Sui outshines Bitcoin and Ethereum: What’s driving this growth?

11/27/2024 19:00

Sui Network outpaces major financial benchmarks driven by SUI token growth and DeFi integrations - positioning it for long-term success.

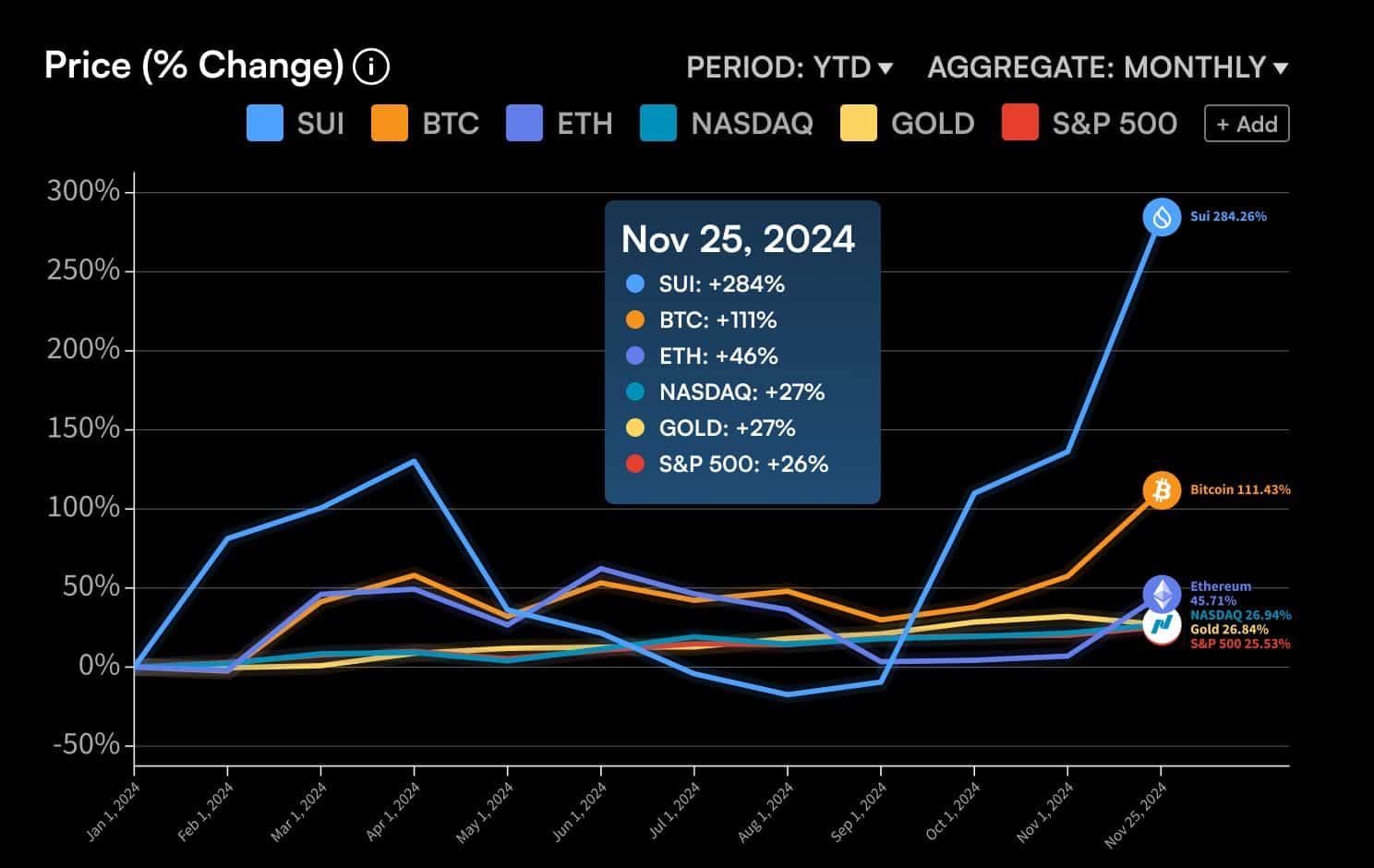

In an era of rapid blockchain evolution, Sui [SUI] has emerged as a standout, surpassing traditional financial benchmarks. It has outperformed Bitcoin [BTC], Ethereum [ETH], the Nasdaq, Gold, and the S&P 500 in terms of performance.

As the network expands, a key question arises. To what extent is Sui’s success, fueled by its native token SUI, driving this growth? Are there other factors driving the platform’s remarkable rise?

What’s behind the network’s performance?

SUI Network is making waves in the blockchain space, outperforming Bitcoin, Ethereum, and major financial indices. Its native token, SUI, has seen significant growth driven by strong adoption and strategic integrations.

A key factor in SUI’s rise is its growing DeFi ecosystem. This growth is fueled by the recent integration of Bitcoin staking via Babylon Labs and Lombard Protocol. This integration brings Bitcoin’s $1.8 trillion liquidity to the Sui network.

Additionally, Router Chain’s integration with Sui adds further cross-chain capabilities, expanding its interoperability with major networks like Solana, Tron, and Bitcoin.

These moves position Sui as a powerful player in the decentralized finance space, paving the way for even more adoption and growth.

The backbone of Sui’s network ascent

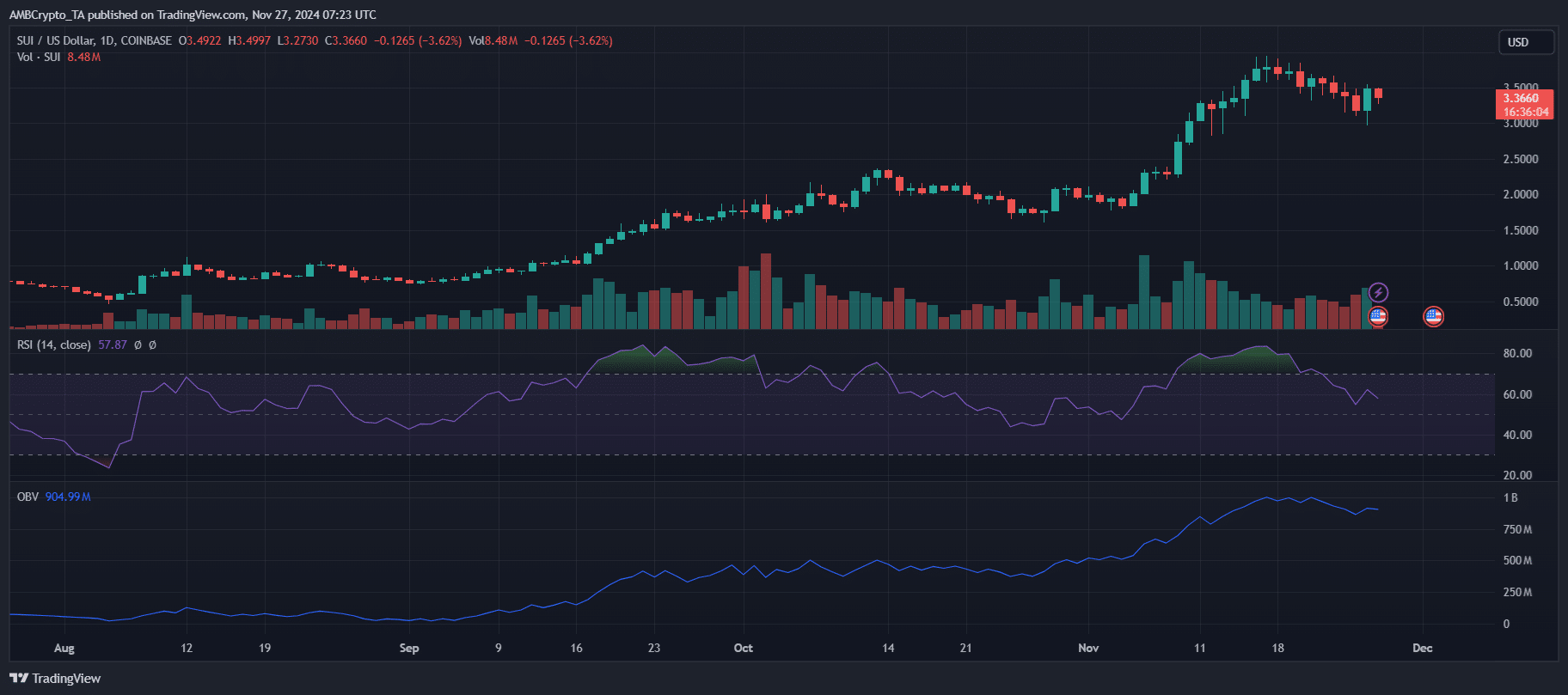

The recent price action of the native token SUI underscores its pivotal role in Sui Network’s expansion. Trading near $3.37 at press time, the token has surged substantially from its mid-year lows, riding a wave of bullish sentiment.

On the daily chart, the RSI at 58.17 indicates healthy momentum, staying clear of overbought territory. Meanwhile, the OBV reflects sustained demand, hinting at robust accumulation despite recent corrections.

Beyond price movements, SUI serves as the backbone of Sui’s economic model. It facilitates transaction fees, liquidity provisioning, and ecosystem incentives, directly linking its demand to network activity.

Recent consolidations hint at market uncertainty. However, sustained growth in DeFi participation and cross-chain integrations could reignite upward momentum. For SUI, network activity, rather than speculative hype, appears to be the driving force.

While the token’s price consolidates after a meteoric rally, its role as the linchpin of the network’s ecosystem ensures its trajectory remains intertwined with Sui Network’s continued evolution.

Network effects and institutional traction

SUI’s trajectory hinges on its ability to sustain network effects and attract long-term adoption. With growing DeFi integrations and cross-chain operability, the network’s utility is set to expand, drawing more developers and users.

Institutional interest is also gaining momentum, demonstrating Sui Network’s appeal in enabling innovative blockchain solutions.

However, sustaining this growth will depend on maintaining high transaction throughput, low fees, and scalability—key pillars of its competitive edge. The token’s adoption as a governance and staking asset further cements its role in ecosystem expansion.

Read Sui’s [SUI] Price Prediction 2024–2025

Market sentiment remains cautiously optimistic, with SUI’s current consolidation signaling the potential for a re-accumulation phase.

In the long term, Sui’s ability to continuously innovate and deliver real-world applications could determine its position as a dominant player in the blockchain space.