El Salvador Launches First Tokenized US Treasuries Offering

11/20/2024 02:46

El Salvador introduces its first tokenized US Treasury Bill offering, powered by NexBridge and Bitfinex Securities.

El Salvador will soon see its first regulated tokenized US Treasury Bill (T-Bill) offering, providing access to this investment vehicle for individuals and organizations previously excluded.

NexBridge Digital Financial Solutions, a licensed digital asset issuer in the country, has partnered with Bitfinex Securities to introduce this new product.

Bitfinex Securities Want to Raise $30 Million for the Tokenized T-Bill

The subscription period for the offering begins Tuesday and runs until November 29. Investors can use Tether’s stablecoin (USDT) to purchase tokens, with plans to accept bitcoin (BTC) in the future.

After the subscription closes, the tokens will trade on Bitfinex Securities’ secondary market. It will be traded under the ticker USTBL. The value of these tokens will be tied to BlackRock’s short-term Treasury bond ETF. Bitfinex Securities aims to raise a minimum of $30 million through this initiative.

“By leveraging Bitcoin’s technology and infrastructure, we’re laying the foundation for a globally accessible financial ecosystem, bringing tokenized U.S. Treasuries to investors worldwide,” said Michele Crivelli, Founder of NexBridge in the press release.

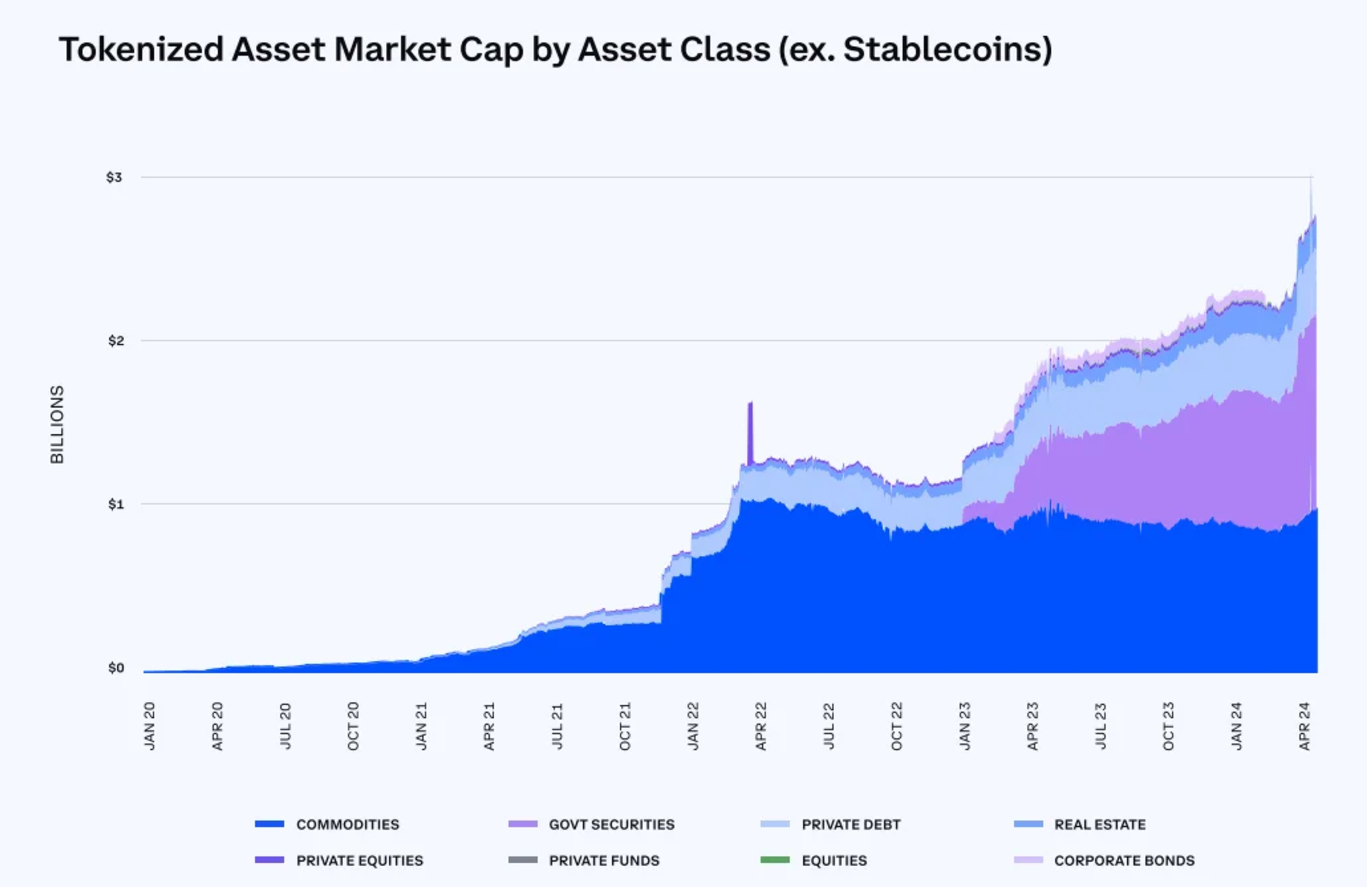

Overall, the tokenization of real-world assets (RWAs) is expanding rapidly. Earlier this month, BNB Chain launched a tokenization portal for RWAs and private companies to simplify access for new Web3 users.

Similarly, MANTRA debuted its mainnet, enabling on-chain RWA integration. This boosted the utility of its OM token, which surged over 200% in November, reaching a new all-time high.

El Salvador Continues to Benefit from Its Bitcoin Holdings

El Salvador continues to push forward with significant financial developments. The government recently launched its third dollar bond buyback. This effort targets over $2.5 billion in bonds, contingent on securing new financing. The decision came after BTC reached an all-time high post-election.

Also, a second term for former US President Donald Trump can be potentially beneficial for President Nayib Bukele’s administration. It will potentially improve El Salvador’s chances of obtaining financial support from the International Monetary Fund (IMF).

Back in 2021, El Salvador gained international recognition when it became the first nation to adopt Bitcoin as legal tender. The country’s Bitcoin holdings are now valued at $515 million.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.