Ethereum price staged a strong breakout on Nov. 27 as Bitcoin and most altcoins bounced back after days in the red.

Ethereum (ETH), the second-biggest cryptocurrency, jumped to $3,690, its highest level since June 10. It has soared by 70% from its lowest level this month, and one popular analyst expects its to get to $10,000 in this bull run.

In an X post, Ali Martinex, a popular crypto analyst with almost 100,000 X followers, estimated that the coin will get to $6,000 in this cycle. His long-term view is that ETH price will ultimately jump to $10,000. If his view is accurate, it means that the coin will jump by 65% and 176%.

Ali’s prediction is based on trend regression on the daily chart from its lowest level in January last year.

Daan Crypto Trades, another popular analyst estimated that ETH price was also preparing for another bull run. He expects it to have the best performance in the first quarter of next year based on its historical trends.

— Daan Crypto Trades (@DaanCrypto) November 28, 2024$ETH Is on track for a good 4th quarter so far.

Generally, Q1 is where ETH really shines and also when ETH/BTC tends to outperform.

Let's see if this time is any different. pic.twitter.com/WYFWCTjd2U

The ongoing bullish Ethereum price forecast is largely contrarian since the coin has underperformed most of its peers this year. Its spot ETFs are also not seeing substantial traction, with the cumulative inflows being at $240 million. Bitcoin’s inflows stands at over $27 billion.

There are also signs that Ethereum is losing market share to Solana (SOL). Data by DeFi Llama shows that DEX protocols on Ethereum handled volume worth $68 billion in the last 30 days compared to Solana’s $126 billion.

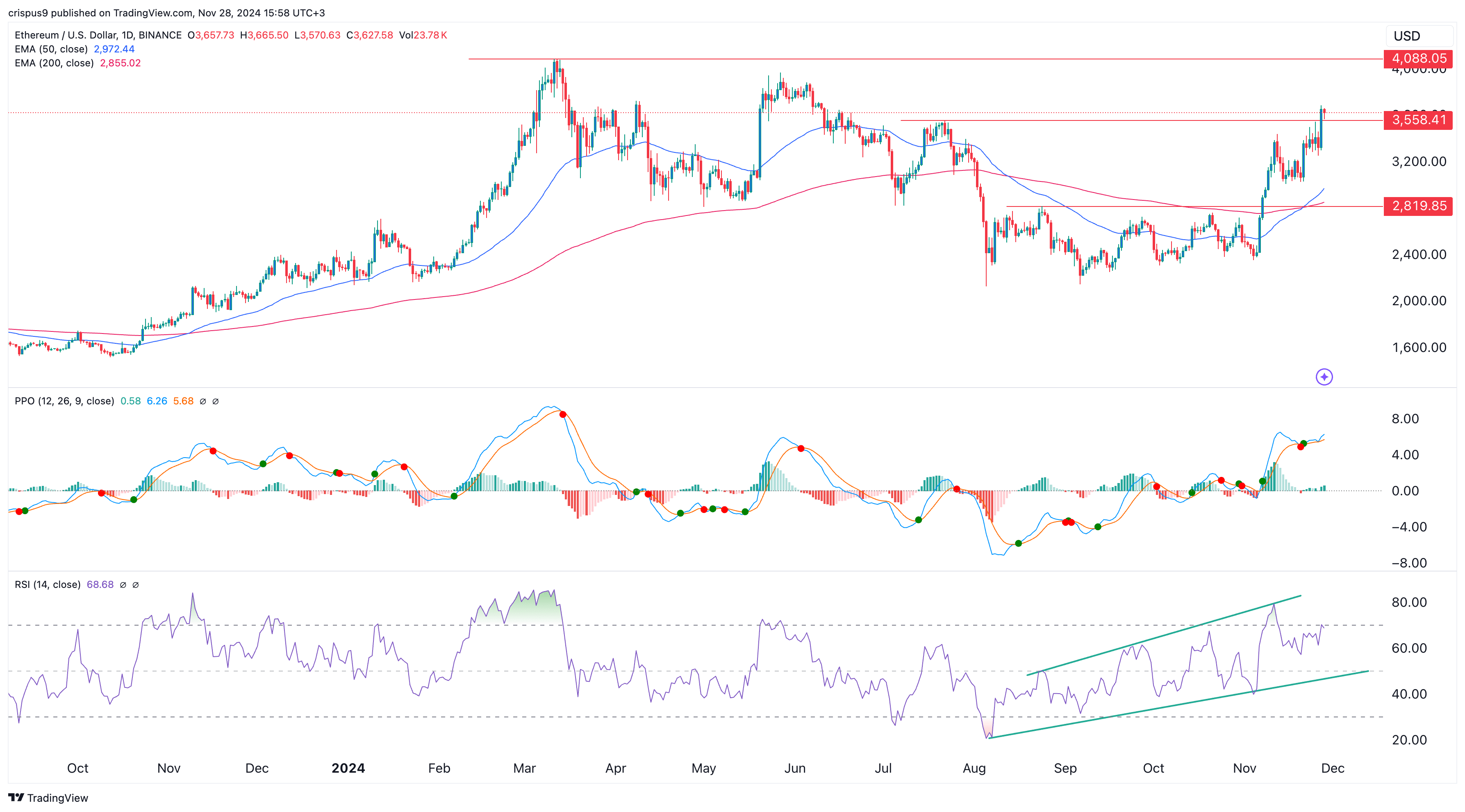

Ethereum price has strong technicals

The daily chart shows that the ETH price has done well in the past few days. It has just formed a golden cross pattern as the 50-day and 200-day Exponential Moving Averages crossed each other. This is one of the most popular bullish patterns in the market.

Ethereum price has also jumped above the crucial resistance point at $3,558, its highest level on July 21. Further, the Percentage Price Oscillator and the Relative Strength Index have all moved upwards.

Therefore, the short-term outlook is where ETH jumps and retests its year-to-date high of $4,088. A break above that level will point to more gains, with the next point to watch being the psychological level at $5,000. This view will become invalid if it drops below the support at $3,100.