XYO price prediction: Wallets in profits rise 20%, is a breakout imminent?

11/29/2024 12:00

XYO price prediction shows mixed signals around the token despite a 20% rise in wallet profitability in less than two weeks.

Posted:

- XYO has gained by 17% in one week causing a 20% spike in wallet profitability.

- The MVRV ratio suggests that XYO is undervalued, giving it room for more growth.

XYO, at press time, had recorded a 67% rise in trading volumes in 24 hours per CoinMarketCap. During this time, the price increased by 6.9%, bringing its seven-day gains to 17%.

The recent gains have seen XYO’s market capitalization rise from $74 million at the start of the month to $123 million. However, a deep dive into technical indicators and on-chain data shows mixed signals around the token.

XYO forms an asymmetrical triangle pattern

XYO had formed an asymmetrical triangle pattern on its four-hour chart, indicating that the price could break out higher or undergo a trend reversal depending on buying or selling pressure.

At press time, XYO was testing resistance at the upper boundary of this triangle, but higher volumes are needed to support the uptrend.

Meanwhile, the Awesome Oscillator (AO) shows that the bullish momentum is gaining strength as depicted in the green histogram bars that are increasing in size. If the rally continues, XYO could aim for $0.0114.

However, several bearish signals are evident with the Chaikin Money Flow (CMF) having a negative value of -0.11 suggesting that sellers were more active than buyers.

This could lead to a trend reversal and a drop below the lower boundary of the asymmetrical triangle to the support level at $0.007.

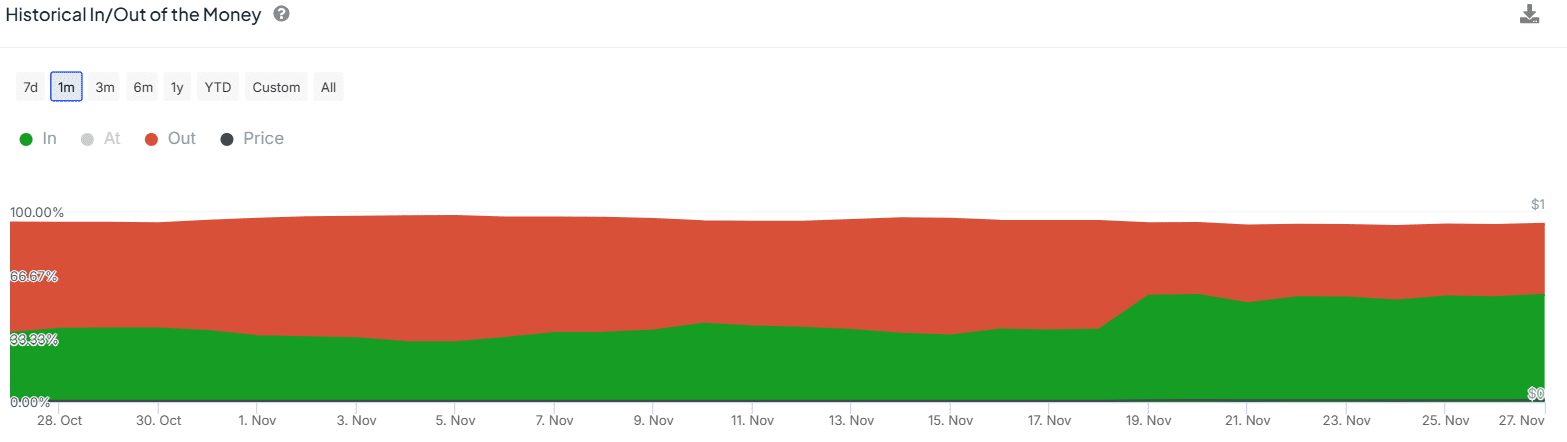

The recent XYO gains have seen the wallets that are In The Money (in profits) increase by 20% in one month from 36% to 56%. On the other hand, the wallets that are in losses have declined from 58% to 37%.

A rise in wallet profitability is bullish for a token as it can boost the market sentiment. However, it can also be bearish if traders look to take profits. Therefore, it is crucial to monitor spikes in selling activity that could fuel a downturn.

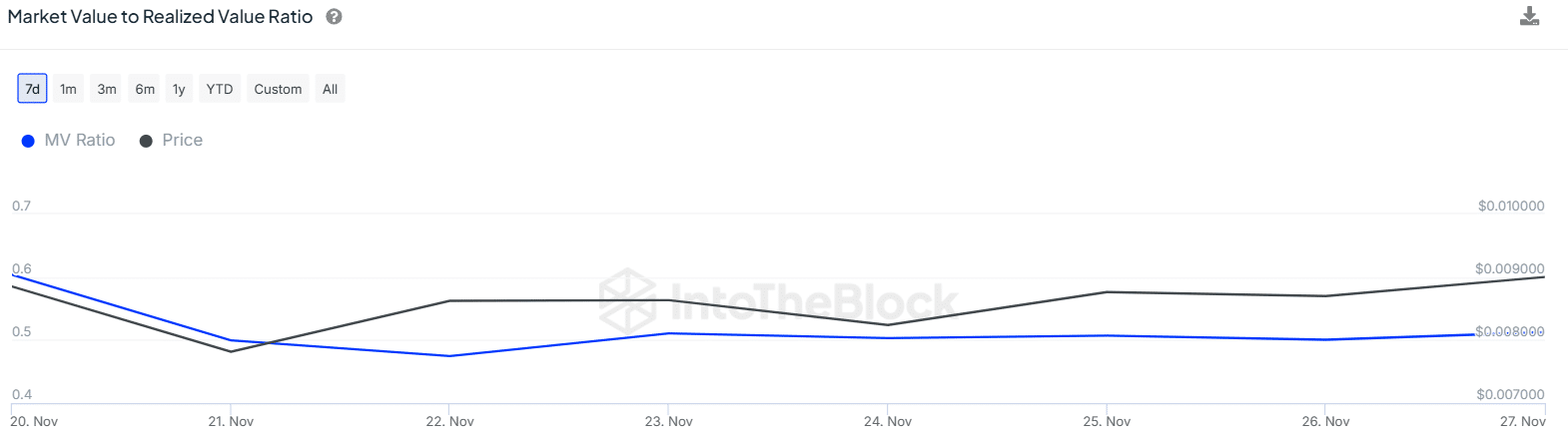

MVRV ratio shows possible undervaluation

The Market Value to Realized Value (MVRV) ratio for XYO shows that the token could be undervalued. At press time, this metric stood at 0.51, with no significant changes in the last seven days.

A low MVRV ratio presents an accumulation zone for new buyers. However, it also shows that investors are sitting on unrealized losses. As such, price gains could attract profit-taking, which could in turn cause a downtrend.