Kaspa: Buyers push KAS towards ATH, but will THIS be a hurdle?

11/19/2024 15:00

Can KAS break resistance or face a reversal? Key metrics and market sentiment reveal its next move amidst a surging market.

Posted:

- Kaspa has seen an impressive rally, but now faces a significant resistance level that could cap its momentum.

- On-chain metrics offered mixed signals, leaving the market uncertain about KAS’s next move.

Kaspa [KAS] has positioned itself as one of the top-performing crypto assets, gaining 11.92% in the past 24 hours as buyer interest grows.

This momentum extends across all time frames, with the KAS posting gains of 6.43% over the past week and a 27.15% over the past month.

While optimism for a breakout to a new all-time high remains, conflicting market sentiment continues to cloud the outlook, making KAS’s next steps unpredictable.

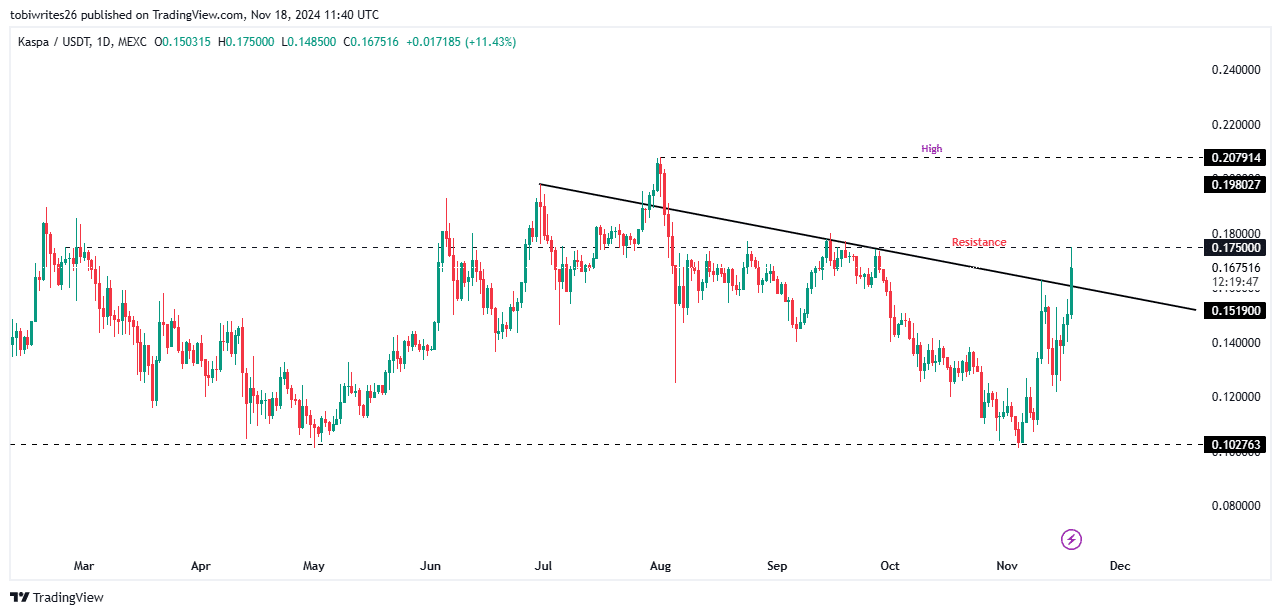

KAS faces challenges on its path to recovery

KAS’s recent surge comes after breaking out of a major descending trendline pattern that had suppressed its price rallies for five consecutive attempts.

Despite this breakthrough, KAS is now facing significant resistance at the $0.1750 level, a price point that has repeatedly acted as a barrier to further upward momentum.

If KAS manages to trade above this resistance, it could potentially reach a new all-time high, surpassing $0.2079 from its press time price level.

Conversely, if bearish sentiment prevails, the asset may fall back into the descending trendline pattern, curbing further progress.

To gauge KAS’s next move, AMBCrypto analyzed additional market metrics. However, the sentiment among market participants remained mixed.

Bulls, bears compete for control

The current market sentiment highlighted a tug-of-war between bulls and bears, with both actively influencing price movements.

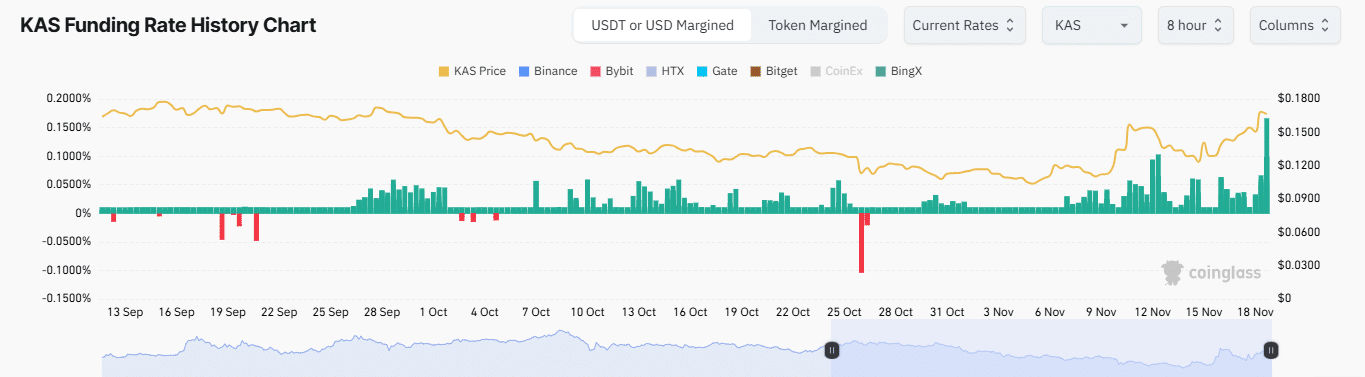

At the time of writing, Funding Rate and Open Interest on Coinglass suggested conditions favorable for continued upward momentum, though with potential bearish undertones.

The Funding Rate, which measures the cost of maintaining balance between the spot and futures markets, currently sits at 0.0200%.

Positive Funding Rates indicate that long positions (buyers) are paying short positions (sellers) to maintain equilibrium, often signaling bullish sentiment and the possibility of higher prices.

Meanwhile, Open Interest has surged by 22.12%, reflecting an increase in active contracts.

This indicates heightened market activity, with bulls holding a significant portion of these contracts, collectively valued at $124.95 million at press time.

Despite the bullish indicators, bearish activity is evident in recent long liquidations, particularly on shorter timeframes.

Long liquidations occur when the price moves against buyers, triggering their stop-loss orders and accelerating downward pressure.

On the 1-hour chart, $90.78K worth of long contracts were liquidated compared to just $6.97K in short contracts, amplifying bearish momentum.

Over the 24-hour timeframe, liquidations amounted to $261.61 thousand in long positions, reflecting sustained bearish pressure.

The long-to-short ratio stood at 0.9048, meaning there are more short contracts than long ones in the market.

Read Kaspa’s [KAS] Price Prediction 2024–2025

Such an imbalance often leaves the market vulnerable to corrections, as the majority’s position becomes overexposed.

While bulls attempt to regain control and drive prices upward, the increasing influence of bearish activity suggests a potential reversal or heightened volatility in the near term.