Bitcoin rally intact despite long-term holders cashing out – How?

11/22/2024 04:00

Long-term Bitcoin holders are selling BTC as the price forms successive all-time highs. However, institutional demand is offsetting the rising supply.

Posted:

- Long-term Bitcoin holders have accelerated selling activity as BTC forms successive new highs.

- Spot Bitcoin ETFs are absorbing the sell-side pressure, giving room for BTC to extend its rally.

Bitcoin [BTC] continues to outshine altcoins with successive all-time highs. At press time, BTC traded at $97,350, with a market capitalization of $1.92 trillion. Since the start of Q4, BTC has gained by 52%.

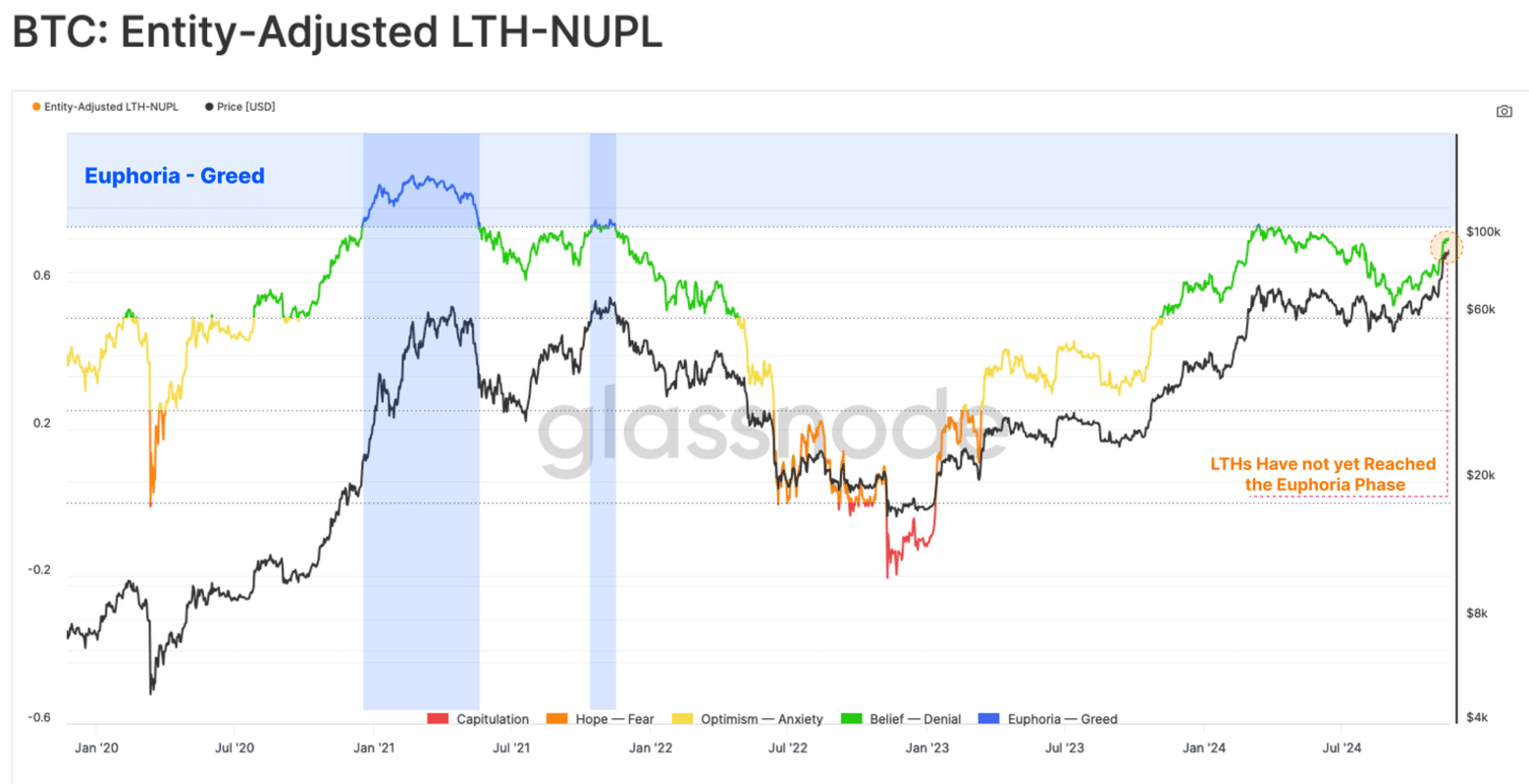

In its weekly on-chain report, Glassnode noted that all long-term Bitcoin holders are now in profit. However, the Net Unrealized Profit/Loss (NUPL) metric for these holders stood at 0.75, suggesting that they are yet to reach the euphoria or greed phase.

Long-term holders usually sell the top and buy when the prices are low. A repeat of this pattern is underway after their holdings dropped by more than 200,000 BTC when Bitcoin broke past $75,000 two weeks ago.

Long-term holders hold 14 million BTC per Glassnode. As such, accelerated profit-taking could stall Bitcoin’s rally.

However, two factors have prevented Bitcoin from succumbing to the sell-side pressure: the anticipation of higher prices and institutional demand absorbing the sold coins.

Spot Bitcoin ETFs are absorbing selling pressure

Institutional demand in Bitcoin, through spot Bitcoin exchange-traded funds (ETFs), has been absorbing the sell-side pressure exerted by long-term holders.

Data from SoSoValue shows that in the past week, weekly inflows to these ETFs have averaged between $1 billion and $2 billion.

Per Glassnode, between 8th October and 13th November, Bitcoin ETFs absorbed 93% of the coins sold by long-term holders. This played a key role in stabilizing prices.

However, over the past week, long-term holders have accelerated selling activity, with this sell-side pressure outpacing the demand from ETFs. If there is an imbalance between supply and demand, it could result in price volatility.

Are short-term Bitcoin holders also taking profits?

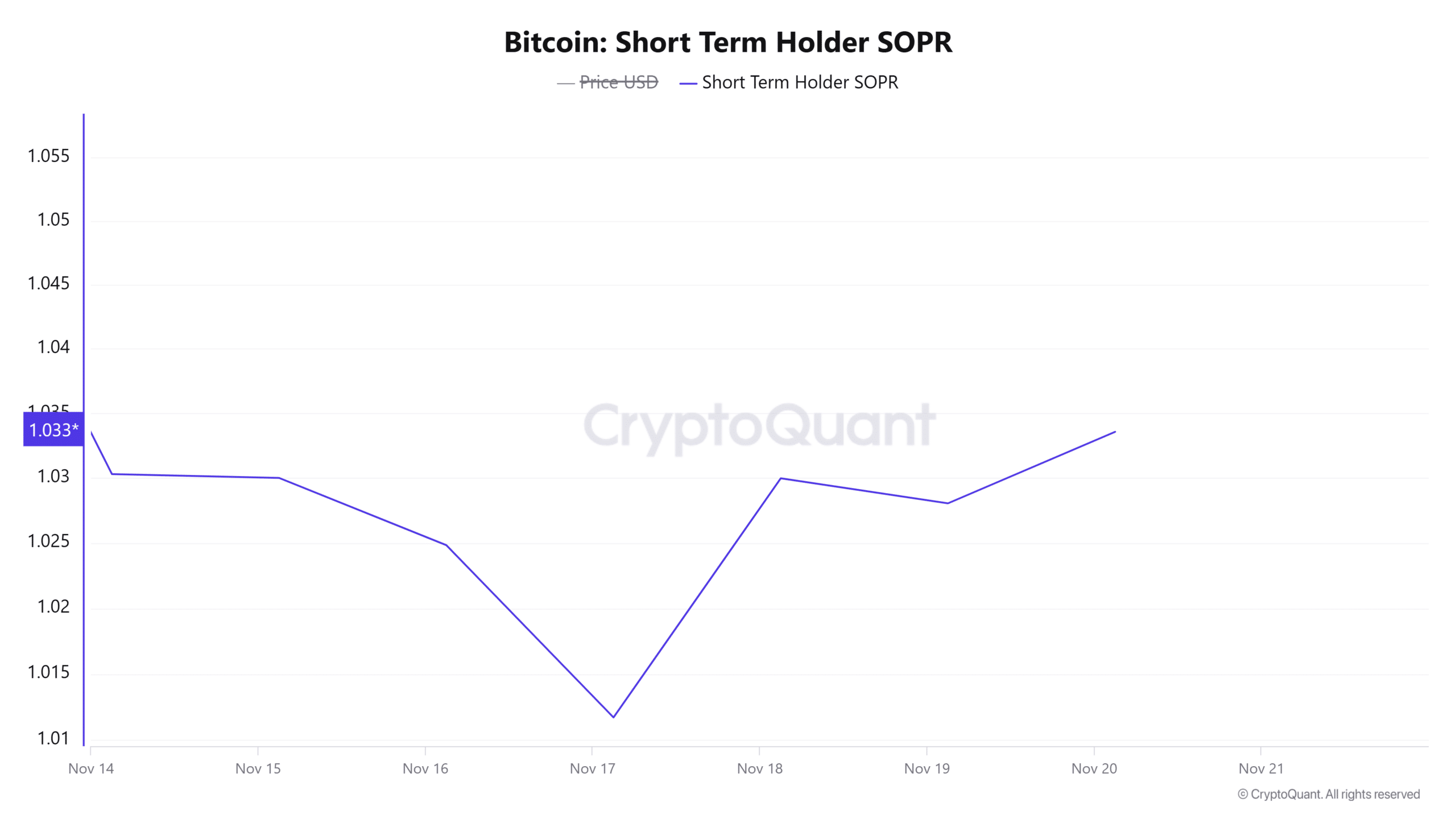

Data from CryptoQuant shows that the short-term holder Spent Output Profit Ratio (SOPR) has surged to its highest level in a week.

The SOPR ratio of 1.03 shows that the coins being moved by these traders are valued at 3% higher than their purchase price. This suggests that short-term holders are yet to reach extreme levels of profitability, which could deter profit-taking as they eye further price increases.

Moreover, with the market sentiment flashing extreme greed, short-term holders, who usually capitalize on short-term price movements, might choose to hold or accumulate more coins in the near term.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Bitcoin short sellers re-enter the market

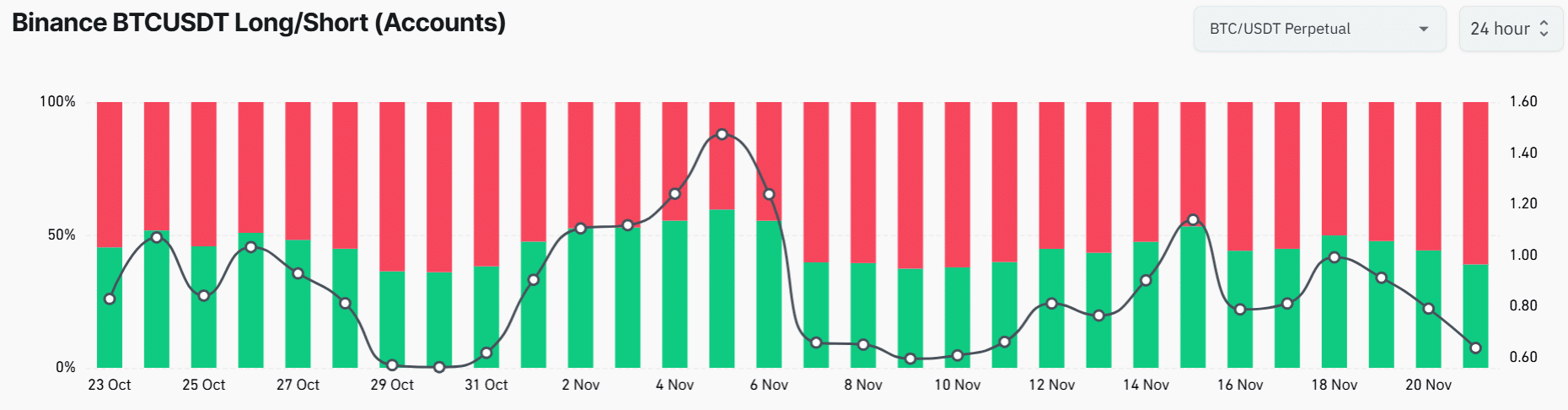

The long-term holder distribution phase has had an impact on the Bitcoin futures market. On Binance, 61% of traders have opened short positions on BTC, marking the highest percentage of short positions in over a week.

The increase in short positions suggests that traders view $100,000 as a strong resistance level for Bitcoin. However, if BTC breaks past this price, a short squeeze could lead to forced buying, which will extend the price rally.