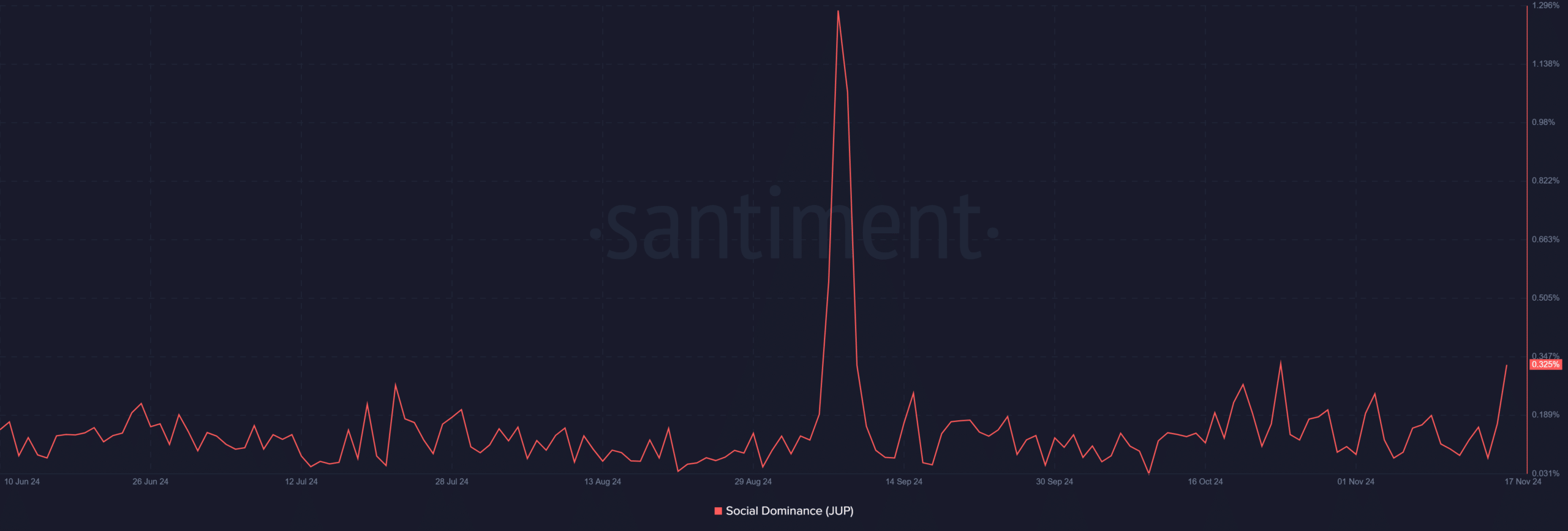

JUP social dominance spikes as interest grows

Jupiter’s rising price is not the only indicator of its recent success. Its social dominance doubled from 0.166% to 0.329% within a day, underlining a sharp increase in online discussions and community engagement.

This growth in social interest often aligns with heightened retail participation, further fueling price action. Consequently, JUP’s increased visibility suggests growing confidence in its ecosystem and potential for sustained demand.

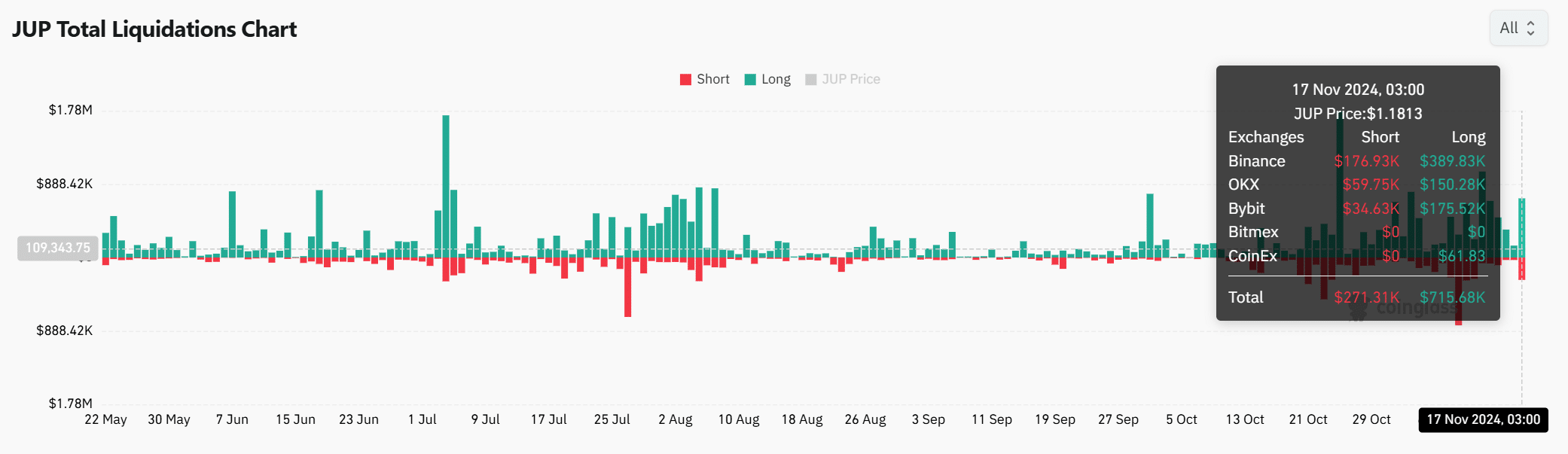

Liquidation data reveals bullish momentum

The liquidation data provides another compelling narrative for JUP’s rally. Over the last 24 hours, long liquidations reached $715,680, while short liquidations totaled $271,310. This imbalance demonstrates strong upward pressure, as liquidated shorts added buying momentum to the market.

Additionally, such events often indicate heightened speculation and volatility, which can drive significant price action in the short term.

Realistic or not, here’s JUP’s market cap in SOL terms

JUP shows clear signs of strength

Jupiter’s surging TVL, record-breaking transaction volume, and price rally highlight its accelerating adoption. With bullish technical indicators and strong on-chain activity, JUP appears well-positioned for further growth.

While short-term caution is warranted due to overbought signals, its breakout above key resistance suggests sustained upward potential. This rally signals that Jupiter is carving a leading role in the DeFi space.