Bitcoin’s long-term holders are HODL-ing, while short-term holders are making profits. This reflects a consolidation of BTC’s price.

According to CryptoQuant, Bitcoin’s (BTC) current market cycle is turning out to be interesting as it throws light on the behaviors of long-term holders and short-term holders. Both groups are important in influencing the asset’s further price movement, and their activities frequently mirror the sentiment of the market.

Long-term Holders Are Holding On:

The data also indicates that long-term BTC holders are maintaining low activity levels, as displayed by the petering out of the Coin Days Destroyed (CDD) metric. This suggests that these holders, who are often considered to be stabilizing forces within the market, are committed to holding onto their BTC despite the recent price hikes.

When long-term holders remain inactive during a price increase, it’s a good indication as it suggests that there’s no panic selling and that many believe prices might continue to rise.

This trend was also noticed in previous cycles, especially in late 2020 and early 2021, when long-term holders continued to accumulate and hold their BTC as it neared new all-time highs (ATH). The long-term holders generally add to market stability and ensure that the changes in supply don’t lead to any drastic price fluctuations for the asset.

Short-term realized profits on the rise:

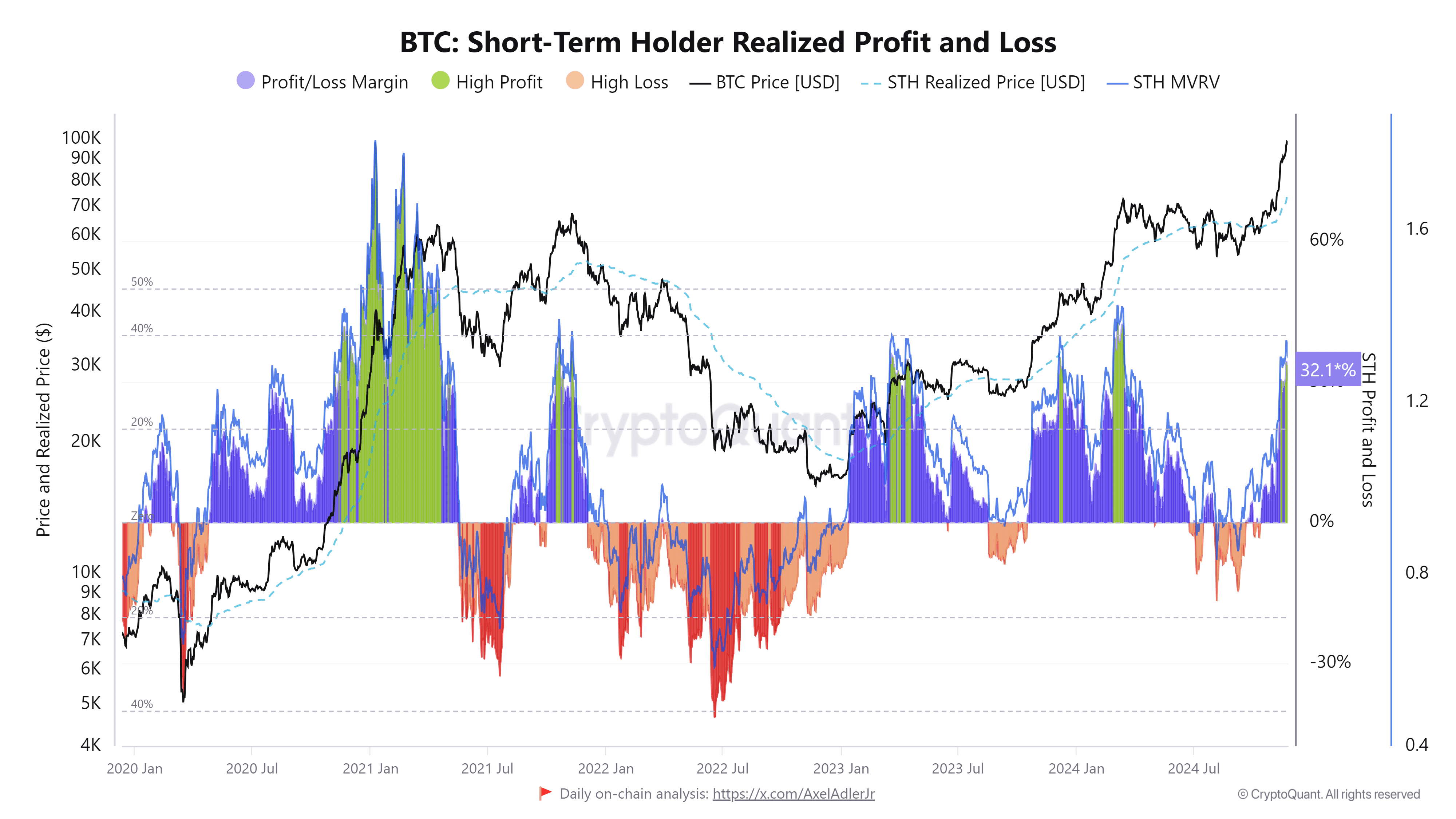

In comparison to long-term holders, short-term holders are capitalizing on BTC’s current price boom. The data also signals that they are making profits at 32.1% and exiting markets. This trend of taking profits home is not uncommon in the market. Generally, we see spikes in realized profits surrounding market highs as they try to lock in their gains, while significant realized losses occur at market lows as investors choose to sell off their holdings.

Critical Juncture Ahead!

With the current market data indicating that BTC is at a crucial juncture, the recent price uptake appears to have been driven mainly by speculative short-term traders, as most of them are cashing out of the market. However, there seems to be steady confidence among long-term holders, suggesting that this rally is supported by a belief in the asset. Still, if short-term holders continue to make profits at this pace, there is a high chance of the market entering a consolidation phase. A price correction might be on its way if long-term holders begin to sell.

https://twitter.com/AxelAdlerJr/status/1860949477936267317

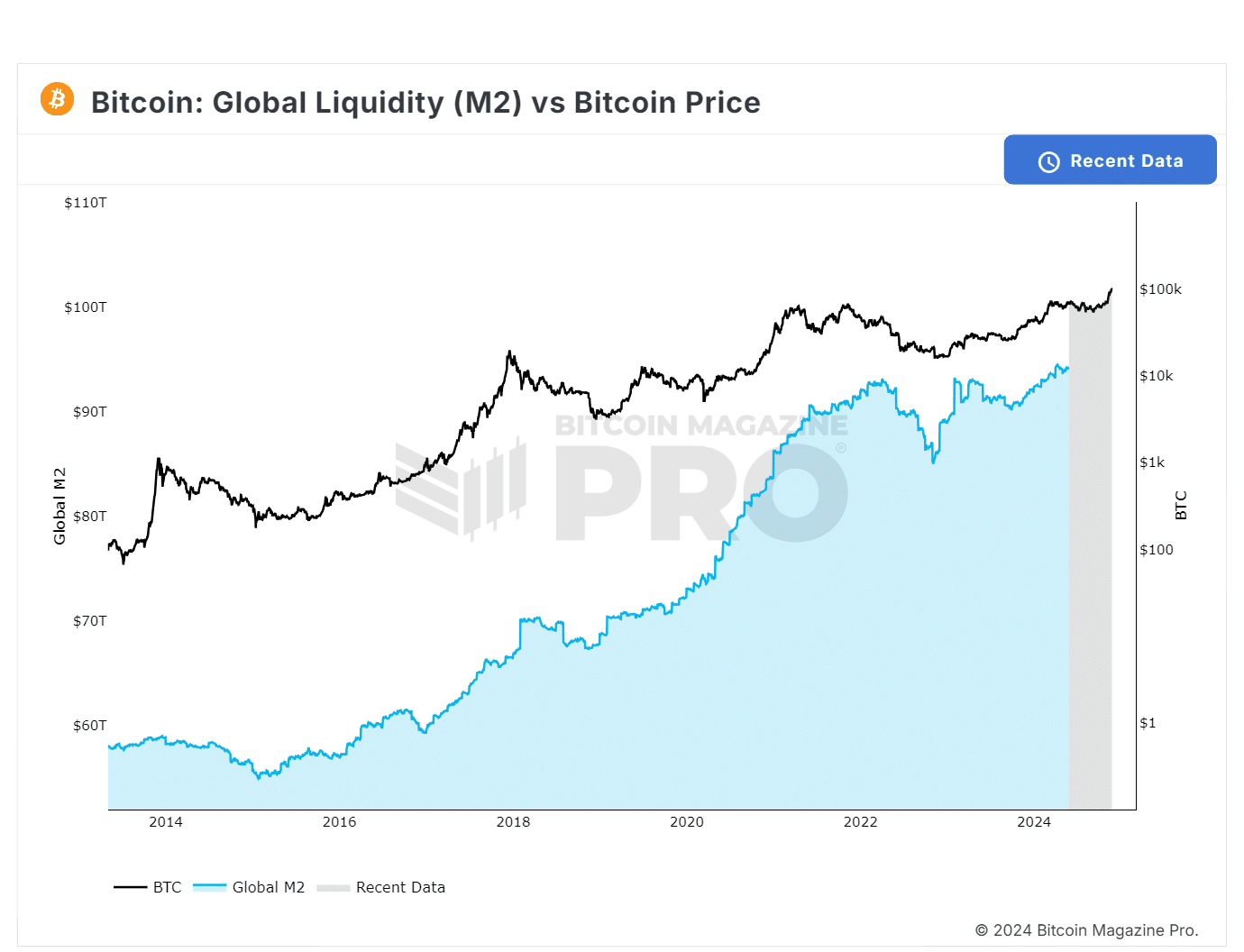

Now, the key psychological price point is $100,000. If BTC manages to exceed this threshold, it could bring more media attention, draw institutional interest, and encourage retail trading, driving prices further up. However, if BTC struggles to break this mark, there is a good chance of consolidation, as it will then serve as a natural resistance level for many traders.