Bitcoin Futures Smash Through $100K Barrier on Deribit

11/25/2024 04:34

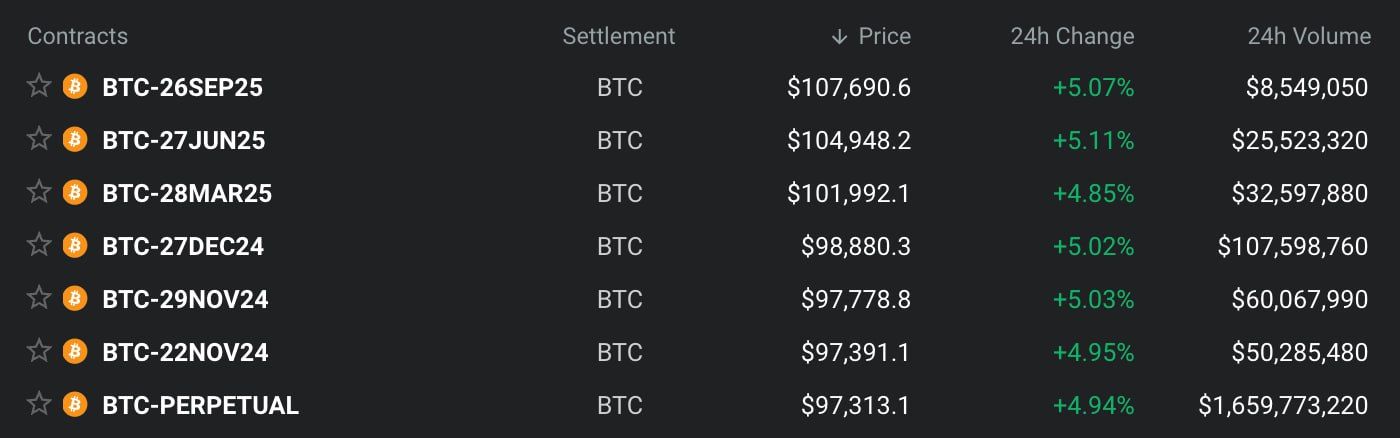

BTC futures expiring in March, June and September 2025 trade at prices greater than $100,000, according to data source Deribit.

Deribit's BTC futures expiring in March, June and September 2025 trade above $100,000.

Updated Nov 21, 2024, 6:54 a.m. Published Nov 21, 2024, 6:50 a.m.

- Deribit's BTC futures expiring in March, June and September 2025 trade above $100,000.

- BTC call option at the $100,000 strike now boasts an open interest of over $2 billion.

Bitcoin (BTC) futures have surged past the $100,000 price mark on Deribit, trading at a premium to its spot market price.

At press time, BTC futures contract expiring on March 28 traded 4.8% higher at $101,992, representing a. premium of nearly 5% to the global average spot price of $97,200, according to data source Deribit and TradingView. Contracts expiring on June 27 and Sept. 26 changed hands at $104,948 and $107,690 in an upward-sloping futures curve.

The pricing represents expectations that the spot price will be comfortably above $100,000 by the end of March and beyond. Deribit's BTC options suggested the same, with the $100,000 call option boasting a notional open interest of $2.13 billion.

However, the futures contract expiring in a few weeks from now on Dec. 28 traded in five figures. Those trading on the Chicago Mercantile Exchange, considered a proxy for institutional activity, also traded below $100,000, according to TradingView.

Omkar Godbole

Omkar Godbole is a Co-Managing Editor on CoinDesk's Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.