CRO price prediction: Bearish pressure looms as whales begin offloading

11/30/2024 03:30

Whales control 93% of Cronos (CRO), driving volatility and bearish trends. Brief gains from derivative traders may falter as sell-offs loom.

Posted:

- Large holders, or “whales,” who own a significant portion of CRO, have started offloading their holdings.

- Meanwhile, derivative traders are increasingly placing bearish bets, signaling expectations of a continued decline.

After a month-long rally that saw Cronos [CRO] surge by an impressive 137.39%, the momentum now appears to be reversing. The asset recently recorded a weekly loss of 4.78%, indicating a potential trend shift.

However, in the past 24 hours, AMBCrypto reported that derivative traders contributed to a 3.03% price recovery. Despite this brief uptick, persistent whale activity continues to cast doubt on CRO’s near-term prospects, putting smaller investors at risk of losses.

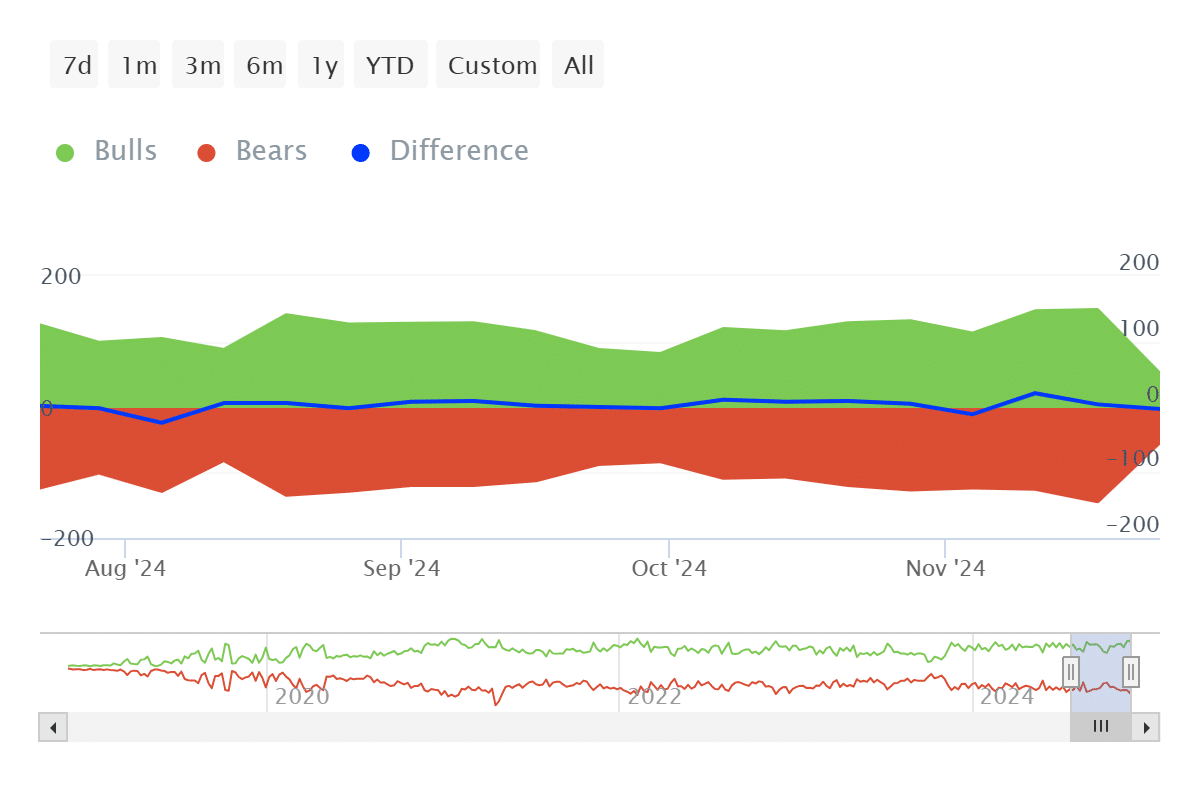

Bears outnumber bulls, signals potential downside for CRO

At the time of writing, data from IntoTheBlock reveals a bearish tilt in the CRO market, suggesting potential downside pressure on its price.

Over the past seven days, there were 144 bulls compared to 115 bears, a marginal difference that might imply only a slight risk of decline. However, the broader market dynamics raise additional concerns.

AMBCrypto highlights a significant imbalance in asset ownership, with whales dominating the market. This disproportionate control amplifies volatility and leaves smaller holders vulnerable to sudden price swings.

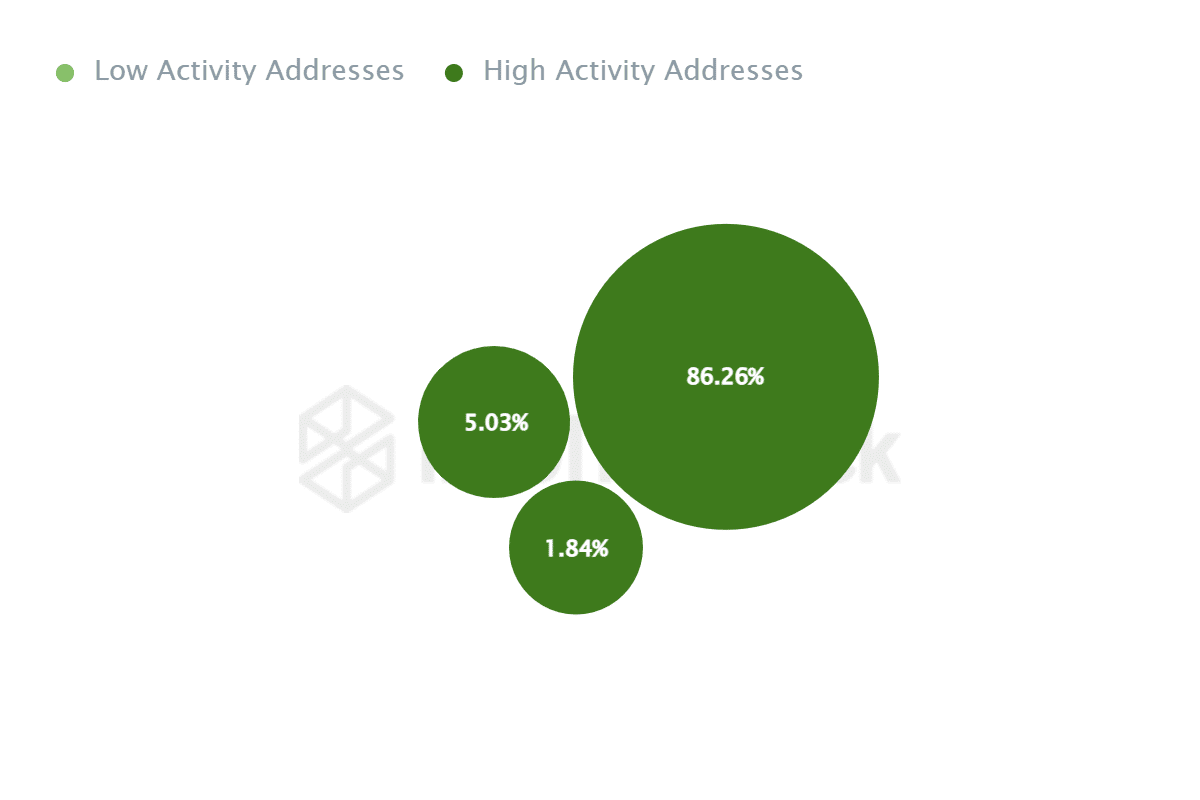

Whales dominate CRO, and downward risk heightens

Further analysis reveals that three highly active whale addresses control over 93% of the circulating supply of CRO. At press time, these whales hold 93.13% of the total supply, distributed as follows: 1.84%, 5.03%, and a staggering 86.24%.

Their high activity is evidenced by over 300 transactions conducted within the specified timeframe, a factor that poses a significant risk to CRO’s price stability.

Additionally, CRO has experienced a surge in transaction volume, with 73.16 million CROs traded in the last 24 hours.

This uptick, combined with the presence of whales and signs of bearish dominance in the market, suggests that CRO could lose its recent modest gains and face potential declines.

Why is CRO up?

CRO’s recent gains are largely driven by derivative traders betting on the asset’s upward movement, to which the price has responded.

A long-to-short ratio of 1.0912 confirms bullish dominance, with more long positions pushing the price higher.

However, if whale activity intensifies, CRO could reverse course, negating the bullish momentum created by derivative traders.