Spot Bitcoin ETFs Now Hold Over 5% of Total BTC Supply

11/18/2024 16:30

Spot Bitcoin ETFs now control over 5% of Bitcoin’s supply, driving prices and adoption as regulatory support fuels institutional inflows.

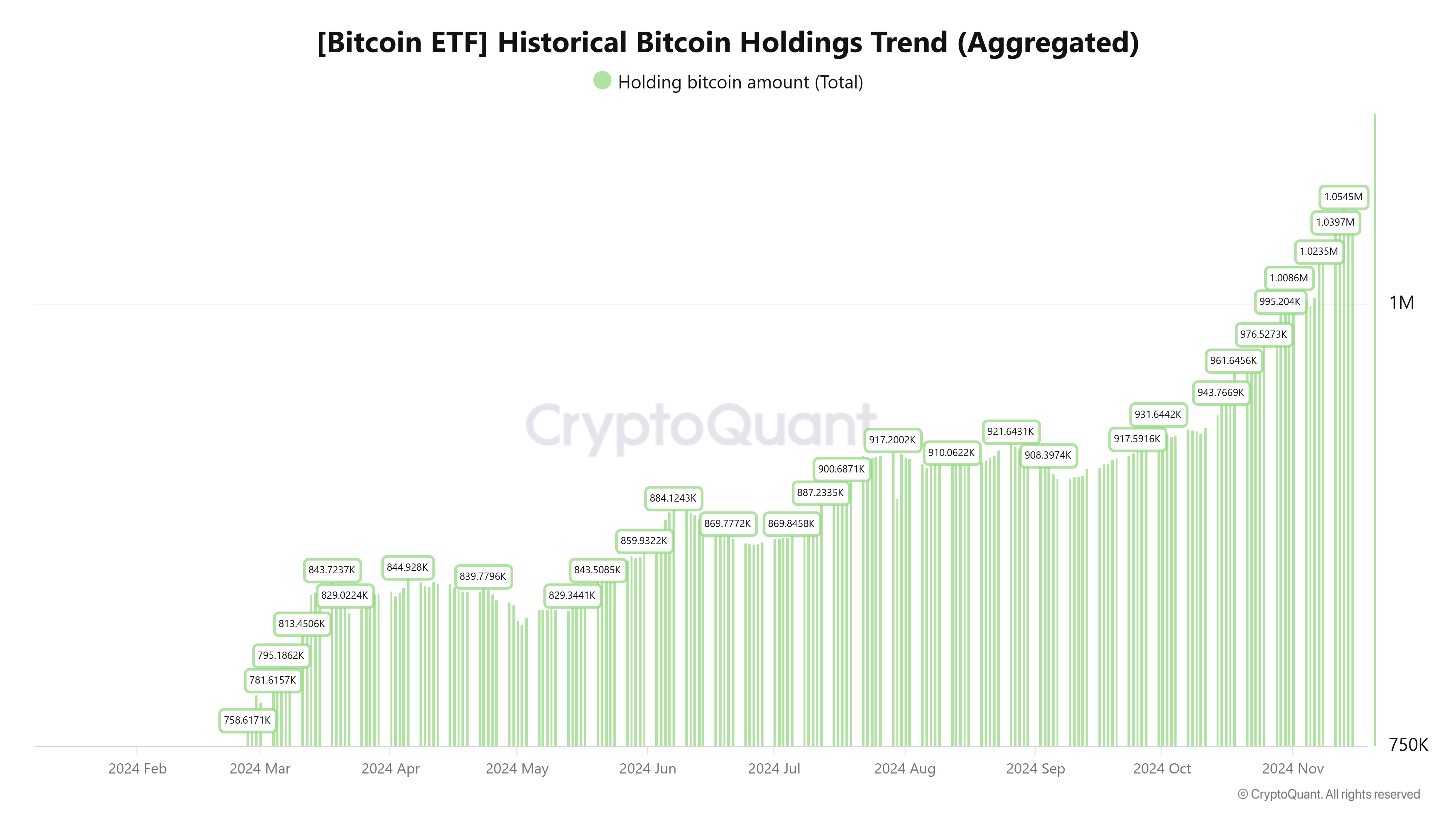

The growing prominence of spot Bitcoin ETFs (exchange-traded funds) is reshaping the crypto market. A CryptoQuant analyst, MAC_D, has revealed that these funds now control 5.33% of the total mined BTC supply — a significant leap from the 3.15% recorded in January.

This marks an addition of 425,000 BTC within ten months, highlighting the rising demand for physically-backed Bitcoin ETFs.

Bitcoin ETF Accumulation Drives BTC Price Growth

The analyst highlights a strong correlation between the accumulation of Bitcoin by spot ETFs and its price movements. This trend was particularly evident during Bitcoin’s price surges in March and November, fueled by significant ETF inflows and positive market sentiment.

“Spot ETF volume increased by +425,000 BTC to 629,900 BTC → 1.0545 million BTC in January when trading began. This is an increase of 2.18% in just 10 months, or 3.15% → 5.33% of the total mined supply of 19.78 million BTC. Looking at March and November, which showed dramatic price increases, we can see that there is a strong correlation between the increase in accumulation and price,” the analyst explained in a post on X.

Indeed, in March, US-listed Bitcoin ETFs saw net inflows of approximately $4 billion, propelling trading volumes to $111 billion — a nearly threefold increase from February. During the same period, Bitcoin’s price surged to a then-record high of over $73,777 on Coinbase.

Similarly, in November, following Donald Trump’s reelection and heightened expectations of regulatory support for crypto, Bitcoin soared past $93,265 on Binance, marking its highest-ever valuation.

“The more Bitcoin is accumulated in spot ETFs, the stronger the price becomes,” MAC_D added.

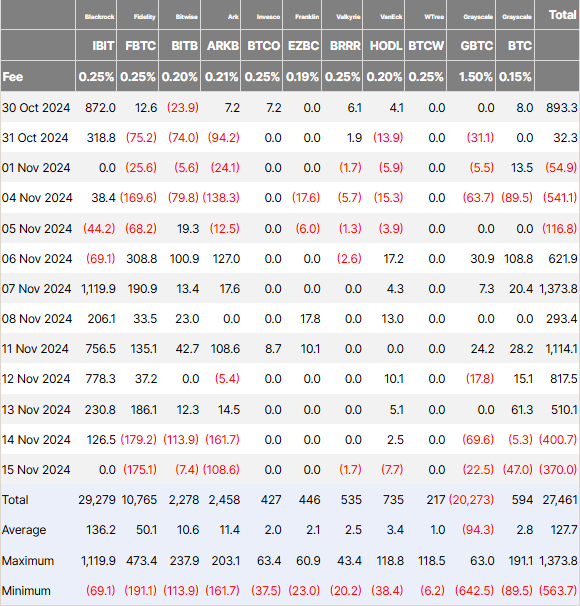

BlackRock’s iShares Bitcoin Trust (IBIT) continues to dominate the spot ETF market. Recent data shows the fund has surpassed $40 billion in assets, accounting for over $3 billion of net inflows since November 6.

While the broader US Bitcoin ETF market displayed mixed performance this week, IBIT added $2 billion in net inflows, consolidating its leadership.

Overall, US Bitcoin ETFs registered $2.4 billion in inflows during the first half of last week. However, redemptions on Thursday and Friday trimmed the week’s net inflows to $1.6 billion as shown above.

Regulatory Tailwinds Bolster ETF Adoption

The surge in Bitcoin ETF adoption is closely tied to changing regulatory frameworks. Recently, the US Securities and Exchange Commission (SEC) approved Bitcoin ETF options. This milestone aligned with recent progress from the Commodity Futures Trading Commission (CFTC), which cleared the spot Bitcoin options trading path.

More recently, the SEC and CFTC approved the listing of eco-conscious 7RCC Bitcoin and Carbon Credit Futures ETF. Taken together, these developments further legitimized spot Bitcoin ETFs, enhancing their appeal to institutional investors. This regulatory backing has played a pivotal role in fostering trust and driving capital into the market.

Optimism surrounding a favorable regulatory environment under the new US administration has also buoyed the inflows into Bitcoin ETFs further. In turn, it has amplified expectations of policies supportive of the digital asset industry, further accelerating Bitcoin adoption via ETFs. BeInCrypto recently reported that Bitcoin ETFs are now in 60% of top us hedge fund portfolios.

The role of macroeconomic factors, such as Federal Reserve policy and US elections, cannot be overlooked. As the Fed’s monetary tightening cools, risk-on assets like Bitcoin are regaining favor.

Looking ahead, analysts predict that the increasing adoption of spot Bitcoin ETFs could pave the way for Bitcoin’s recognition as a reserve asset. Should the US government adopt this trend, the inflow into ETFs is expected to rise even further, solidifying Bitcoin’s position in global finance.

Meanwhile, the growing share of Bitcoin held by spot ETFs has broader implications for the crypto market. By controlling over 5% of Bitcoin’s supply, these funds are stabilizing liquidity while potentially reducing market volatility.

Nevertheless, there are concerns about institutional control over Bitcoin, as this would be contrary to the pioneer cryptocurrency’s original decentralization ethos.

“Does this not defeat the whole purpose of “decentralization”? BlackRock will be the biggest hodler, it doesn’t get much more centralized than that,” one X user quipped.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.