XRP price has performed well so far this month, with crypto experts predicting that the rally could gain momentum soon.

Ripple (XRP) crossed the key resistance level at $1 this week as demand surged, marking a nearly 200% increase from its lowest level in June.

Crypto experts remain optimistic about XRP’s potential. In an X post, analyst XRP Queen, who has nearly 50,000 followers, suggested that XRP could experience its “biggest pump” if Gary Gensler resigns as the head of the Securities and Exchange Commission

Speculation about his resignation has grown following Donald Trump’s election win, as Trump is expected to appoint a new SEC chair who may be more favorable to the crypto industry.

Such a chair might end Ripple Labs’ ongoing litigation and approve additional crypto ETFs, including XRP.

Fundamental developments also bolster optimism. Ripple plans to launch RLUSD, a stablecoin backed by the US dollar, which it hopes will expand its role in the blockchain and payments sectors.

On the technical side, analysts highlight a bullish pennant pattern forming over the past seven years. Javon Marks, a crypto analyst, noted in a recent post that a breakout above this pattern could signal further gains in the months ahead.

XRP price has more upside

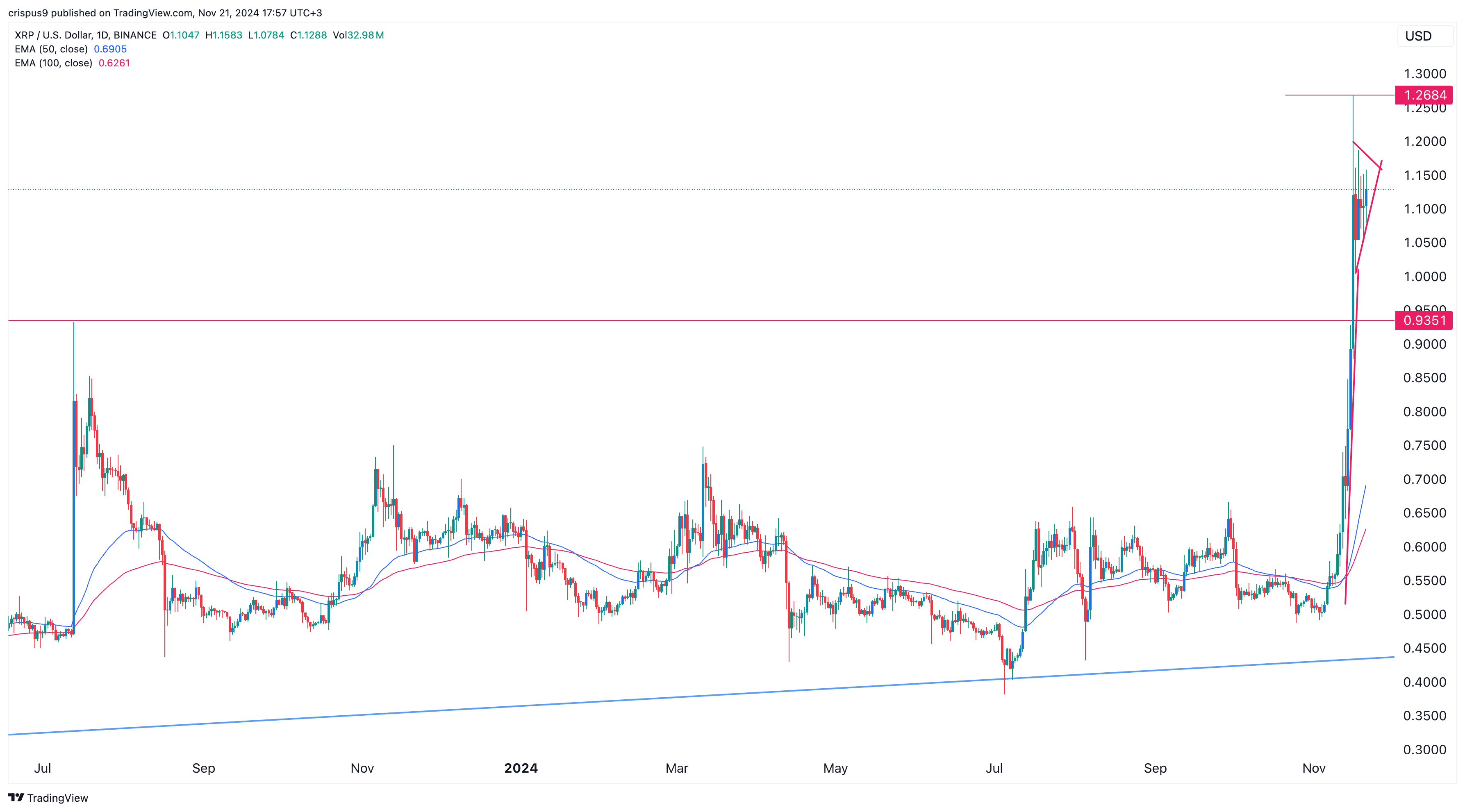

The daily chart shows XRP consolidating after its recent rally, forming a bullish pennant pattern, which is generally a positive indicator. The coin has moved above the 50-day and 200-day Exponential Moving Averages and is holding support at $0.9351, a key level from July last year.

A bullish breakout could push XRP toward $1.2685, its high this week. Breaking above that could increase the chances of reaching its 2021 peak of $1.97, representing a 75% gain from current levels. However, a move to its all-time high of $3.54, requiring a 215% surge, is considered less likely this year.