Block's Cash App quietly sunsets fee-free p2p transfers for Bitcoin

12/03/2024 00:30

Cash App is ending its Bitcoin transfer by user tags feature months after federal investigations into Block’s compliance practices, sparking concerns about the app's ability to handle risks

Cash App is ending its Bitcoin transfer by user tags feature months after federal investigations into Block’s compliance practices, sparking concerns about the app’s ability to handle risks.

Cash App, a popular mobile app known for peer-to-peer payments, investing, and crypto transactions, will end its Bitcoin (BTC) feature by late December, months after federal authorities raised concerns over the platform’s ability to prevent money laundering.

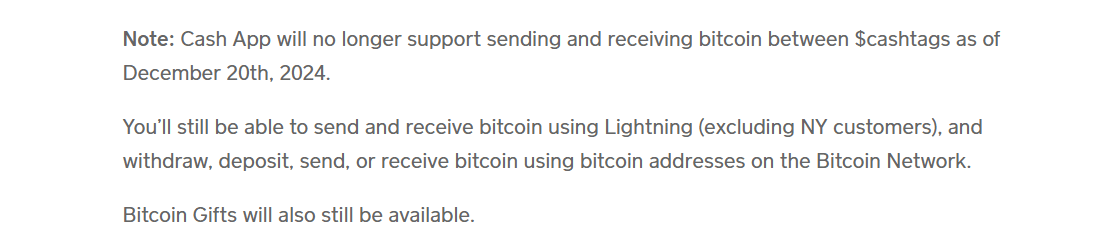

In a notice on its help page, Cash App announced it will “no longer support sending and receiving bitcoin between $cashtags as of December 20th, 2024.” The company noted that users could still send and receive Bitcoin using Lightning Network or the Bitcoin blockchain.

A check of the Wayback Machine shows no such notice in October, raising questions about the sudden change. Moreover, the change appears to only impact Bitcoin transfers and doesn’t seem to affect other services, such as sending stocks or cash via cashtags, unique identifiers.

A spokesperson for Cash App told crypto.news that the company made this decision to “focus our internal resources on the products and services that Bitcoin holders on Cash App use and value most.”

“We’ve notified customers that starting December 20th, we will no longer support peer-to-peer bitcoin transactions between $cashtags. We made this decision to focus our internal resources on the products and services that bitcoin holders on Cash App use and value most.”

Cash App’s spokesperson

Launched in 2013 as part of Block Inc., Cash App (formerly known as Square Cash) started as a peer-to-peer payment system, similar to PayPal’s Venmo. It has since expanded into a super app with features like Bitcoin and stock purchases, savings, lending, and even pre-paid Visa debit card issued by Sutton Bank.

It’s unknown how popular Bitcoin p2p transfers are on Cash App as the platform does not disclose this data. However, regulatory filings show that the crypto aspect was profitable for the company as in Q4 2023, Cash App generated over $65 million in Bitcoin gross profit, up 90% from Q4 2022. In the first none months of 2023, Cash App generated net revenue of more than $10.3 billion, representing around 65% of Block’s net revenue at that time.

As of December 2023, the app had 56 million active accounts, but it is unclear how many of them used the crypto services.

Cash App changes offerings amid federal investigation

The decision to stop transfers by user tags comes seven months after reports revealed that federal prosecutors are looking into compliance practices at Block, the parent company of Cash App.

In May, NBC News reported that Cash App’s design raised compliance risks, with internal documents indicating that “due to the nature of the product […] customers do not appear to leave stored balances in Cash App very long so our ability to block a stored balance or reject funds is limited. In virtually all situations, balances have been depleted by the time of review.”

The report also showed that about 100 pages of internal documents list small transactions involving entities in countries under U.S. sanctions, such as Russia, Iran, Cuba, and Venezuela. In response to that leak, Block said that sanctions risk on Cash App is mitigated by compliance controls and the nature of the customer base, which is focused on U.S. customers. At the time, Cash App told NBC News that the company partners with law enforcement “to help disrupt illegal or illicit activity.”

Addressing those events, the spokesperson made it clear in a statement to crypto.news that the decision to end Bitcoin p2p transfers is not connected to the investigation.

“$cashtag transactions using U.S. dollars and all other bitcoin features, including the ability to send and receive bitcoin using Lightning and the Bitcoin Network, are not impacted by this update. We remain committed to building innovative, accessible products for customers who use bitcoin on our platform.”

Cash App’s spokesperson

That wasn’t the first time Block has faced regulatory challenges. In late 2021, the Financial Market Supervisory Committee of the Bank of Lithuania instructed Verse Payments Lithuania UAB, the European version of Cash App, to verify the identities of customers whose information was either incomplete or did not meet the legal requirements for preventing money laundering and terrorist financing.