Solana breaks $250 barrier: Can SOL breach $260 ATH, rally 10x next?

11/27/2024 10:00

Solana breaks the $250 resistance for the first time. Is a 10x rally to $300–$400 next? What SOL's fundamentals suggest.

Posted:

- Solana closed above the $250 resistance, signaling a potential breakout toward $300.

- Solana saw record activity, with 6.07M active addresses and $11.99B trading volume in 24 hours.

Solana [SOL] has made a historic move by closing above the $250 resistance level on the weekly timeframe for the first time.

According to crypto analyst Rekt Capital, this marks a critical development in the coin’s price action.

The $250 level has historically been a key resistance point, previously tested during Solana’s peak in late 2021 when it reached $260 before a prolonged bear market ensued.

If this breakout is confirmed with $250 turning into a support level, Solana could enter price discovery mode.

Analysts point to potential targets of $300, which serves as a psychological level, and $350–$400, based on Fibonacci extensions and historical price behavior.

However, if Solana fails to hold $250, it may retest support levels at $202.82 or even revert to $135.97, though current bullish momentum makes the latter scenario less probable.

Price, trading volume trends

As of press time, Solana was trading at $231.93, marking a decline of 8.99% in the past 24 hours and 4.80% over the past week.

The price has fluctuated within a 24-hour range of $231.87 to $256.23, with a seven-day range of $232.43 to $263.21.

Solana’s 24-hour trading volume has surged by 25.94%, reaching $11.99 billion, according to Coinglass data. This spike indicated strong trading activity despite the recent pullback.

Open Interest, which measures the value of active derivatives contracts, has decreased by 7.57% to $5.18 billion, reflecting some reduction in leveraged positions after the price volatility.

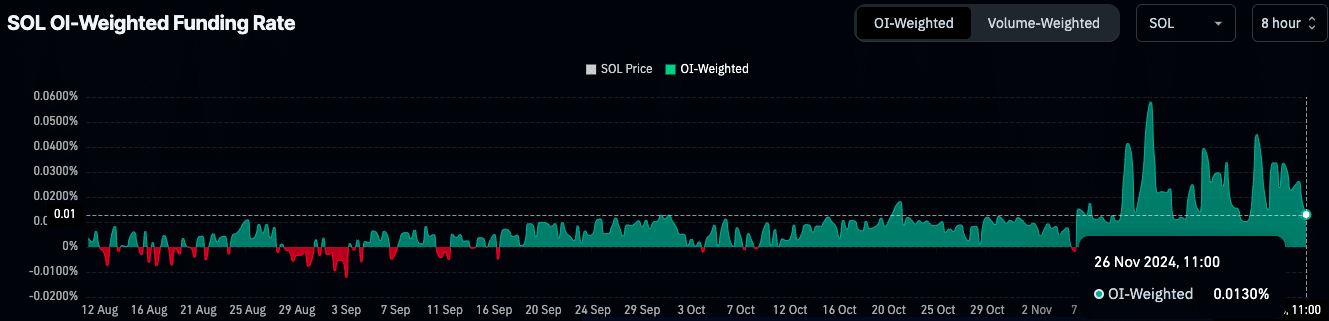

Funding Rates reflect optimism

The Open Interest (OI)-Weighted Funding Rate for Solana remained positive at press time, trending upward since mid-October. It was at 0.0130%, showing moderate but sustained optimism in the derivatives market.

Spikes in Funding Rates during early and mid-November aligned with leveraged long positions, indicating bullish sentiment during key price rallies.

On-chain metrics indicate growing activity

Data from DefiLlama showed that Solana’s total value locked (TVL) in decentralized finance is $9 billion, down 3.29% over the past 24 hours.

Its stablecoin market capitalization was $4.598 billion, while the network generated $7.16 million in fees and $3.58 million in revenue over the same period.

Read Solana’s [SOL] Price Prediction 2024–2025

Solana’s ecosystem remains highly active, with 6.07 million active addresses recorded in the past 24 hours, contributing to 52.71 million transactions.

Whale activity and inflows of $1.75 million suggest continued interest in the network despite short-term price corrections.