Dogecoin signals caution: Is a DOGE drop needed before a rally?

11/22/2024 06:30

The short-term bubble risk for Dogecoin has escalated to a critical value of 2.84 indicating caution to go long on the memecoin.

Posted:

- Heightened bubble risk for Dogecoin, signaling caution ahead.

- The price action of DOGE’s pump mirrors Bitcoin’s halving years.

The short-term bubble risk for Dogecoin [DOGE] has escalated to a critical value of 2.84, indicating that the meme-based cryptocurrency may be nearing a potential price correction.

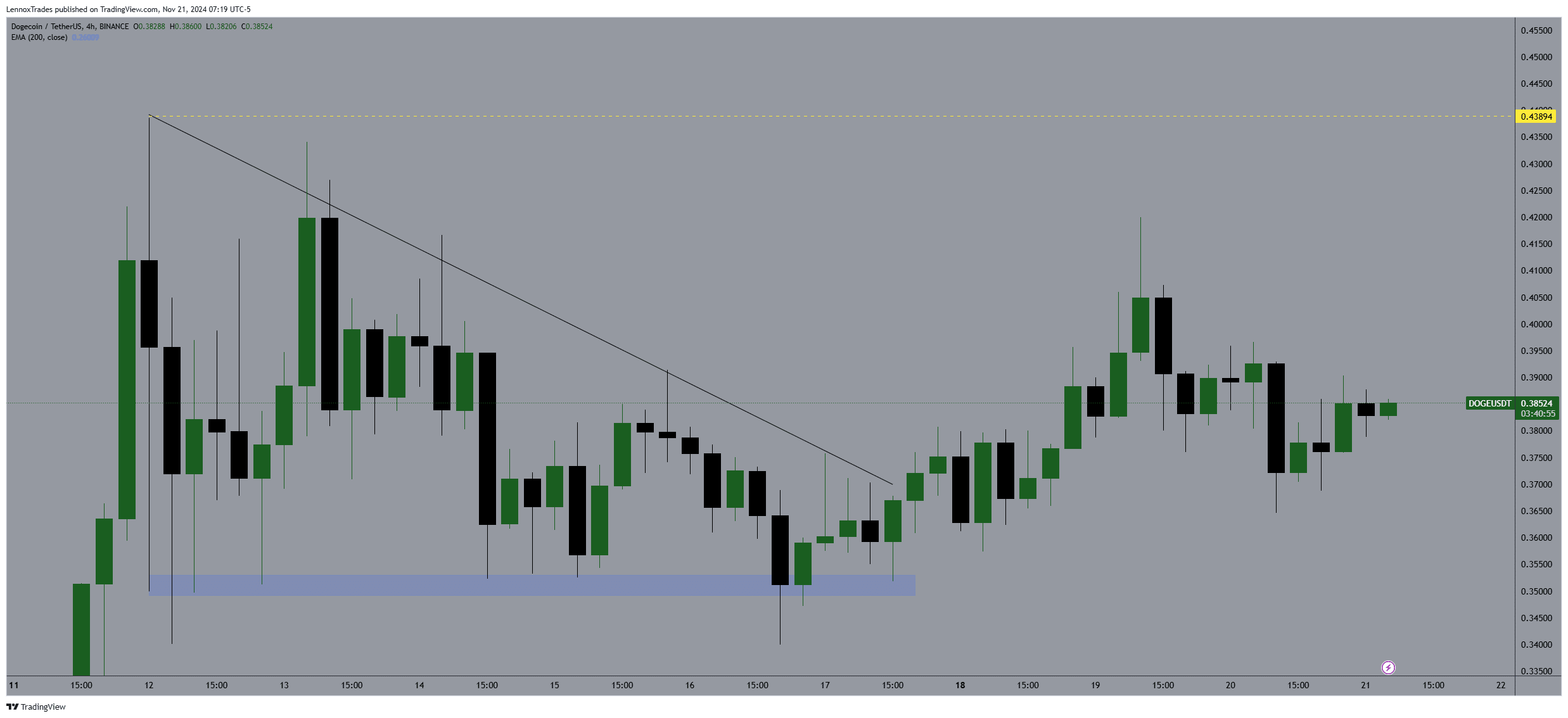

Dogecoin was trading at $0.38, a slight decline from its recent high of $0.42. The indicator suggested traders should be wary of initiating long positions under current market conditions.

The chart showed DOGE’s price in correlation with its bubble risk levels over the years, displaying significant peaks that historically precede market pullbacks.

This pattern advised investors to approach Dogecoin with caution, as the market could be due for another downturn.

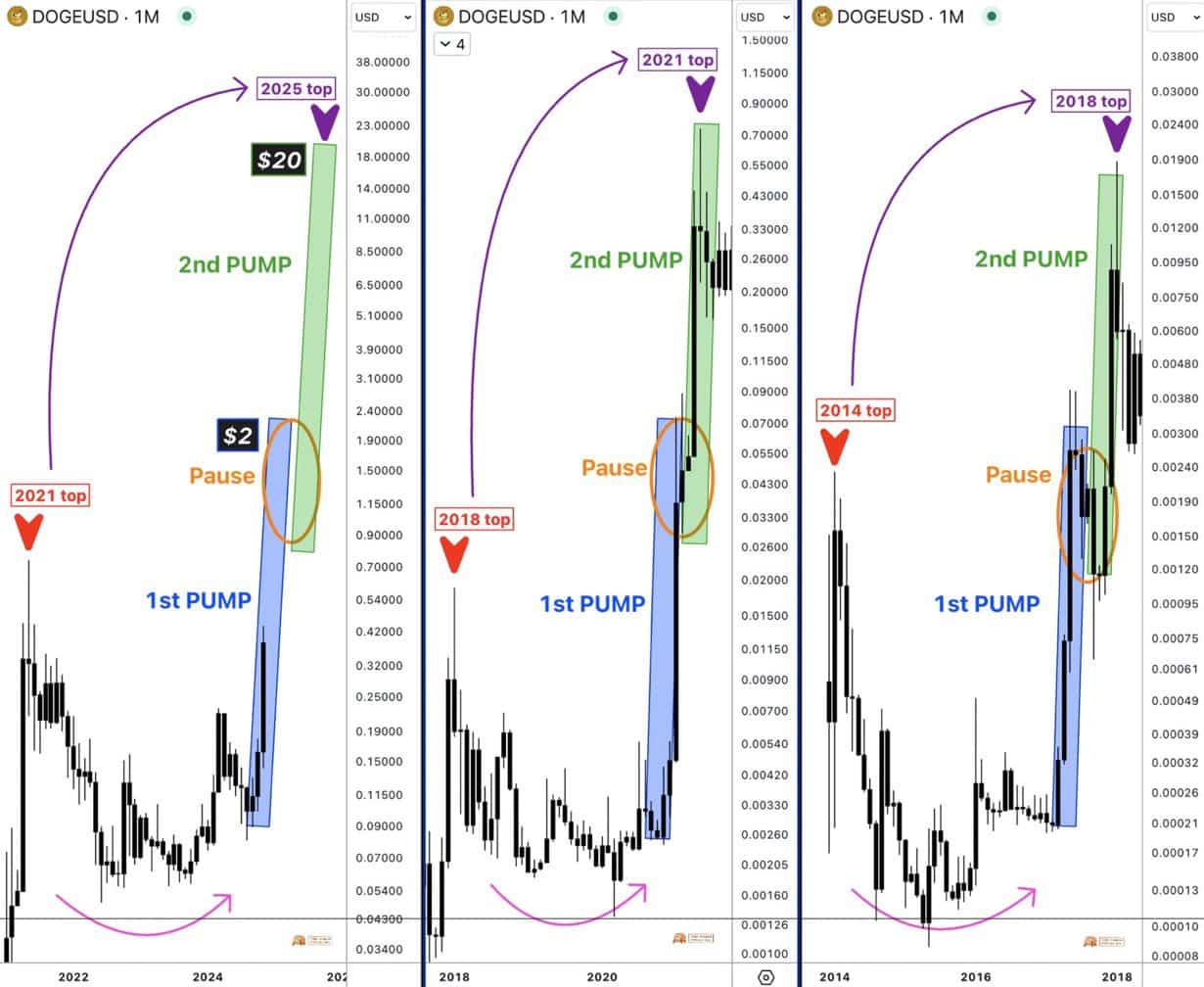

Dogecoin’s historical surge patterns

DOGE patterns of rallying post-Bitcoin [BTC] halving events, notably in 2016, 2020, and 2024 indicated each cycle presented a striking symmetry in Dogecoin’s price action.

After the 2016 and 2020 Bitcoin halvings, DOGE experienced its first major price pump, followed by a period of consolidation, and then a second, more substantial pump.

The 2024 cycle mirrored this pattern closely, suggesting that historical behaviors are repeating.

The charts marked these phases clearly: the initial surge (first pump), followed by a stabilization period (pause), and then a secondary, stronger rally projected to peak by 2025.

The current trajectory of Dogecoin suggested a potential climb to $20 by 2025, following its rise in the post-halving momentum this year.

With DOGE’s short-term bubble risk at a high of $2.84, traders exhibited caution as it was trading at $0.38, Dogecoin has struggled to extend gains beyond $0.42.

Technical analysis suggested a potential dip to $0.36 could serve as a critical juncture to accumulate liquidity needed to push prices higher.

This setup aimed to retest recent highs, offering a pivotal moment for Dogecoin to overcome bearish pressures.

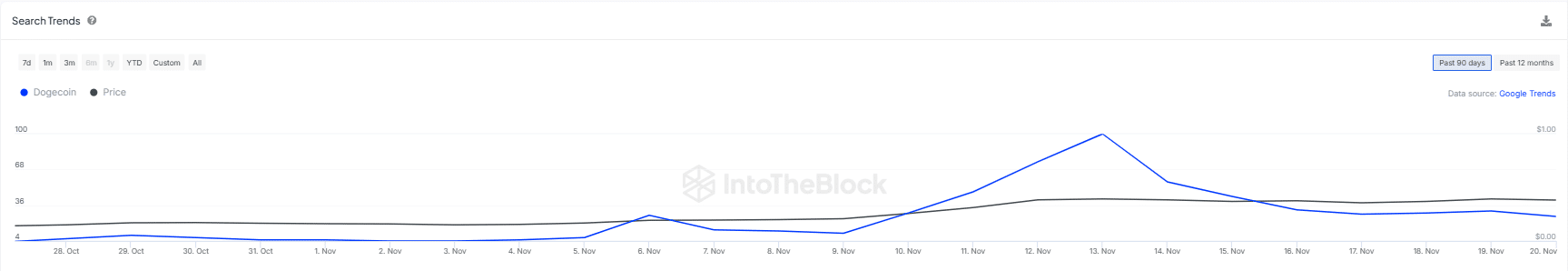

Search trends signal rising interest

Additionally, Dogecoin’s search trends in November have illustrated significant interest spikes, hinting at an upcoming surge in its market price.

Analysis of the trend data revealed a peak in search activity around the 5th of November, coinciding with noticeable price movements.

As interest waned, so did the price, showing a direct correlation between public interest and market behavior.

These trends were essential indicators of how community engagement could potentially drive price changes.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

Historically, these trends have signaled upcoming market movements. This observation is crucial for those aiming to profit from Dogecoin’s volatility.

This observed pattern supported the notion that heightened curiosity could soon translate into higher market activity for Dogecoin.