Ethereum in November: Up 34%, with staking at an ATH – What now?

11/25/2024 17:00

Ethereum staking sees a record weekly Netflow over the past week. ETH has surged by 7.82% over this period

Posted:

- Ethereum staking sees a record weekly Netflow of +10k ETH.

- ETH has surged by 7.82% over this period.

Throughout the month, Ethereum [ETH] has experienced increased demand and a strong price upswing to hit $3500 for the first time since July.

While ETH has struggled to keep pace with Bitcoin [BTC], which has reached new ATHs five times over the past week, the altcoin has spiked by 34% on monthly charts.

Over the past week especially, Ethereum has seen a strong upswing from a low of $3031 to a high of $3500. During this period, Ethereum staking saw a record breaking inflow. According to Maartunn, ETH staking weekly netflow has hit a record high.

Ethereum staking sees a record weekly netflow

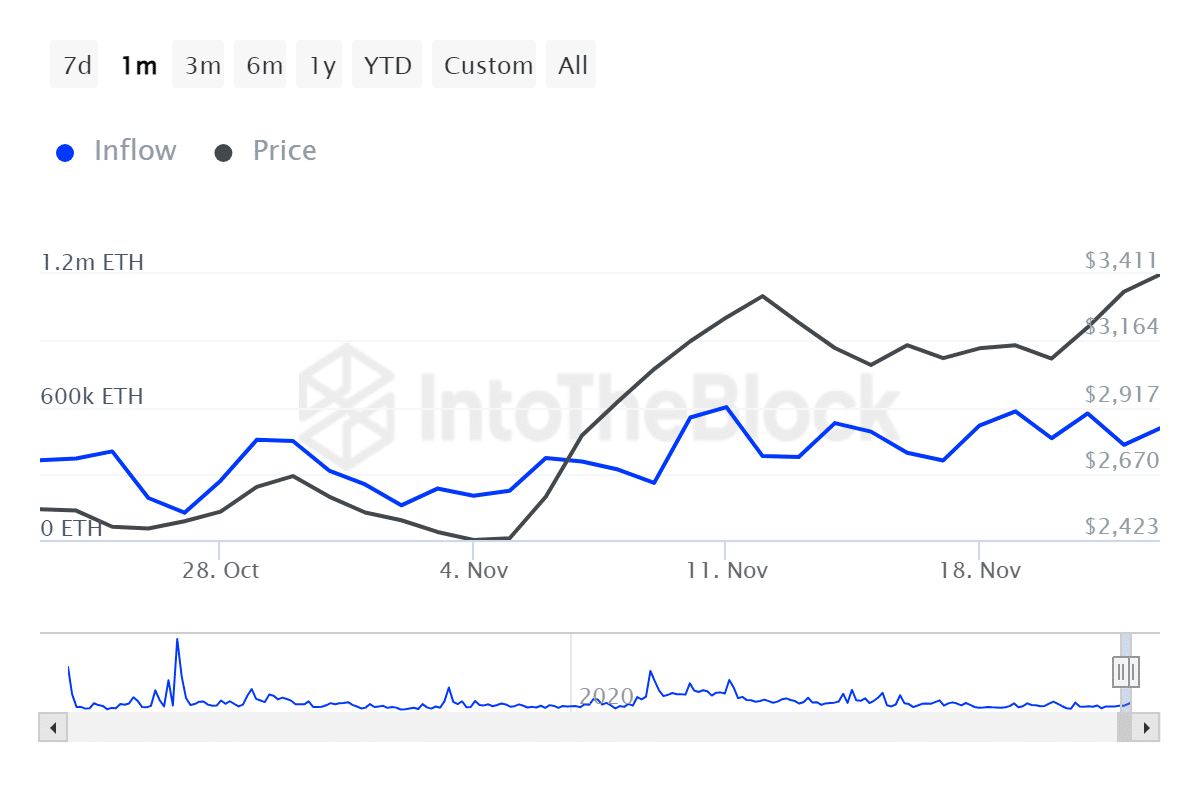

According to IntoTheBlock data, Ethereum’s staking has experienced a strong weekly netflow after months of outflows.

Over the past week, Ethereum’s staking recorded a total netflow of +10k ETH, with 115k ETH deposited and 105k ETH withdrawn.

Such a huge netflow makes a considerable change in market dynamics since withdrawals have outweighed deposits for a long time.

Based on Maartunn’s observation, some of the factors driving the surge are increased ETH prices and improved staking infrastructure.

Therefore, this shift is essential for ETH prices since it helps in the reduction of ETH supply which helps in lowering inflation. Often, reduced supply and rising demand are essential for a price rally.

Thus, this increased inflow is a vital positive indicator for overall Ethereum ecosystem growth and ETH future value.

What ETH charts show

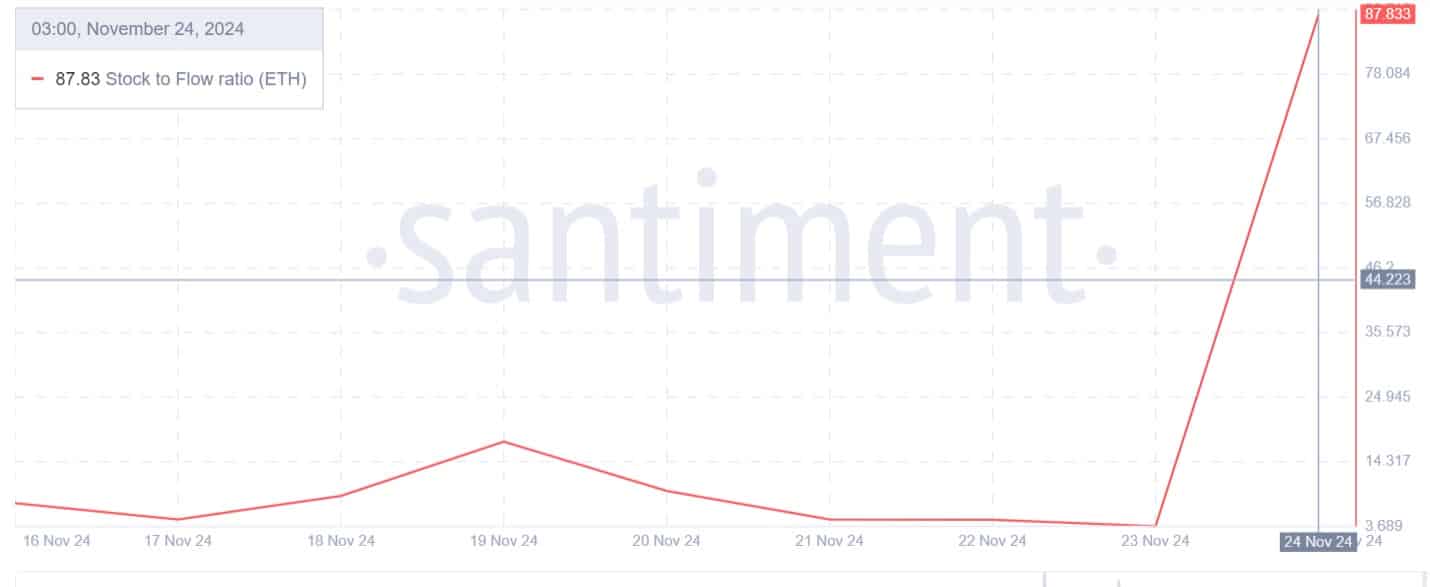

This reduction in ETH’s supply is further evidenced by a rising stock-to-flow ratio. When SFR rises it implies that an asset is becoming scarce. Usually, scarcity is central to value as it reduces oversupply.

When an asset is low in supply and higher in demand, prices often appreciate.

Equally, our analysis of IntoTheBlock shows that Ethereum has seen considerable inflow from large holders. This has surged to hit a monthly high.

Such market behavior implies that large holders are actively purchasing the altcoin, thus creating buying pressure and further reducing supply.

Impact on price charts?

As observed above, increased net flows have had positive impacts on ETH prices. As such, while, deposits have been rising, the altcoin’s prices have also surged to reach a recent high.

Read Ethereum’s [ETH] Price Prediction 2024–2025

During this period, ETH has surged by 7.82 to trade at $3381 as of this writing. This shows that, although bulls are fighting dominant bears, the altcoin is building upward momentum.

Thus, if buyers take full control of the market, ETH could see more gains. If this happens, ETH will reclaim the $3560 resistance level.