Sperax crypto soars 100%, volumes surge 28x – Is ATH coming?

11/29/2024 01:00

Sperax crypto surges 100% in 24 hours with 28x volume spike - could the coin be up for an all-time high soon?

Posted:

- Sperax crypto soars 100%, reaching $0.022, breaking key resistance levels.

- Whale activity and DeFi growth contribute to Sperax’s rapid momentum and bullish sentiment.

Sperax [SPA] has experienced an explosive 100% surge in the past 24 hours, with trading volumes skyrocketing by 28 times. This dramatic rally has caught the attention of investors and market watchers alike, sparking speculation that the altcoin could be on the verge of reaching a new all-time high.

With such a sharp upward movement, many are now questioning whether this surge is the start of a longer-term bullish trend or just a temporary spike in an otherwise volatile market.

Price analysis and catalysts behind SPA’s surge

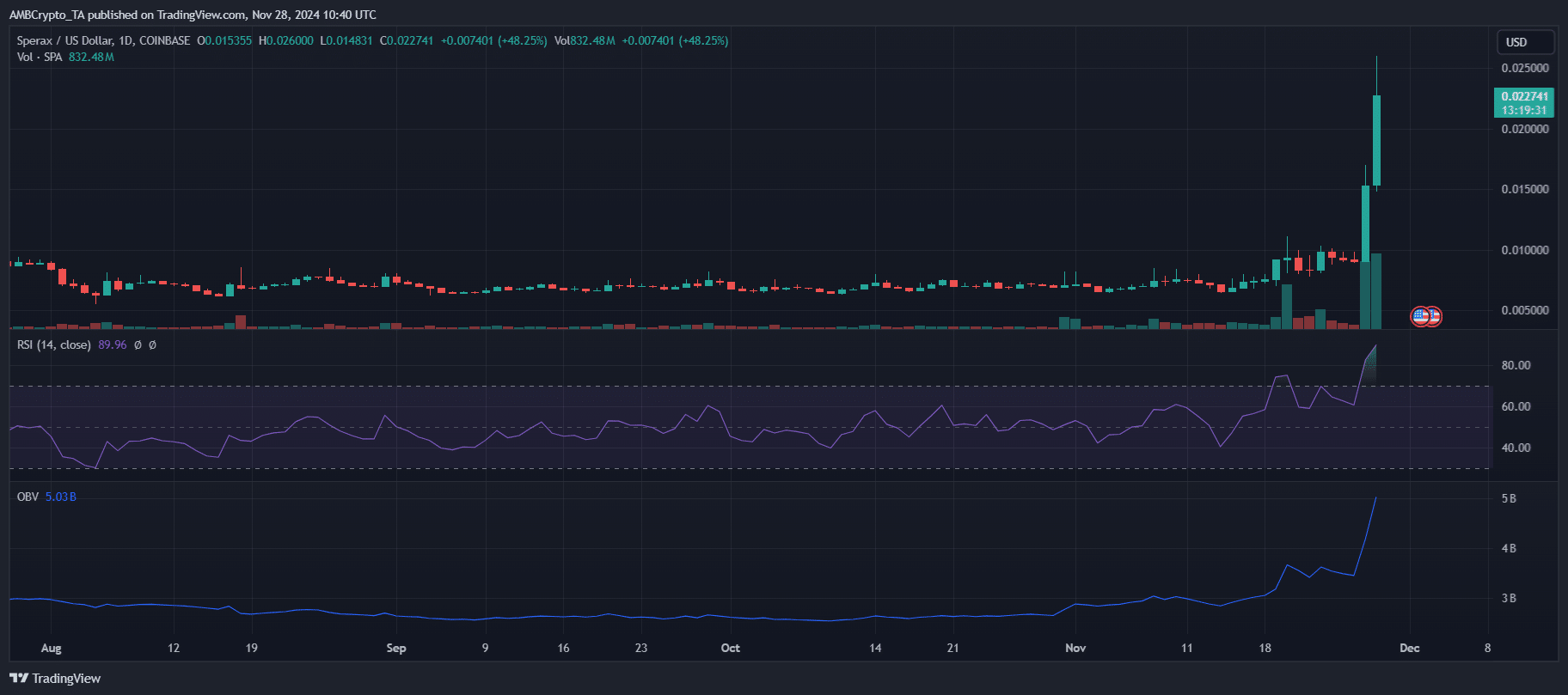

Sperax surged from $0.010 to $0.022, breaking key resistance levels with a 100% gain in 24 hours. Trading volume spiked by 28x, reflecting heightened market interest. The rally pushed SPA’s RSI to 89, signaling overbought conditions but highlighting strong buying pressure.

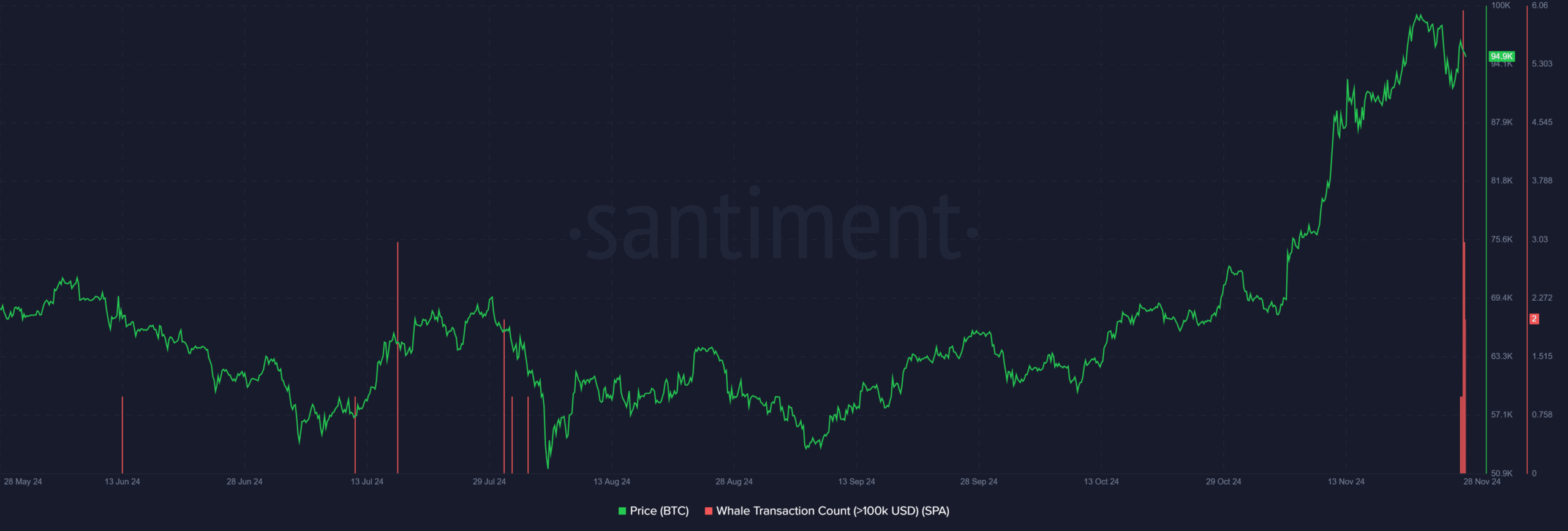

On-chain data shows increased whale activity, with significant accumulation driving upward momentum. The spike coincides with broader market optimism in altcoins and speculation around Sperax’s ecosystem growth, particularly its expanding presence in DeFi.

Additionally, the rally may be attributed to SPA’s low market cap, making it susceptible to outsized moves during periods of heightened demand.

Sustaining gains above $0.020 will be crucial for confirming the start of a sustained bullish trend, as current indicators suggest short-term volatility.

Sperax crypto: What the indicators say

The 28x spike in trading volume reflects robust market enthusiasm for Sperax, with heightened liquidity amplifying price momentum.

Market sentiment appears overwhelmingly bullish, as evidenced by the sharp move above both the 50-day and 200-day simple moving averages (SMAs). These levels, previously key resistance points at $0.0078 and $0.0084 respectively, have now flipped into support zones.

The golden cross formed by the 50-day SMA trending above the 200-day SMA shows a potential long-term bullish outlook. However, with the RSI nearing 90, overbought conditions warrant caution.

A correction could retest the SMAs as support, but maintaining volume-driven momentum will be critical for sustaining the rally. Investors should monitor shifts in sentiment and institutional activity to gauge the sustainability of this surge.