Whales accumulate EIGEN: Is this a sign of EigenLayer’s future rally?

11/22/2024 09:00

A major investor’s strategic accumulation of EIGEN suggested growing confidence in the token’s future. Will this trigger...

Posted:

- Massive whale accumulation has brought significant attention to EIGEN.

- Whale activity aligned with EIGEN’s price rise and spikes.

EigenLayer [EIGEN] was trading at $2.58 at press time, marking a 7.18% increase over the past 24 hours. The 24-hour trading volume was $158.47 million, up by 24.71%.

However, the Open Interest (OI) for EIGEN stood at $66.46 million, reflecting a 7.20% decrease.

Whale activity often signals potential market trends, and $EIGEN has recently taken center stage. Major investor’s strategic accumulation suggests growing confidence in the token’s future.

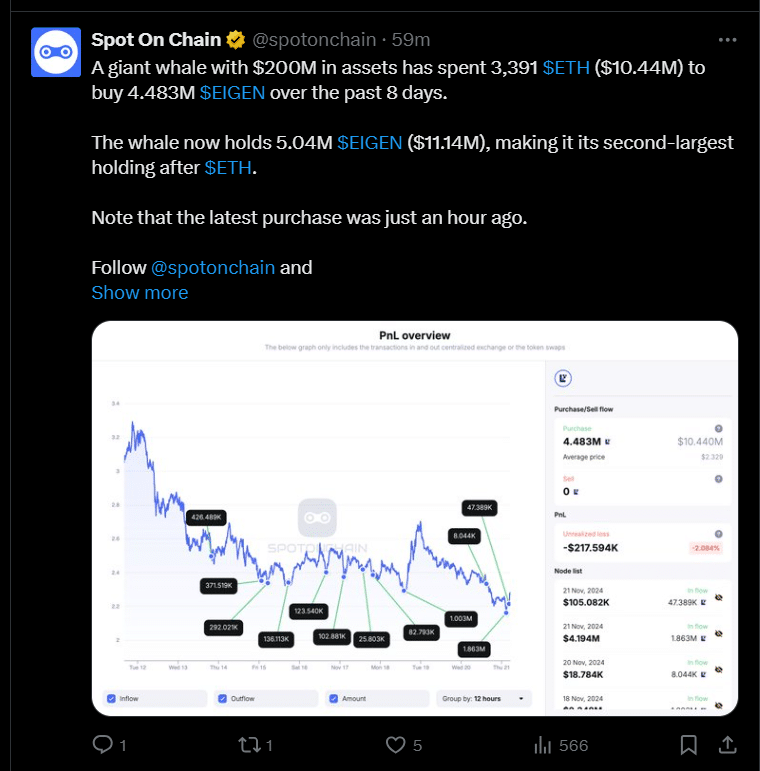

A whale with $200 million in assets spent 3,391 ETH, valued at $10.44 million, over eight days to acquire 4.483 million EIGEN.

This move raised its holdings to 5.04 million EIGEN worth $11.14 million, making it the whale’s second-largest position after ETH. This highlighted a consistent and deliberate strategy.

Is copying whales the hack?

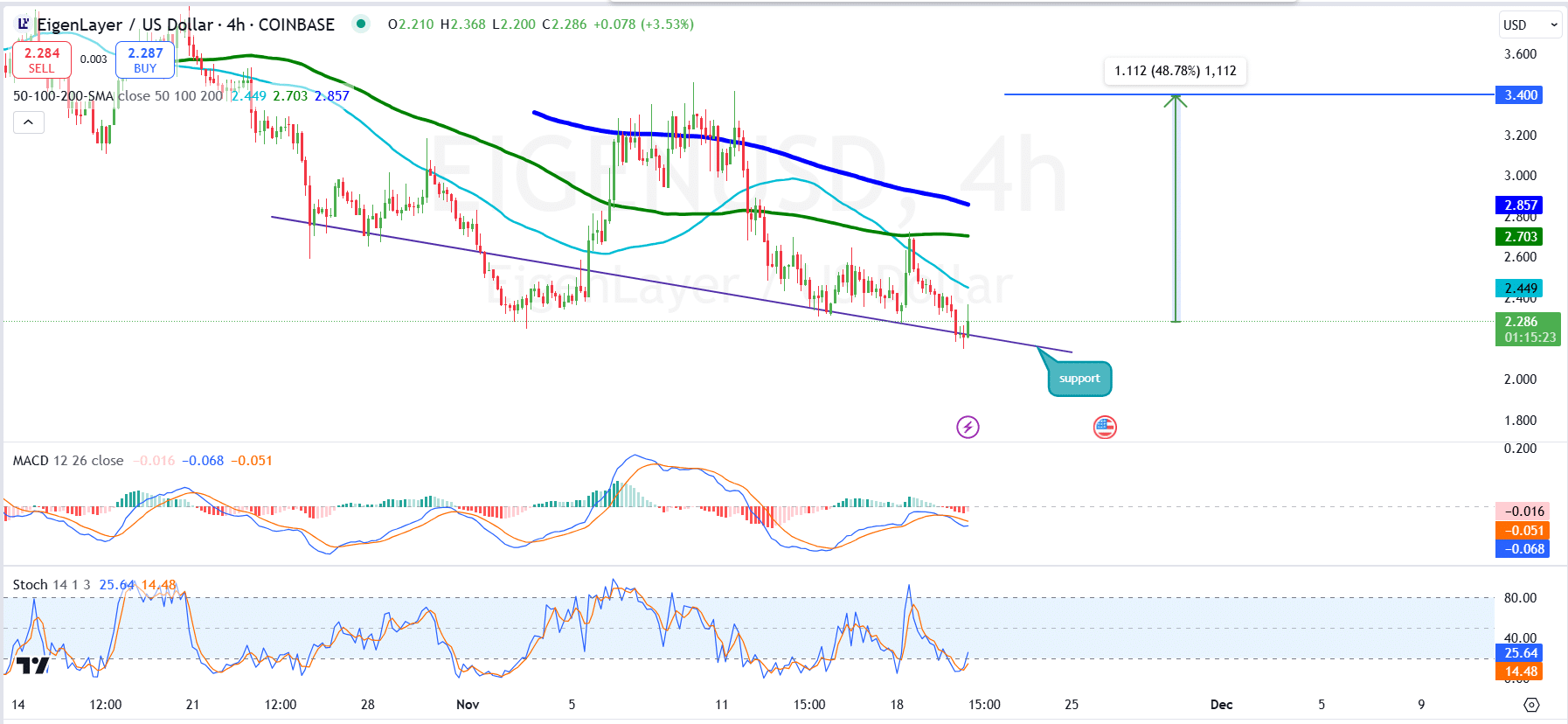

The immediate support level for the token was at $2.20. Resistance levels were observed at $2.80, with a key resistance at $3.40. This setup offered a potential upside of 48.78%.

The price has recently rebounded from the support trendline, indicating the possibility of a short-term recovery.

Moving Averages (MA) are also aligned with these levels.

The 50 SMA at $2.449 acts as immediate resistance, followed by the 100 SMA at $2.703 and the 200 SMA at $2.857, marking key barriers for sustained upward movement.

The MACD histogram showed decreasing bearish momentum as the signal lines were approaching a potential bullish crossover.

Meanwhile, the stochastic RSI was in oversold territory, with the fast line at 14.48 and the slow line at 25.64, suggesting a likely upward reversal.

Overall, while the indicators hint at bullish potential, confirmation through a price break above $2.80 is essential for further upward momentum.

Whale transactions help EIGEN surge!

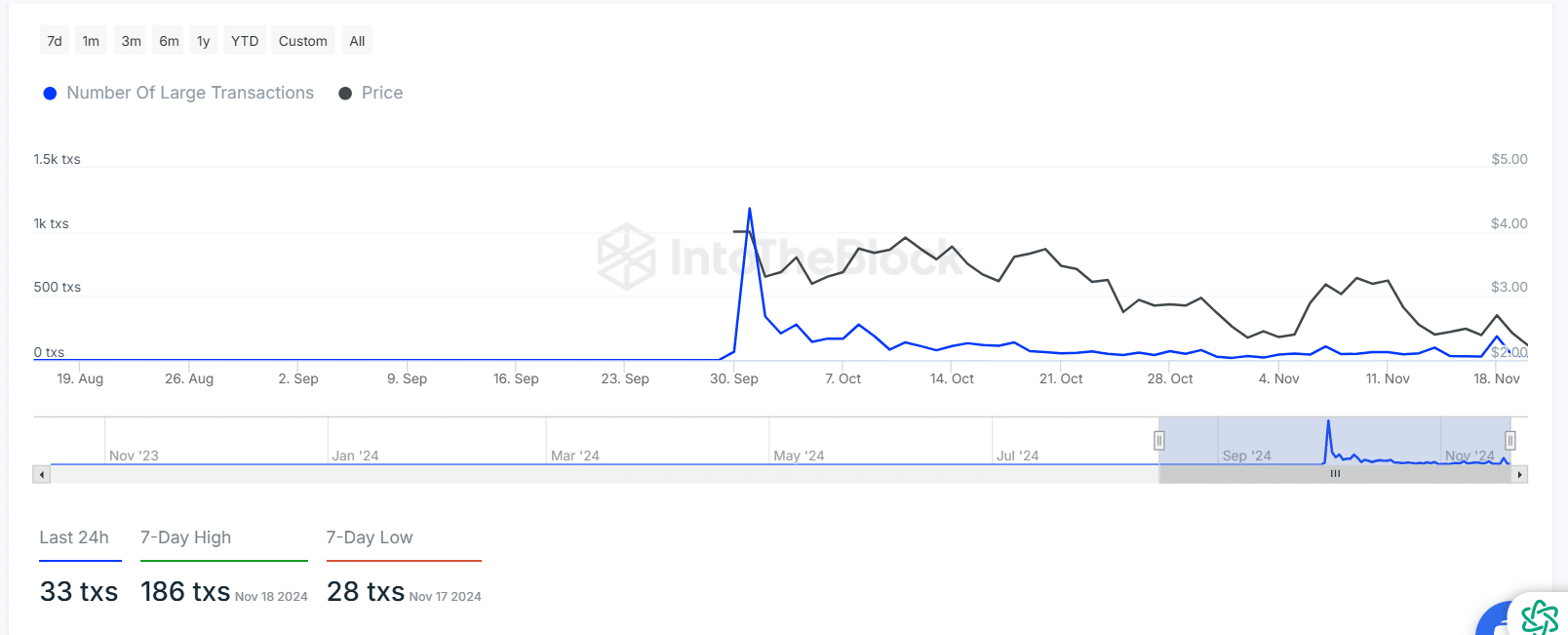

An analysis of IntoTheBlock data by AMBCrypto showed a strong correlation between whale activity and EIGEN’s price movement. In late September, a sharp spike in large transactions exceeded 1,500, pushing the price above $4.00.

This was driven by heightened interest from institutional players or whales.

Following this peak, both transaction counts and price declined steadily through October, with transactions dropping below 500 and the price consolidating in the $2.50-$3.00 range.

Is your portfolio green? Check out the EIGEN Profit Calculator

Early November showed flat activity, with transactions fluctuating between 50 and 200 daily as the price stayed within a narrow band.

Over the past week, activity slightly increased, with a seven-day high of 186 large transactions on the 18th of November and a low of 28 on the 17th of November. This shows inconsistent whale engagement.