PYR crypto soars 45% in 30 days – Time for cool-off?

11/29/2024 06:00

PYR crypto rallied 45% in a month but hit a roadblock at $4, with short positions piled at the level. Will it clear the hurdle?

Posted:

- PYR crypto rallied 45% this month but cooled off below $4.

- Will a short squeeze push it above $4 and extend the rally?

PYR crypto, the native token for the gaming blockchain Vulcran Forged, more than doubled in November, rallying from $2.1 to $4.6. As of this writing, the token was valued at $3.5, a 45% surge in the past 30 days.

With the buyer exhaustion seen in the past few days, will PYR crypto continue to cool off or reignite the uptrend?

PYR crypto rally cools

The upper long candlestick wicks indicate buyer exhaustion that always precedes cool-offs. PYR followed a similar trend and has been consolidating below $4 for the past few days.

If the bull run and the altcoin momentum continued, PYR could consolidate for a while before surging forward. The latest price rejection happened at $4, which doubled as a former Q2 support-cum-resistance.

So, a decisive move above $4 could signal an uptrend continuation and increase the odds of PYR hitting the $5 and $6 targets.

However, technical indicators inclined towards a likely local top. The RSI hit an overbought level and headed southwards, indicating buying pressure waned. Will it head to the 50 mid-level before rebounding?

Similarly, the OBV (On Balance Volume) faltered near June highs, collectively suggesting the PYR price momentum could cool off or retrace.

Short positions pile at $4

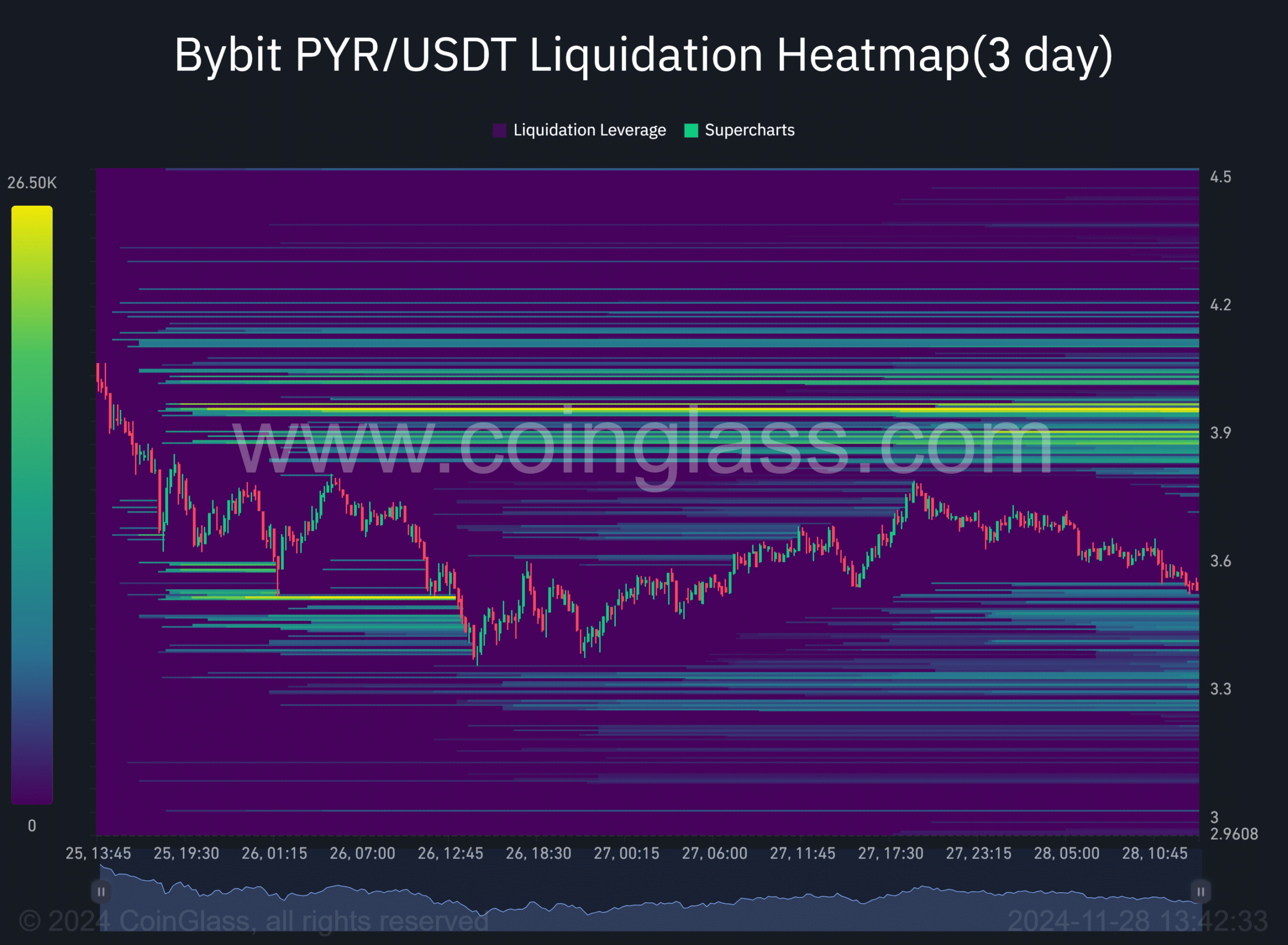

The $4 level could become a key resistance in the short term. According to the Coinglass, there was a spike in leveraged short positions at $4, illustrated by the bright orange levels.

With no significant liquidity on the lower side of price action, a hunt for upside liquidity could push PYR to re-target $4 again or trigger a short squeeze to go higher. However, a drop below $3.3 could complicate the move above $4.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion