Ethereum dApp volumes hit new highs: Can this help ETH rally above $3,200?

11/21/2024 06:00

Ethereum DApp volume surges 38% in a month, hitting $3.54 billion in transactions, but will it fuel a bullish breakout for ETH?

Posted:

- Ethereum has registered the highest dApp volume in the last 30 days.

- ETH’s price trend has been less active.

Ethereum’s [ETH] decentralized application (dApp) ecosystem has witnessed an impressive surge in activity, with volumes climbing by 38% over the past month.

This growth signaled renewed interest in DeFi, NFTs, and gaming sectors. However, a critical question remains—will this on-chain activity drive a bullish breakout for ETH’s price?

The Ethereum network appears active with rising gas usage, increasing transaction volumes, and dApp engagement. Still, price action remains cautiously optimistic.

Ethereum dApp volumes on the rise

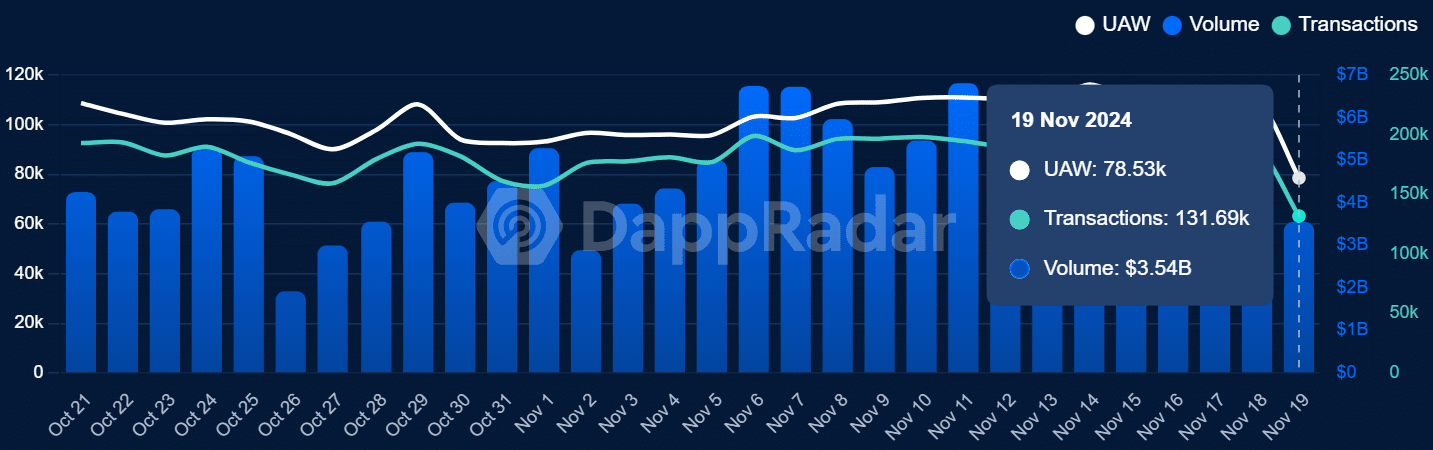

Recent data from DappRadar highlighted a steady increase in Ethereum dApp usage.

Total transaction volumes have reached $3.54 billion as of the 19th of November 2024, while the number of daily unique active wallets (UAW) surged to 78.53k, signaling growing participation in the ecosystem.

Additionally, analysis reveals that in the last 30 days, its dApp volume rose to almost $150 billion, which was the highest.

The data also showed a 37.67% increase in the last 30 days, making its increase the most impactful.

DeFi protocols have been the largest contributors to this growth, benefiting from higher total value locked (TVL) as lending and trading activities gain momentum.

NFT marketplaces and blockchain-based gaming platforms have also played a significant role in driving transactions.

On-chain activity reflects increased demand

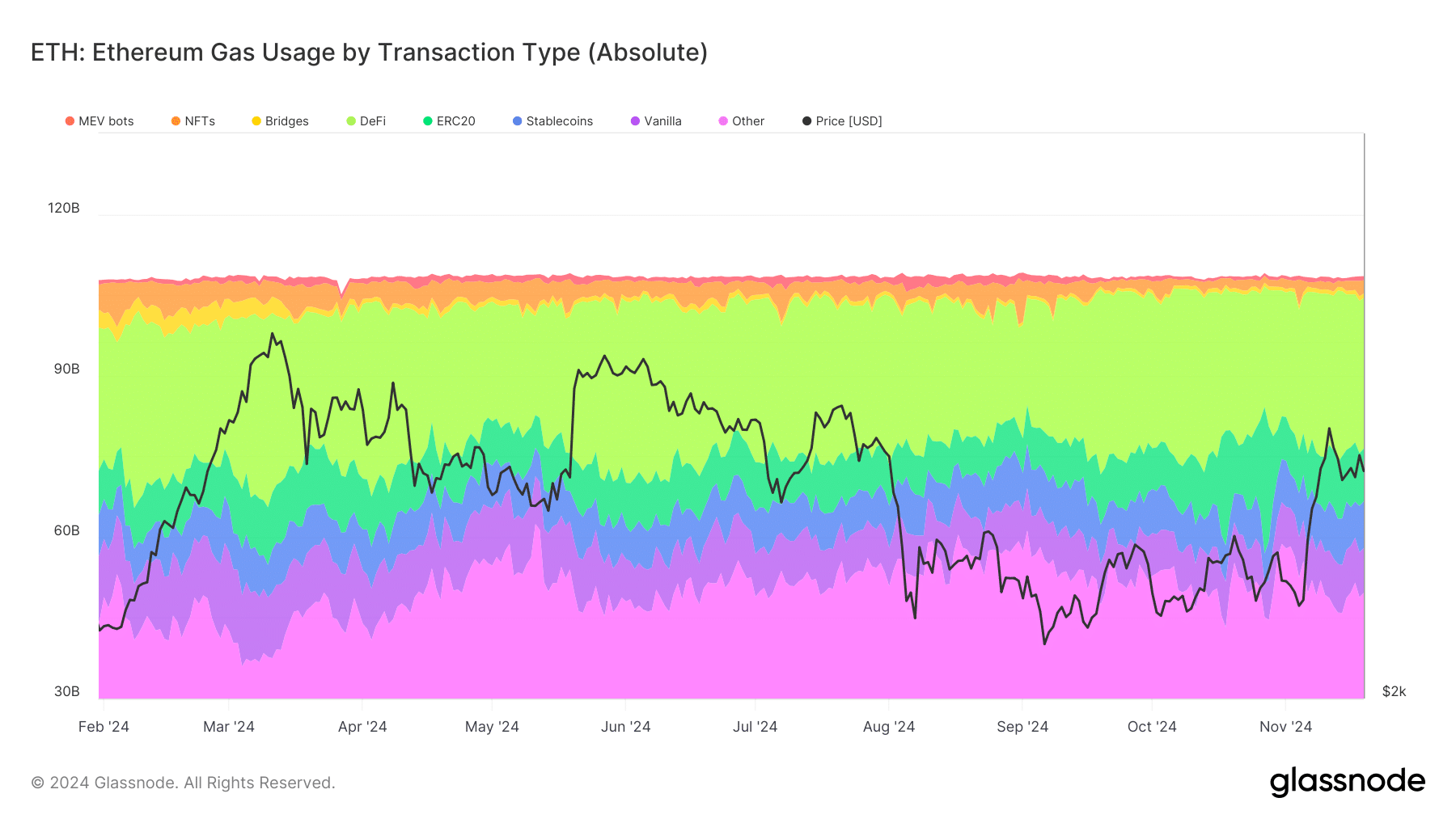

AMBCrypto’s analysis of Ethereum’s on-chain activity provided additional context to its growing dApp ecosystem.

According to Glassnode, gas usage has risen across various transaction types, including DeFi, NFTs, and stablecoin transfers. Further analysis showed that the DeFi sector dominates gas usage on the platform.

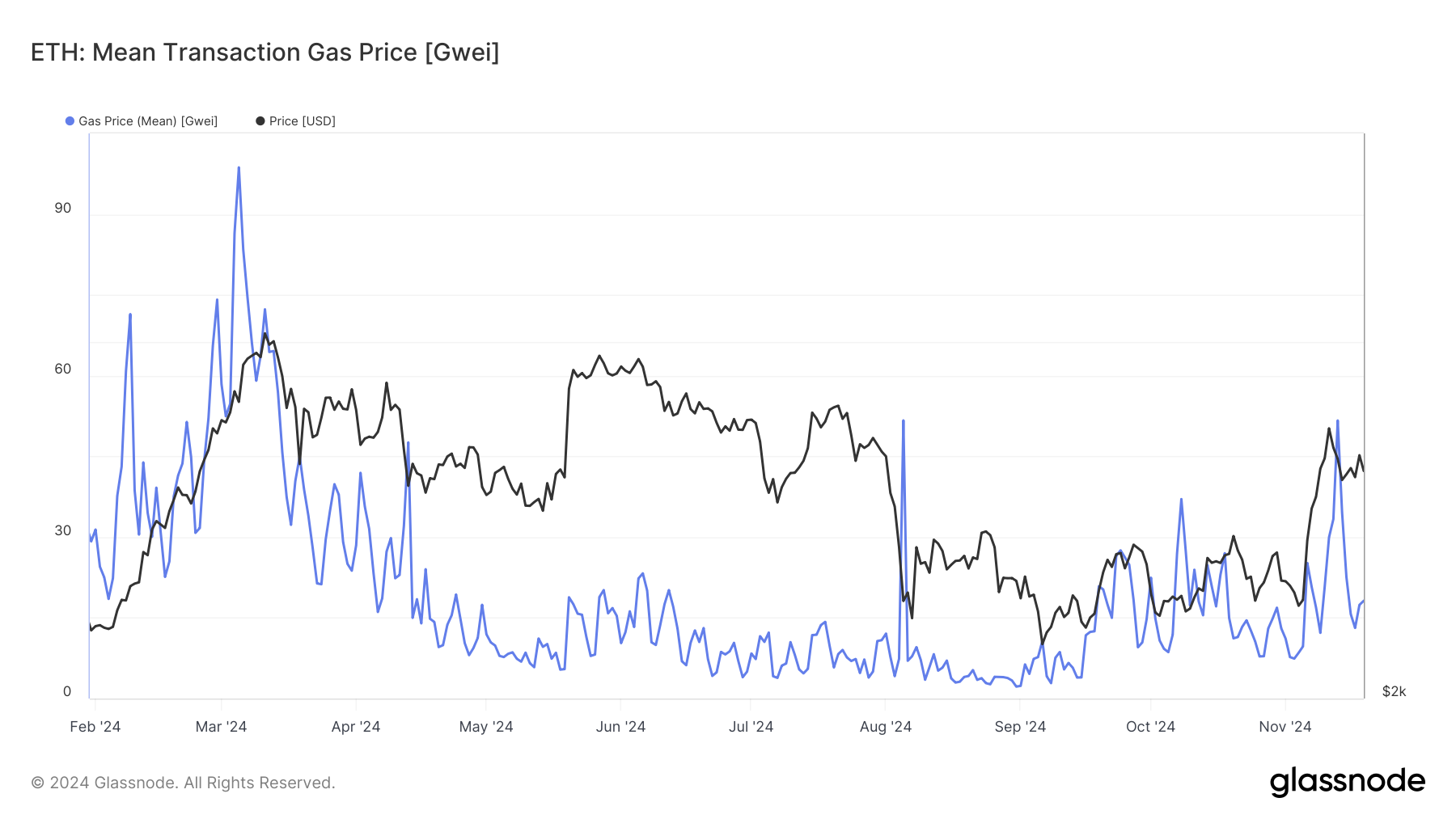

Furthermore, the analysis showed a recent spike in gas fees, averaging 50 Gwei. Historically, higher gas fees have coincided with spikes in on-chain activity, often preceding significant price movements for ETH.

Ethereum’s price action and technical indicators

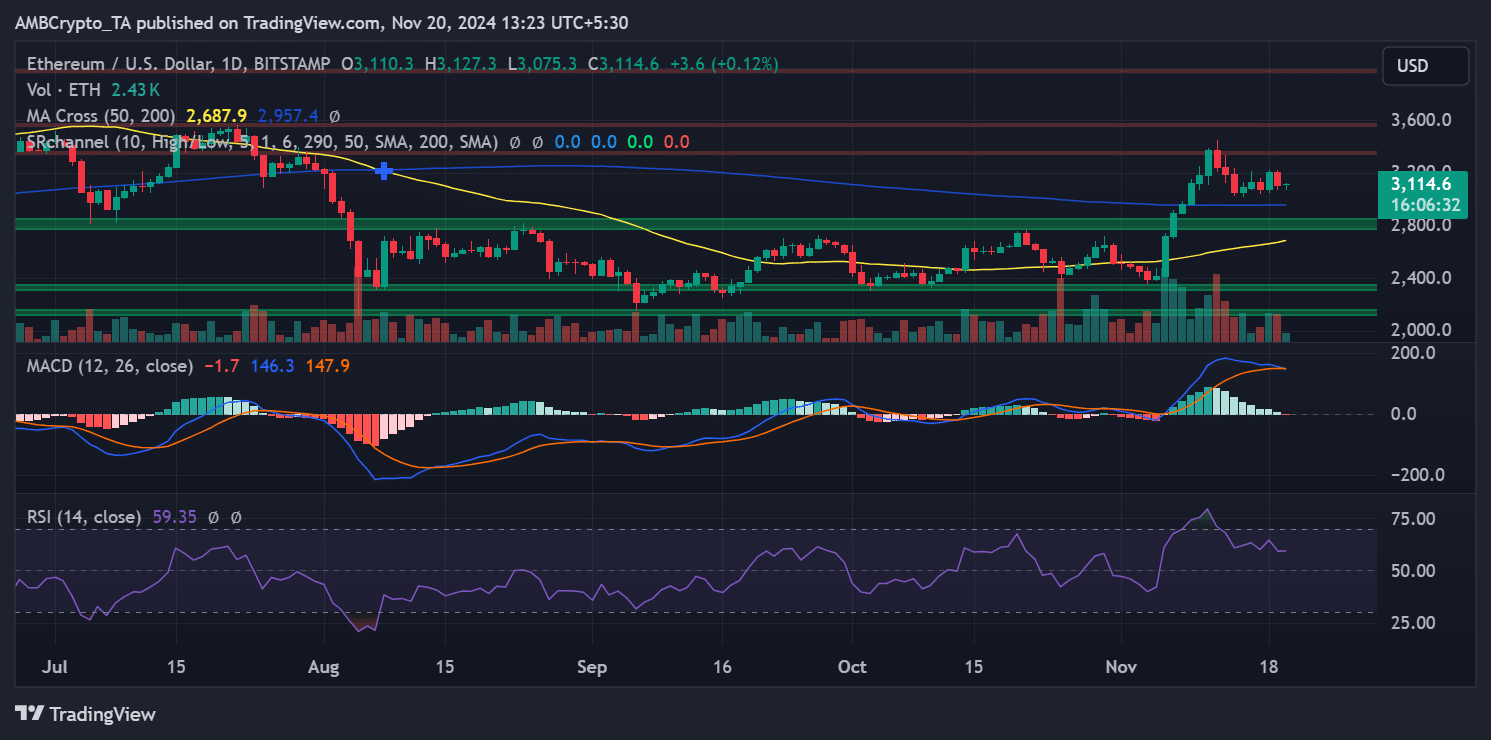

Despite the rise in network activity, Ethereum’s price action has remained subdued, trading around $3,114 at press time. The technical outlook revealed mixed signals as well.

Notably, the 50-day moving average of $2,687 sits above the 200-day moving average at $2,957, indicating an overall bullish trend. The MACD shows a slight bearish divergence, pointing to weakening momentum.

Meanwhile, the RSI at 59.35 reflected neutral conditions, suggesting that Ethereum’s price could move in either direction in the near term.

Ethereum must break above critical resistance at $3,200 to sustain its bullish trajectory.

On the downside, the $3,000 support level is crucial, as a breach could lead to a prolonged consolidation phase or even a short-term correction.

Will ETH follow the dApp volume surge?

The significant increase in Ethereum’s dApp volumes underscored strong network demand. However, translating this activity into sustained price growth depends on several factors.

The continued expansion of DeFi and NFT sectors could enhance Ethereum’s intrinsic value, driving investor interest.

Additionally, ecosystem upgrades such as EIP-4844 (Proto-Danksharding) are expected to improve scalability and network efficiency, potentially boosting Ethereum’s appeal.

Read Ethereum’s [ETH] Price Prediction 2024-25

However, challenges remain. High gas fees could deter further user participation, limiting the ecosystem’s growth.

Broader macroeconomic conditions and fluctuations in Bitcoin’s price could also weigh on Ethereum’s ability to capitalize on its network activity.