Solana (SOL) Struggles to Hold Gains After Reaching New ATH

11/27/2024 00:30

Solana (SOL) price falls 10% amid bearish momentum. Key support at $204, resistance at $248. Will it recover or face further decline?

Solana (SOL) price reached an all-time high of $264 on November 22 but has since entered a correction, dropping nearly 10% in the past 24 hours. Indicators like BBTrend and DMI show increasing bearish momentum.

The EMA lines, while still showing a bullish structure, hint at a potential death cross, which could intensify the correction if it forms. As SOL approaches key support levels, its ability to recover bullish momentum will determine whether it revisits resistance at $248 or faces further declines toward $194.

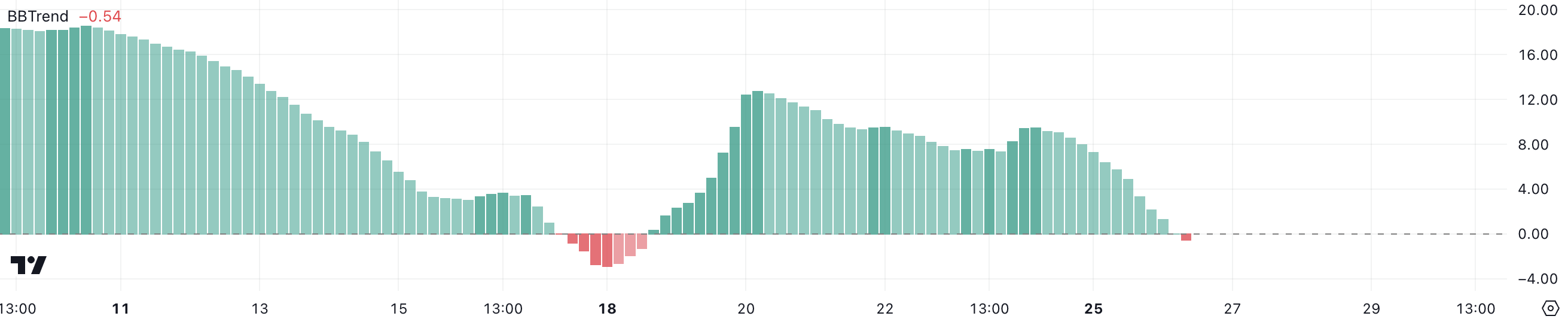

SOL BBTrend Is Negative for the First Time in 8 Days

Solana BBTrend has turned negative for the first time since November 18, currently sitting at -0.54. The BBTrend, or Bollinger Bands Trend, measures the momentum and direction of price movement relative to the Bollinger Bands, with positive values indicating upward trends and negative values suggesting downward trends.

This shift to negative territory signals increasing bearish momentum, marking a stark contrast from its recent peak of 10.8 on November 20, just before SOL reached a new all-time high.

Although -0.54 might not seem significant, it reflects a clear change in market sentiment, with SOL now down nearly 10% in the last 24 hours.

If the BBTrend continues to decline, it could amplify the bearish pressure, pushing SOL into a deeper downtrend. This would likely lead to further price corrections as sellers dominate and the market loses confidence in its short-term recovery potential.

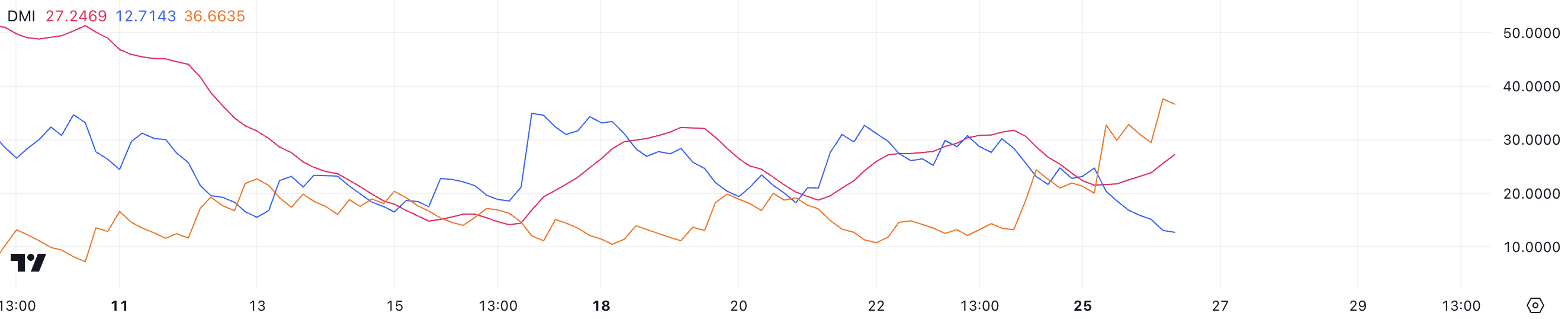

Solana Downtrend Is Getting Stronger

SOL DMI chart shows its ADX rising to 27.24 from 21 yesterday, signaling a strengthening trend momentum. The ADX, or Average Directional Index, measures the strength of a trend, with values above 25 indicating a significant trend, whether bullish or bearish.

In Solana’s case, the rising ADX reflects increasing momentum in its current downtrend, suggesting that selling pressure is intensifying.

The DMI indicators further reinforce this bearish sentiment, with D+ at 12.7 and D- at 36.6. This large gap shows that bearish forces (D-) significantly outweigh bullish ones (D+).

An ADX above 25 and growing in a downtrend indicates that the negative momentum is solidifying. If this trend continues, Solana price could see further declines as the market tilts heavily in favor of sellers.

SOL Price Prediction: No New All-Time Highs For Now?

SOL EMA lines present a pivotal scenario, with the short-term lines still positioned above the long-term ones, indicating a lingering bullish setup.

However, the shortest-term EMA lines are trending downward and nearing a potential crossover with longer-term lines, signaling the possible formation of a death cross. This pattern often indicates a shift from bullish to bearish momentum, raising caution among traders.

If a death cross forms, SOL’s correction could intensify, leading the price to test its nearest support at $204. Should this level fail to hold, SOL price could decline further, targeting $194.

On the other hand, if Solana regains bullish momentum and reverses the trend, it could challenge resistance at $248. Breaking above this level could propel SOL price to surpass $264, achieving a new all-time high and reinforcing bullish sentiment in the market.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.